3 Facts Investors Must Know Before Investing in BigBear.ai @themotleyfool #stocks $BBAI

July 25, 2025

Artificial intelligence is all the rage, but is this the right company to invest in?

BigBear.ai (BBAI -1.28%) has become a popular AI stock pick for investors. The stock has been incredibly volatile in 2025, but is up over 80% this year. That’s a strong performance, and with BigBear.ai’s small size, is there more room for the stock to run?

I believe there are three key points that potential BigBear.ai investors should know about before purchasing shares. If you’re aware of these three things, you can then make your own analysis to determine if the stock is a smart buy today or not.

Image source: Getty Images.

1. Customer concentration

BigBear.ai is focused on providing tailored AI solutions primarily to the U.S. government in the national security and defense sector. This can be a solid customer to build a business with, and many successful companies have started off doing business solely with the U.S. government before expanding into broader markets (just look at Palantir).

However, one key factor to note is that BigBear.ai doesn’t have a wide customer footprint within the U.S. government. In 2024, four clients accounted for 52% of its revenue. If one of those important customers decides to leave, it could spell disaster for BigBear.ai. This is exactly what happened recently, as a customer who made up 19% of revenue in 2022 is no longer a client. Fortunately, BigBear.ai secured another customer that’s now contributing 11% of total revenue.

BigBear.ai must continue to capture new business, which it has done by expanding its partnership with the United Arab Emirates.

BigBear.ai’s customer concentration isn’t necessarily a red flag; it’s simply something investors should be aware of, as it could lead to the business’s downfall if it loses a contract with a critical customer.

2. Low revenue growth

We’re in the prime expansion time for businesses selling AI products. Everywhere you look, AI products are being advertised, and nearly all businesses selling AI products seem to be posting exceptional growth rates, except for BigBear.ai.

In Q1, revenue rose a mere 5% year over year. We’ll receive another growth update on Aug. 11, but Wall Street analysts aren’t overly bullish on BigBear.ai’s prospects. For Q2, the average analyst projects a mere 3.5% revenue growth.

That doesn’t cut it for growth rate, and it’s not hard to find another AI company that’s growing faster.

3. Low gross margins

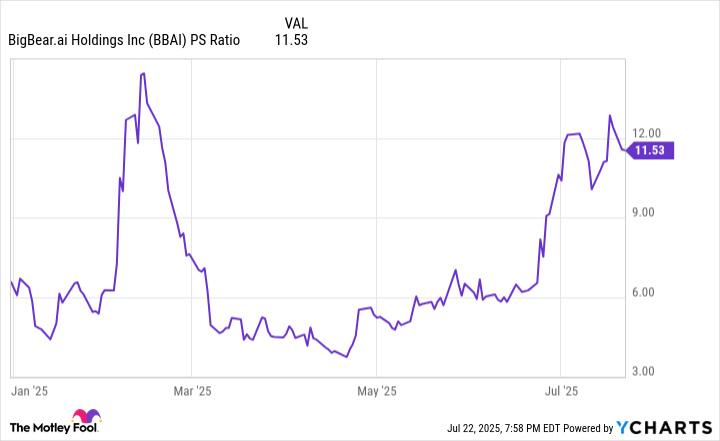

BigBear.ai’s valuation seems to compensate for its slow growth rate. Most software companies trade at a multiple of 10 to 20 times sales, so BigBear.ai’s 11.5 times sales ratio doesn’t look too expensive.

BBAI PS Ratio data by YCharts

However, that doesn’t tell the full story. Most software companies trade between 10 to 20 times sales because they have high gross margins, which gives them the potential to produce outstanding profit margins when fully mature. It’s not uncommon to see gross margins in the high 70% to low 80% range.

To achieve that range, software companies must focus on providing the software, rather than actively serving and designing custom solutions. BigBear.ai is more focused on the service side, which results in significantly lower gross margins.

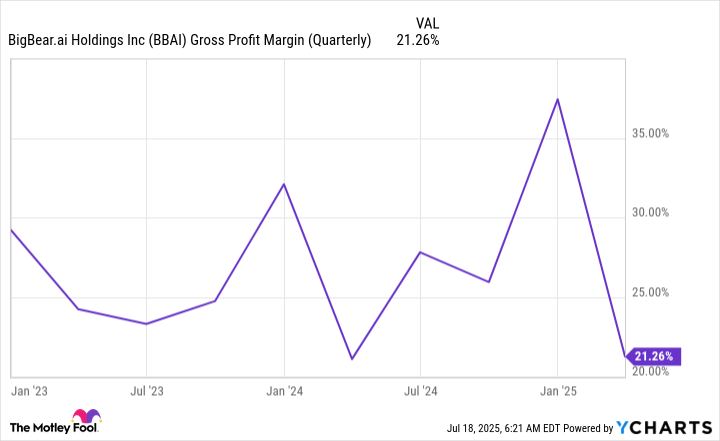

BBAI Gross Profit Margin (Quarterly) data by YCharts

BigBear.ai’s gross margins are still stabilizing, but tend to average around the mid-20% range. Most software companies aim for profit margins of around 30%, which is something BigBear is unlikely to achieve. As a result, its valuation should be significantly lower than it currently is, because it lacks the long-term potential of some of its software peers.

BigBear.ai’s slow growth and low gross margins are huge red flags for me. Combine that with a somewhat precarious customer concentration, and I think BigBear.ai is a stock investors should avoid. While the stock may continue to rise due to investor interest, there is little to no long-term investment opportunity here. There are far too many solid AI stocks investors can buy today, and BigBear.ai is not one of them.

Search

RECENT PRESS RELEASES

Related Post