Global Electric Vehicle Sales Up 62% (Overall Auto Sales Down 8%)

November 18, 2022

Global Electric Vehicle Sales Up 62% (Overall Auto Sales Down 8%)

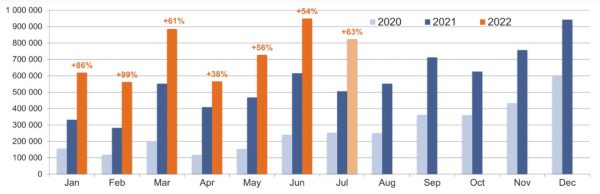

Electric vehicle sales were up 62% globally in the first half of 2022 compared to the first half of 2021. That includes fully electric vehicles and plugin hybrids. These plugin vehicles reached 4.3 million sales in the first half of 2022, according to global EV analysis leaders at EV-Volumes. Looking at growth in core regions, here’s what we get:

- European EV market: +9%

- US & Canadian EV market: +49% (at same time as overall auto market was down 17%)

- Chinese EV market: +113%

Globally, the share of light vehicle sales that were plugin vehicles rose to 11.3% in H1 2022, up from 6.3% in H1 2021. That 11.3% is dominated by full electrics (BEVs), which had 8.2% of the overall market. Plugin hybrids had 3.1% of the overall auto market.

Plugin hybrid sales increased, but not as much as full electric vehicle sales. Thus, their share of the plugin pie dropped a little, from 29% in H1 2021 to 27% in H1 2022. Overall, this is how the five key drivetrains changed year over year in the first half of 2022:

- Full battery electrics: +75%

- Plugin hybrids: +37%

- Mild hybrids: -7%

- Full hybrids: +14%

- Pure fossil-powered vehicles: -16%

Overall, global automobile sales were down 8%. “Global light vehicle markets are contracting again,” EV-Volumes writes. “Following a brief recovery in 2020 H2 and 2021 H1, 2022 H1 sales were 8.1 % lower than last year. We expect small gains for H2 as numbers compare to the depressed sales of 2021 H2. 2022 auto sales in most mature markets stayed 20–30 % below the 2015–2019 average, so far.” The EV information firm adds: “EV sales held up well in this environment: while global light vehicle sales lost -8.1 %, BEVs and PHEVs increased by +62 % for H1. The relative weakness in Europe’s EV growth relates to the EV boom in 2020/2021 and the repercussion from the war in Ukraine.”

Notable country or regional results in terms of share of sales coming from plugins in the first half of the year were:

- Norway: 77% (69% BEVs, 8% PHEVs) — the world leader in this metric

- China: 21%

- Europe: 18%

- USA: 6.5%

Country markets with the fastest growth were:

- India: +273% (20,700 plugin vehicle sales)

- New Zealand: +260% (8,300 PEV sales)

Naturally, all of this growth was driven by many automakers increasing their electric vehicle production and sales. However, the two biggest players stand out from the crowd. Tesla was the most dominant automaker — by a wide margin — in the pure BEV space. With sales up 46%, it took 18% of the pure BEV market. Looking at the broader plugin vehicle market, BYD took the crown. BYD was second in the pure BEV market, but it had enough PHEV sales (about the same as its BEV sales — 315,000 vs. 326,000 sales) to put it almost 100,000 units ahead of Tesla in the overall plugin market (641,000 vs. 565,000 sales).

Below BYD and Tesla — far below them — Volkswagen Group had a clear edge in #3 in terms of plugin sales, but GM (yes, GM) had more sales in terms of pure battery electrics. That GM position is heavily propped up by the sales of the Wuling Mini EV in China.

The Hyundai–Kia collaboration and Stellantis (which is now what, 100 brands?) are on the next tier, but they again rely a bit more on plugin hybrid sales, especially Stellantis. We’ll see what the second half of 2022 brings! And 2023 should be even much more interesting.

For more details on H1 2022 electric vehicle sales numbers, see the full EV-Volumes report. Here’s one more chart from EV-Volumes on the top selling plugin vehicle models in the world:

Search

RECENT PRESS RELEASES

Related Post