3% of Bitcoin supply in control of firms with BTC on balance sheets: The good, bad and ugl

April 21, 2025

- Firms with Bitcoin on their balance sheets now hold over 630,000 BTC, more than 3% of BTC’s fixed 21 million supply.

- Corporate accumulation supports the narrative of Bitcoin as a strategic reserve asset.

- Major holders include Tesla, Block, Strategy and BTC mining firms, signaling a shift from retail flows to strategic institutional positioning.

- Short-term market uncertainty could support Bitcoin gains in the long term.

- BTC crosses $88,000 sticky resistance on Monday, eyes re-test of $90,000.

Bitcoin disappointed traders with lackluster performance in 2025, hitting the $100,000 milestone and consolidating under the milestone thereafter. The largest cryptocurrency however found its calling as a “strategic reserve asset” for giants like Strategy, Tesla, Block and several Bitcoin mining firms.

Bitcoin rallied past $88,000 early on Monday, the dominant token eyes the $90,000 level.

Bitcoin accumulation by sophisticated market participants, like corporates buying BTC with funds from their balance sheet and crossing a key milestone, controlling over 3% of supply is positive for the cryptocurrency’s growth.

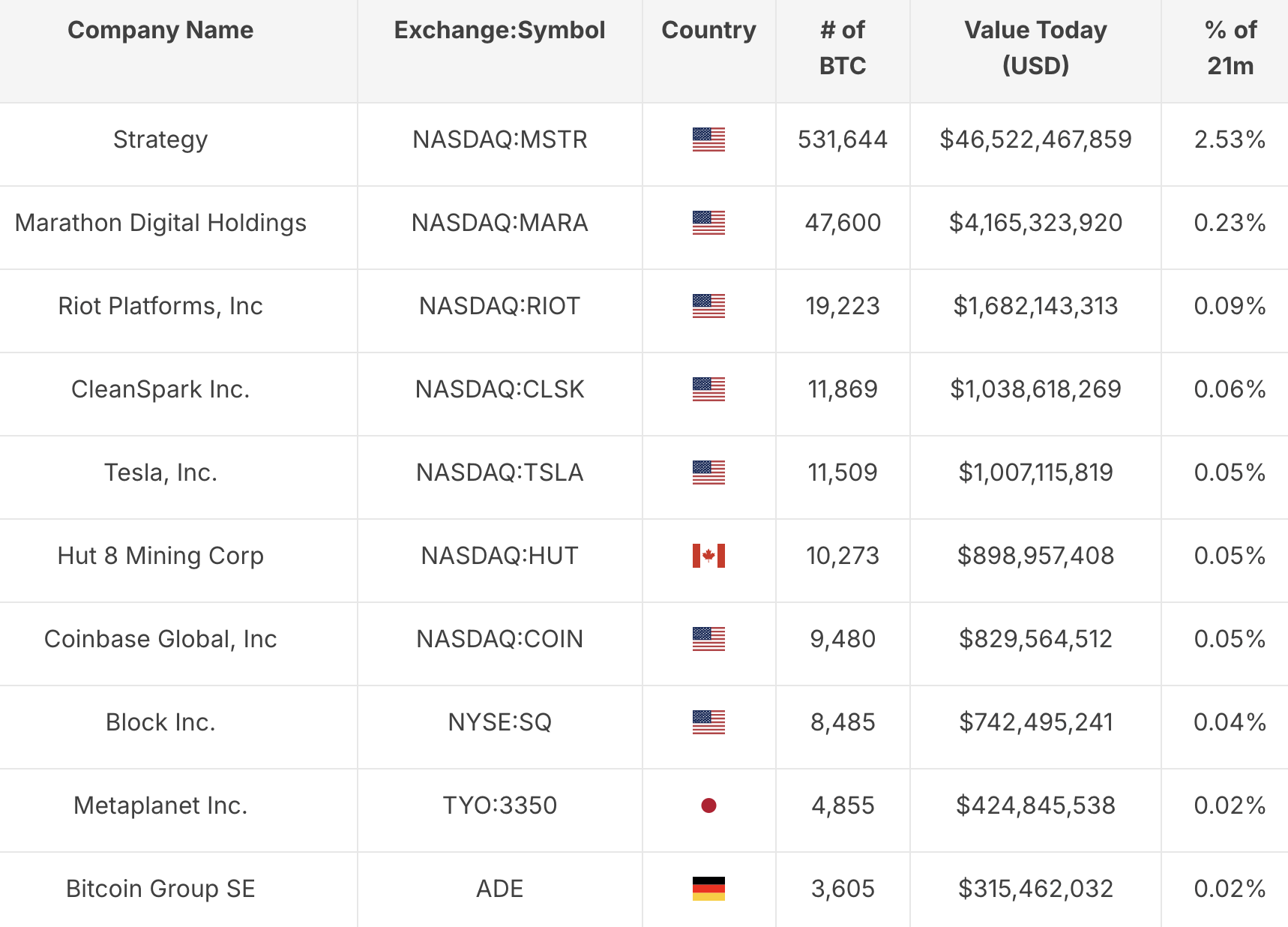

Data from Bitcoin Magazine shows the top 10 firms and their Bitcoin holdings, the total crosses 630,000 BTC, signaling their confidence and a shift in Bitcoin cycle structure from retail speculation to institutional accumulation.

Strategy, formerly MicroStrategy, leads the group, followed by Bitcoin mining firms Marathon Digital Holdings, Riot Platforms and CleanSpark.

Top ten publicly known firms holding Bitcoin on their balance sheet | Source: Bitcoin Magazine

On the one hand, Bitcoin ETF inflows are drying up and on the other firms are positioning themselves strategically with Bitcoin reserves in their treasury. Data from The Block shows that

US-based spot Bitcoin ETFs recorded $7.14 billion in volume last week, the lowest daily average for any week with at least four trading days so far this year.

With tightening Bitcoin supply and rising demand from firms gobbling BTC tokens for their treasuries, BTC could see a shift in its scarcity narrative and its four-year market cycles.

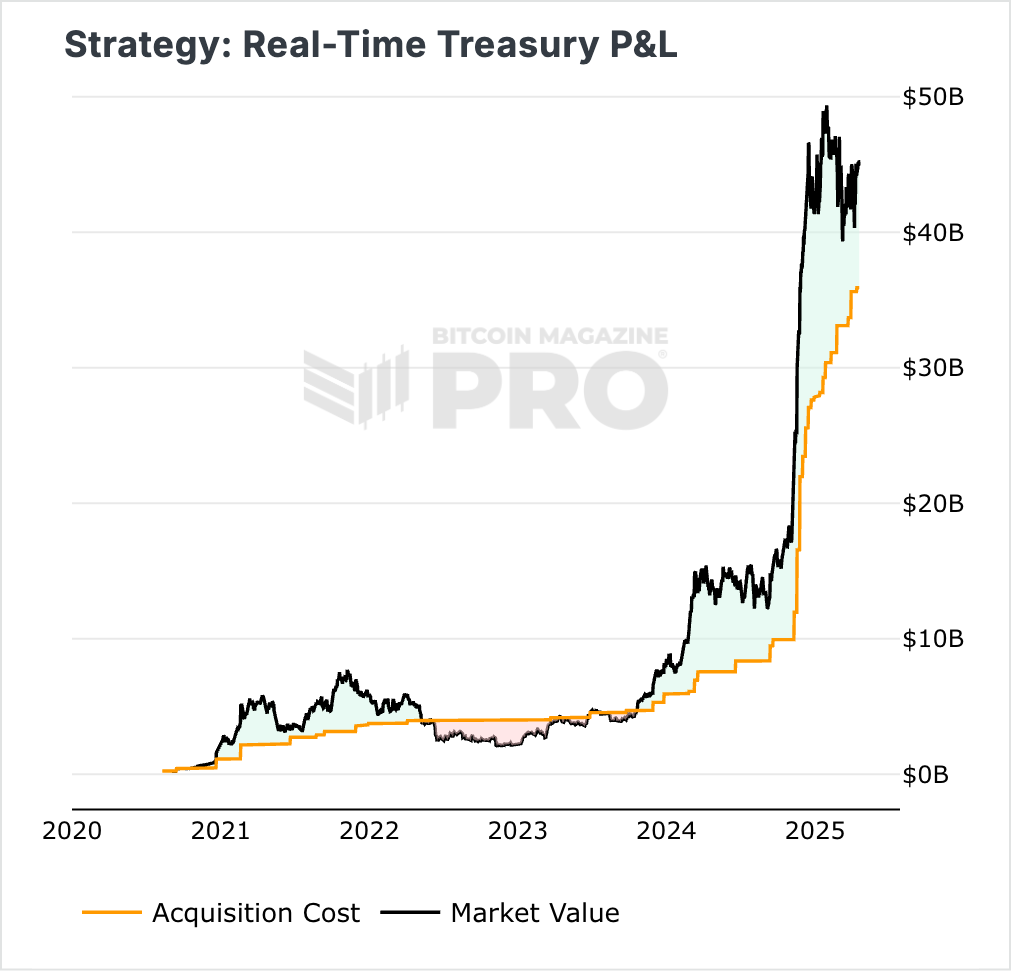

Strategy’s treasury is sitting on unrealized gain of $9.32 billion, and the stock price has rallied 2,466% since the firm started holding BTC. With fewer than 2 million BTC left to be mined, Bitcoin’s narrative changes and if firms follow in Michael Saylor’s (former Strategy CEO’s) plan, demand could increase further and support gains in the token.

Strategy’s real-time P&L of treasury as of April 20 | Source: Bitcoin Magazine

Metaplanet announced earlier today that with the acquisition of 330 Bitcoin tokens, their total holdings climbed to 4,855. Beyond BTC accumulation, Saylor’s playbook involves funding future Bitcoin purchases and managing of BTC as part of a corporate treasury.

While markets continue to deal with the uncertainty of President Trump’s pressure on the Federal Reserve to cut interest rates, there is higher volatility in top cryptocurrencies. While traders grapple with the uncertainty, Bitcoin could benefit from retail investment, accumulation by whales and large wallet investors.

The digital gold narrative could make a comeback and Bitcoin could emerge as an asset relevant to traders in the long-term.

Bitcoin is nearly 2% away from the closest resistance of $90,000. Less than 5% gains could push Bitcoin to test resistance at $92,540, the February 25 high for BTC. Two key momentum indicators, Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support a bullish thesis for Bitcoin.

RSI is sloping upwards and reads 59 and MACD flashes green histogram bars above the neutral line.

BTC/USDT daily price chart

Bitcoin trades at $88,086 at the time of writing, traders await a re-test of the $90,000 level.

Share:

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post