3 Takeaways From The White House Crypto Summit

March 8, 2025

The latest pro-crypto policy event organized by the White House was the hosting of the inaugural Crypto Summit, featuring leaders and perspectives from across the digital asset space. Investors and policy wonks alike were also sure to note that the Summit occurred mere hours after the White House created the U.S. Bitcoin Strategic Reserve via Executive Order, adding further energy to the already highly anticipated event.

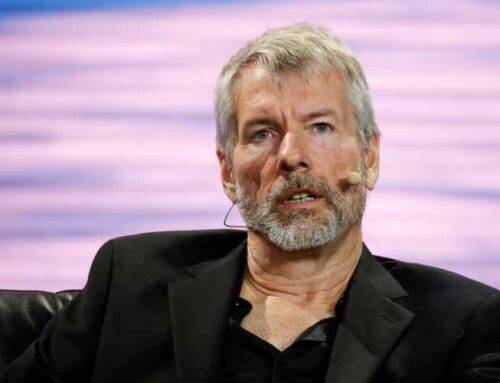

Notable invitees included Michael Saylor, Brian Armstrong, and Brad Garlinghouse amongst other high profile investors, policy advocates, and the like. The summit was important not only for who was in attendance, but for what the Summit represents for crypto investors, the future of digital assets in U.S. markets, and how the digital asset policy of the U.S. is continuing to evolve in real-time.

The White House Summit also indicates that, for the first time, the crypto industry has a direct line of communication open to the highest levels of government and policy makers in the U.S., as well as bringing together different perspectives from the sector. Notably, inviting both Garlinghouse and Armstrong – who have supported the idea of a digital asset reserve, albeit with different allocations – resulted in a robust dialogue capturing opinions that should assuage investors fears of any singular company dominating policy discussions.

While the White House Summit is newsworthy in its own right, policy changes and potential legislation remains further down the timeline; let’s take a look at a few of the takeaways that investors should keep in mind as these conversations move forward.

Bitcoin and Digital Asset Stockpiles Are Real

When then candidate Trump appeared and spoke at Bitcoin 2024 the reaction from the cryptoasset marketplace was mixed; some were enthusiastic that a Presidential candidate had apparently embraced the industry whereas others were more muted with regards to expectations. Although still in the early part of the administration, the Trump White House had seemed to prioritize other domestic (and foreign) policy issues versus the elevated status that crypto proponents had initially expected. This reality, and the reality of the (comparatively) slow speed with which legislative efforts progress, had led to bitcoin retreating from the $100,000 level it had initially reached following the election results.

The executive order and follow-up commentary from the White House and Crypto Czar David Sacks are reinforcing the fact that not only is the U.S. government committed to supporting the crypto industry, but will be actively exploring measures to 1) acquire additional tokenized assets and 2) reverse some of the more burdensome regulation that had been implemented by the previous administration. Put simply, with the SBR now a reality and the digital asset stockpile in progress, the U.S. policy apparatus appears committed to a pro-crypto stance moving forward.

The U.S. Has A Digital Asset Strategy

In media appearances in the run-up to the White House Summit AI and Crypto Czar David Sacks reiterated several important points that every crypto investors and policy advocate should be aware of moving forward. First and foremost, the U.S. is creating and implementing a digital asset strategy for the first time since bitcoin and other cryptoassets became part of the mainstream conversation. Second, the seriousness and rigor with which the administration seems to be approaching the industry is a reflection of the maturity that bitcoin and other on-chain have achieved. Particularly in the aftermath of the FTX collapse and fraud, any investment or support for the fast-growing (but still relatively nascent) cryptoasset ecosystem needs to be seen as above reproach.

Lastly, while the U.S. is not the first nation to wholeheartedly embrace bitcoin and other on-chain assets at the policy level, the reality is that the actions taken are being watched and analyzed across the globe. By prioritizing transparency and working with industry leaders to redirect policy in a well thought-out manner the U.S. strategy is set to provide a framework for others to follow.

Crypto Audits Are Becoming A Priority

One other insight that can be taken away from the White House Summit is just how important the concept of crypto audits is becoming. Among the first actions to be taken as both the SBR and digital asset stockpile are formed is a comprehensive audit of what assets are actually owned and controlled by the U.S. government. Crypto audits have been a sore point for the crypto marketplace– with Prager Metis being fined and Armanino having to exit the service area in the aftermath of FTX – but this looks set to change given the buy-in and support from the highest levels of U.S. government.

Greater transparency will not only increase the confidence with which the U.S. policy actions are viewed but will also spill over into greater reporting consistency for the private sector. On-chain assets are, ultimately, financial instruments and the ecosystem is long overdue for crypto-specific audit and attestation standards. Increased transparency, more standardized reporting, and higher levels of trust in the ecosystem will be tailwinds for the entire space.

The U.S. continues to pivot to a pro-crypto stance, and with ramifications for investors domestic and abroad emerging on an almost daily basis crypto investors and policymakers would be well served to closely monitor these developments as the move forward.

Search

RECENT PRESS RELEASES

Related Post