3 Coins Investors Prefer Over Ethereum as Citigroup Gives Bearish $4,300 Year-End ETH Pric

September 28, 2025

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Ethereum has long been the dominant altcoin, but a recent note from Citigroup has cooled bullish sentiment. The bank projects ETH will finish 2025 at just $4,300, citing weaker ETF inflows and the risk that much of Ethereum’s price action is sentiment-driven rather than fundamentally supported. Citi’s cautious tone has prompted some investors to look elsewhere for bigger upside potential. Three coins stand out: Little Pepe (LILPEPE), Polkadot (DOT), and Hyperliquid (HYPE).

Citi’s Ethereum Price Call: Conservative Outlook Raises Eyebrows

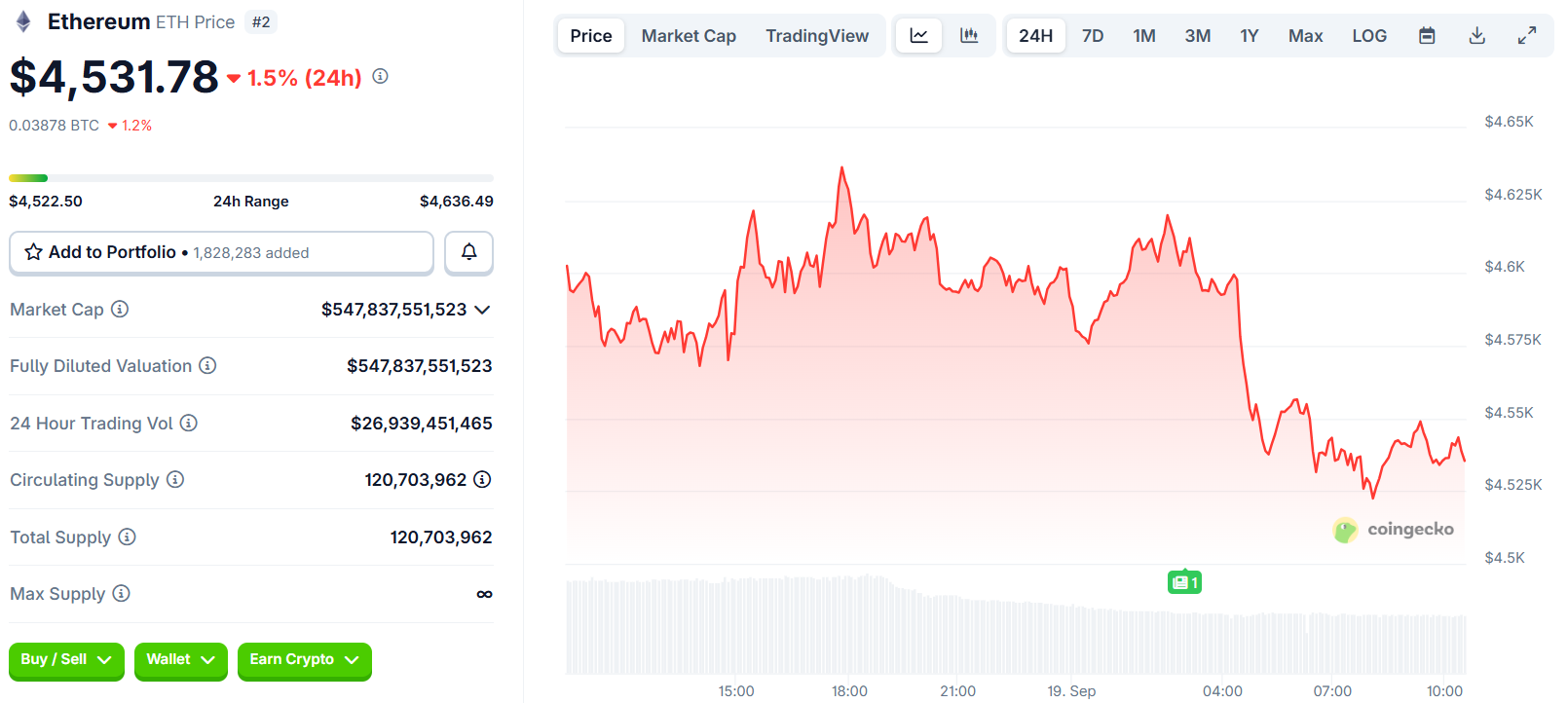

Ethereum is trading around $4,500, just under 8% from its all-time high. Yet, Citigroup believes ETH will finish 2025 closer to $4,300, pointing to weaker ETF flows and the possibility that sentiment, rather than fundamentals, is driving much of the recent upside.

Ethereum Price Chart | Source: CoinGecko

The bank acknowledges Ethereum’s role in tokenization and stablecoin growth, but warns that inflows into ETH ETFs have lagged behind those into Bitcoin. If that trend persists, Citi argues, ETH may struggle to sustain its highs into year-end. Other institutions disagree. Standard Chartered has a bullish $7,500 call, and BlackRock has added over $360 million in ETH to its holdings, spotlighting the divide in expectations. For now, though, Citi’s cautious stance has prompted some investors to turn to altcoins with more substantial short-term upside. This is where Little Pepe, Polkadot, and Hyperliquid come into play as the best coins investors are choosing over Ethereum this cycle.

Little Pepe (LILPEPE): The Meme Coin Layer 2 Revolution

Unlike Ethereum, which faces debates over scalability and concerns about fees, Little Pepe is a unique meme project that addresses these issues head-on. Built as a Layer 2 blockchain explicitly designed for meme coins, it offers:

- Ultra-low fees and fast finality.

- Sniper-bot resistance for fairer trading.

- Zero buy/sell tax for maximum liquidity.

- EVM compatibility enables seamless integration with existing decentralized applications (dApps).

The project isn’t just about memes. It introduces Pepe’s Pump Pad launch hub, providing real utility, fueling new token launches, and onboarding communities at scale. Momentum has been tremendous: the presale has already surpassed $26 million, with Stage 13 tokens priced at $0.0022 en route to a $0.003 listing. For early investors, the nearly immediate upside is already baked in, with analysts predicting potential gains of 100 times or more if adoption continues. LILPEPE’s combination of meme culture and infrastructure makes it one of the strongest Ethereum alternatives for traders hunting the next breakout star.

Polkadot (DOT): Scarcity Sparks Renewed Demand

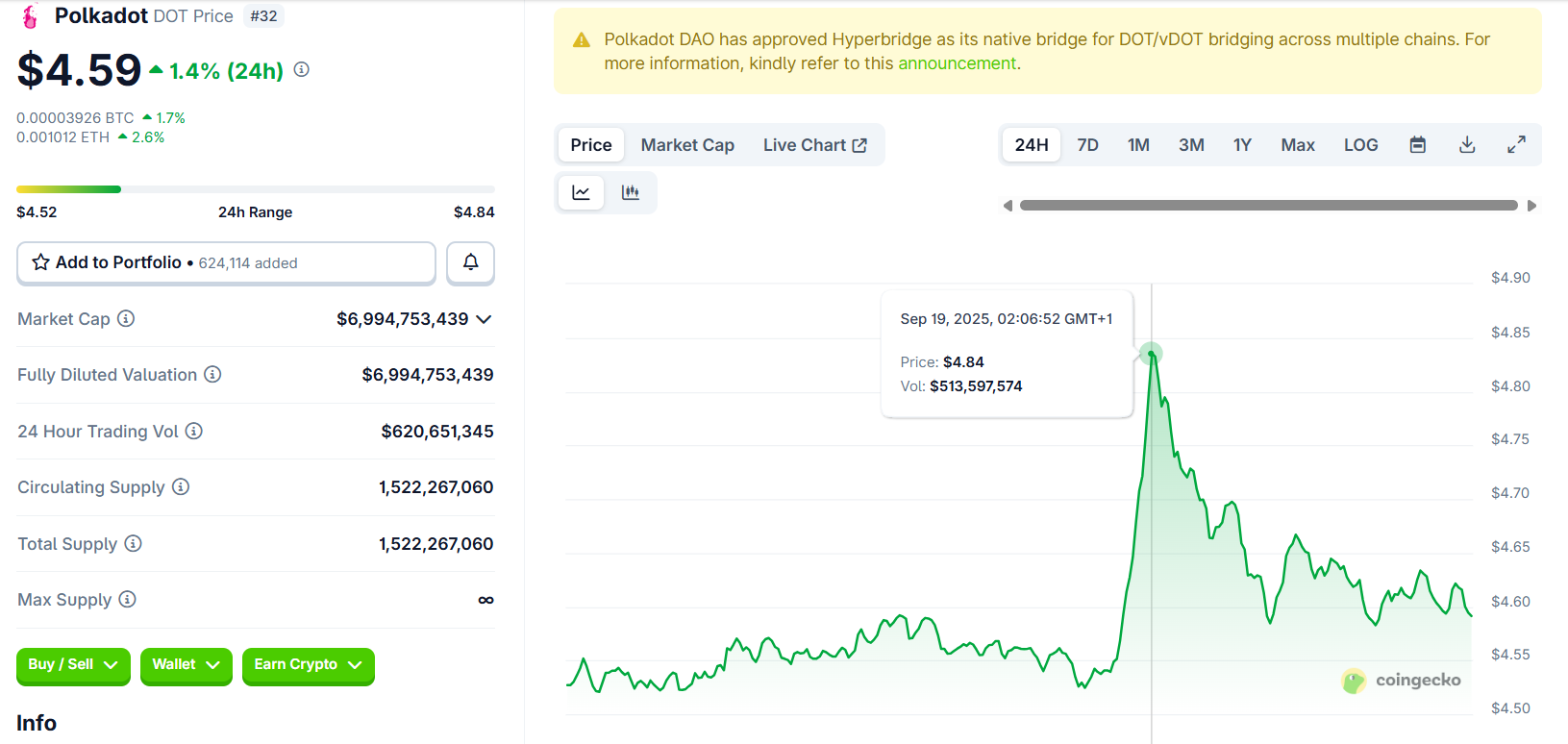

Polkadot recently made headlines after passing Resolution 1710, capping its supply at 2.1 billion DOT. This hard cap replaces its previous unlimited supply model, introducing the scarcity narrative that has fueled Bitcoin’s success.

Polkadot Price Chart | Source: CoinGecko

The market responded quickly. Open interest in DOT futures climbed to $685 million, the highest YTD, while trading volume hit new high levels since mid-July. Price action confirmed the optimism, breaking out of a months-long triangle pattern with technical targets set at $6.52. Polkadot offers exposure to a multichain ecosystem with fresh scarcity dynamics and technical momentum for investors rotating out of ETH’s sideways chop.

Hyperliquid (HYPE): Institutional Backing Fuels Rally Toward $65

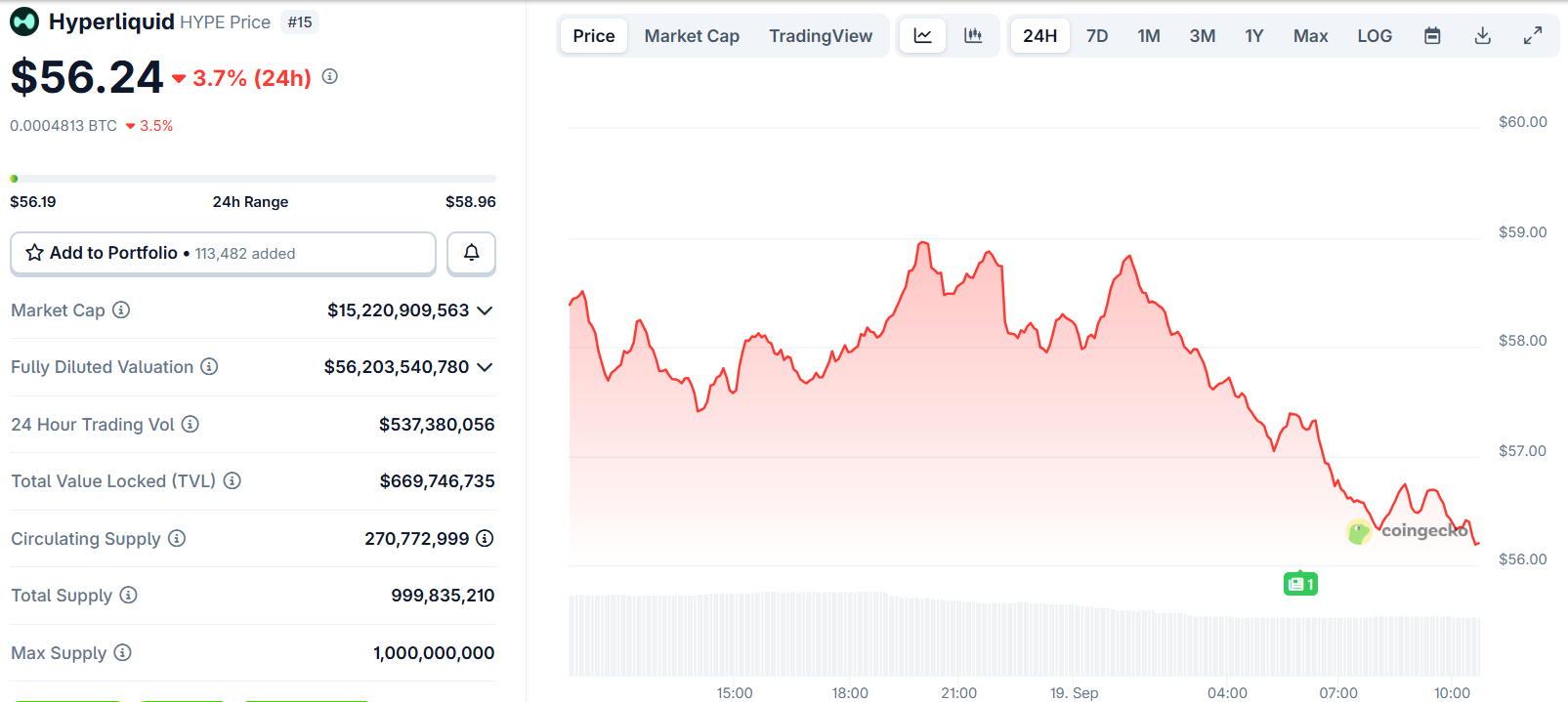

Hyperliquid (HYPE) has emerged as one of 2025’s breakout performers, climbing past $59 to reach fresh all-time highs. Intense buy pressure, consistent higher-low structures, and over $668 million in daily trading volumes have all confirmed robust demand.

Hyperliquid Price Chart | Source: CoinGecko

The bullish case strengthened after Circle announced a direct investment into Hyperliquid and joined as a network validator. This institutional alignment added credibility to HYPE’s rapid rise, with analysts now eyeing the $60–$65 range in the short term and possibly much higher if momentum holds. From an on-chain perspective, the token’s order book has cleared major sell walls. At the same time, funding rates remain balanced, a sign that growth is driven by organic accumulation rather than excessive leverage.

Rotating Out of ETH to Bigger Upsides

Ethereum remains the backbone of decentralized finance, but with Citigroup capping its year-end potential at $4,300, the bigger percentage plays may lie elsewhere.

- Little Pepe is rewriting the meme coin playbook with real infrastructure.

- Polkadot is finally tapping into scarcity with a hard supply cap.

- Hyperliquid is powering into fresh highs with institutional muscle.

For investors seeking growth beyond Ethereum’s conservative outlook, these three projects aim to deliver more substantial returns as the Q4 bull run unfolds.

For more information about Little Pepe (LILPEPE) visit the links below:

Website: https://littlepepe.com

Whitepaper: https://littlepepe.com/whitepaper.pdf

Telegram: https://t.me/littlepepetoken

Twitter/X: https://x.com/littlepepetoken

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Search

RECENT PRESS RELEASES

Related Post