640K ETH Bought, 305K Sold—Is Ethereum Gearing for a Breakout?

April 25, 2025

- Ethereum whales sold 305K ETH, while silent wallets accumulated 640K ETH.

- Falling wedge breakout and RSI point to a possible bullish setup.

- Exchange inflows suggest short-term caution persists despite long-term accumulation.

Ethereum (ETH) remains caught between accumulating long-term holders and active short-term selling, as conflicting on-chain trends suggest a volatile path ahead.

Recent on-chain data showed that large investors capitalized on Ethereum’s latest price surge by unloading more than 63,000 ETH within 48 hours, according to Ali Martinez.

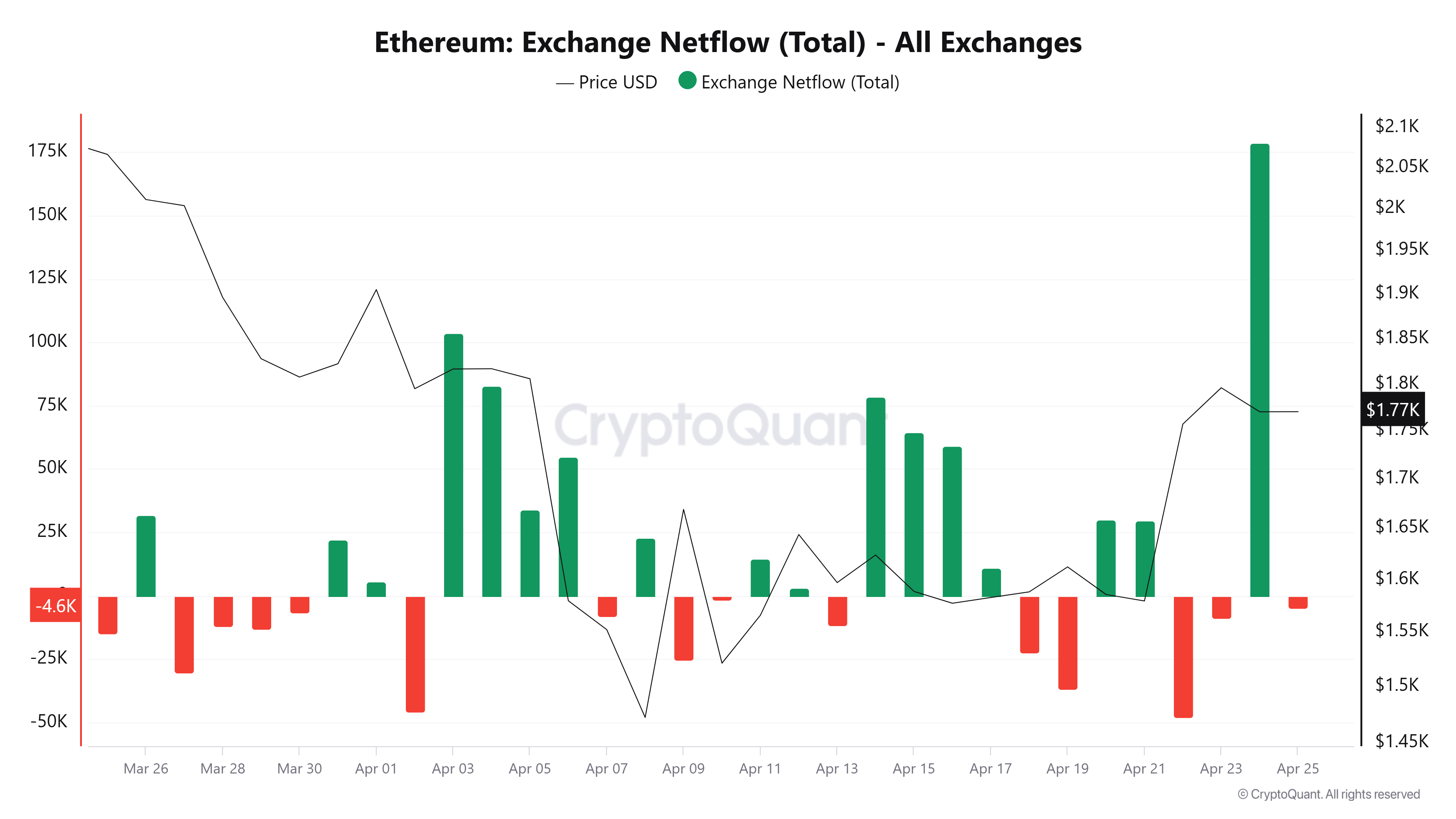

Over the past week, approximately 305,000 ETH moved to exchanges, reinforcing the notion of persistent selling pressure. Analysts often view inflows to exchanges as a precursor to liquidations, especially after price increases.

Despite this, Ethereum managed to limit losses. ETH fell by 1% on Friday, hovering around the $1,750 support level after briefly dipping below it, per CryptoQuant data.

In contrast, accumulation addresses — wallets that have never spent ETH — show a resurgence in confidence. Crypto analyst Crypto Patel highlighted that over 640,000 ETH moved into these dormant addresses, the largest such inflow since 2018.

CryptoQuant data confirmed that between Apr. 17 and 23, over 1.11 million ETH flowed into these wallets. Nearly half of the inflows occurred after Ethereum’s brief midweek price rally.

Accumulation at this scale suggests that long-term holders view current price levels as attractive, regardless of short-term volatility.

Ethereum’s technical setup adds another dimension to the story. Technical analyst Merlijn The Trader flagged a breakout from a multi-month falling wedge pattern.

The Relative Strength Index (RSI) also confirmed the bullish move with a clean breakout, a signal that often precedes trend reversals. According to Merlijn, the last time Ethereum experienced a similar setup, its price doubled within weeks.

However, history does not guarantee repetition. Market participants remain cautious, balancing optimism with lingering sell-side pressure.

Despite bullish technical patterns and accumulation signals, exchange netflow data shows Ethereum investors remain wary.

CryptoQuant reported one of the largest daily ETH net inflows to exchanges in 2025 on Thursday. Over 178,900 ETH, worth approximately $317 million, moved onto exchanges, a metric typically associated with selling intent.

The mixed behavior suggests that while some market participants accumulate quietly, others use price upticks to exit positions at break-even or minimal loss levels.

Further supporting the potential for bullish momentum, Ethereum’s net taker volume — the difference between futures contract buying and selling — has been steadily declining since January.

Although shorts have dominated ETH futures markets over the past six months, the falling negative net taker volume signals that sellers are losing steam.

This exhaustion trend emerged even as Ethereum’s price dropped to $1,473 on Apr. 11, suggesting a possible medium-term bottom for ETH prices.

Ethereum will celebrate its 10th anniversary on July 30, marking a decade since the Genesis block.

The Ethereum Foundation plans to host global meetups, unveil on-chain artifacts, and organize a live stream event. While unlikely to impact price directly, the anniversary adds an emotional catalyst to the narrative surrounding Ethereum’s current positioning.

Ethereum’s technical breakout, combined with long-term holder accumulation and declining net taker volume, points toward a possible bullish setup.

However, elevated exchange inflows and recent whale selling keep bearish risks alive. As accumulation and selling battle for dominance, Ethereum’s price is likely to remain volatile in the short term.

In this article, the views and opinions stated by the author or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Search

RECENT PRESS RELEASES

Related Post