Investing in a New World: Capturing Opportunity and Weathering Uncertainty

March 6, 2025

US equity investors have experienced an extraordinary run. Now the world is changing, with new variables at play, from the AI boom to Trump—presenting distinct opportunities and challenges. How can investors position to continue capturing great returns, given the wide range of ways the world could play out? This paper explores these questions and introduces Bridgewater’s All Weather® approach designed for investors seeking to reliably compound their wealth.

Out of any 15-year period to be invested in equities dating back to 1970, the one we’ve just lived through was the best. Stocks (especially US stocks) have been on a relentless tear, with any dips quickly fading into memory. Returns have been more than double the average. This run-up has enriched investors greatly. How can investors lock in gains and continue to capture great returns as the world evolves?

Almost every investor is positioned the same way, and there is a paradox at work in that positioning.

The run-up in equities has left investors more concentrated than almost ever before—the only time it’s come close was after the ride up to the top of the dot-com bubble in the early 2000s. This means that whether explicitly or implicitly, investors are betting that strong stock performance will continue, and that the US will keep on winning out over other countries.

Yet,the run-up in US equities makes it harder for them to continue outperforming going forward.

It’s like what happens when everyone expects one sports team to win a game. As anyone who has tried their hand at betting on sports knows, when one team is favored a lot, you don’t profit much just by betting on them to win—you need to bet on them to win by more than expected.

Similarly, US equities’ great performance has pushed valuations higher, effectively baking lofty expectations into the price—which raises the hurdle to continue generating the outsize returns investors have experienced in the recent past and are implicitly positioned for.

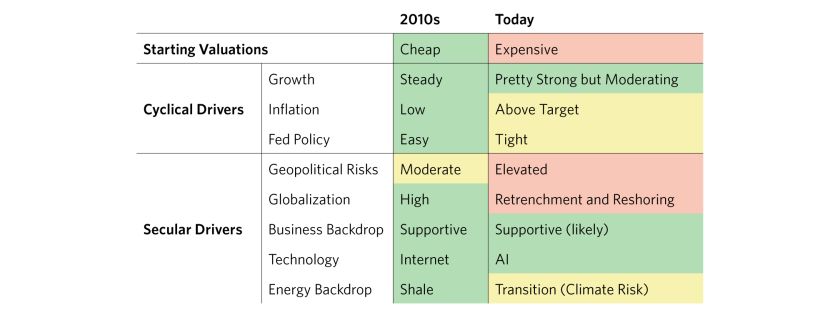

The table below shows how what is “baked in” to US stock prices has evolved over the last decade.

To continue earning high returns, US companies have to not just deliver on already high expectations—but to beat them. That’s a tall order. It’s also exactly what portfolios are (implicitly) betting on.

Is it likely that US companies will live up to such high expectations?

There are plenty of reasons to question whether the recent extraordinary returns can be sustained. Achieving them took a unique confluence of low starting valuations, a long runway for strong growth without creating inflation or triggering Fed tightening, and a backdrop of increasing globalization and pro-business policies such as corporate tax cuts. Looking ahead, the picture is more mixed. The table below synthesizes the key drivers and the shifts that we are monitoring.

Speaking with investors, we feel both their optimism and excitement, alongside anxiety and fear.

We can analyze, we can estimate, but the truth is no one has the answers. What is safe to say is that there’s plenty of uncertainty about where we are going. The good news is that there’s power in recognizing that uncertainty.

II. Crafting a Resilient Portfolio (Without Playing Defense)

One of the most timeless insights of investing is that you don’t need to bet on knowing how it will all turn out. Investing wisely is about preparing for a range of outcomes:

- You don’t need to give up on equities and endure the FOMO of getting out at the wrong time.

- You don’t need to retreat to cash.

- You don’t need to go into a defensive crouch.

Instead, no matter how much you may have benefited from the recent extraordinary equity run, moving into diversifying holdings can cushion you if and when stocks experience a drawdown.

Even incremental shifts can be quite impactful. Because most portfolios are starting from a concentrated equity position, even relatively small moves can have an outsized impact on making your portfolio more resilient.

What does this look like in practice? First and foremost, hold assets to address the different reasons that equities can experience a drawdown—and what can protect you in each. There are a few distinct archetypes:

Here’s what this has looked like in practice, scanning across the 10 instances since 1970 when global equities fell more than 15%.

![AW ETF WP_07[1].png](https://bridgewater.brightspotcdn.com/dims4/default/5e00edd/2147483647/strip/true/crop/2016x831+0+0/resize/840x346!/quality/90/?url=http%3A%2F%2Fbridgewater-brightspot.s3.us-east-1.amazonaws.com%2Ff4%2Fd0%2Fc0373f164b529f3b90f5ad9f5a23%2Faw-etf-wp-071.png)

Armed with this understanding, you can build a resilient portfolio that includes not just equities, but also assets that can do well at times when equities do poorly—in a way that is not simply resigning yourself to a 60/40 or 70/30 mix.

- Bonds have more room to cushion against a stock market decline as the Fed can lower rates if growth slows; they also provide yield if conditions hold up.

- Inflation-linked bonds add built-in inflation protection to bonds by literally paying out the inflation rate. That gives them great option value in case inflation creeps back up.

- Commodities add inflation protection. Goldhas particular appeal in the context of geopolitical risk and an ever-growing pile of Treasury debt.

Since a broad liquidity pullback tends to hurt all assets in the affected country, one of the key ways to avoid such losses is simply to spread your exposure more across countries, which capture different opportunities and get hit by different risks. For example, in 2022, when all kinds of US assets suffered from Fed tightening, Japanese policymakers were on an all-out offensive to support the economy and assets, and Japanese equities performed well.

To recap: investors can position to prosper across a wide range of possible futures by putting some of their investments into assets that can do well in different economic environments, and across different countries facing different pressures.

That is the foundation of what we do at Bridgewater in our “All Weather” strategy.

60/40 and 70/30 refer to mixes of stocks and bonds, respectively. Based on Bridgewater analysis. The recipient should not solely rely upon the materials enclosed to make an investment decision.

III. All Weather Is Bridgewater’s Answer to the Question of How to Reliably Invest for an Uncertain Future

Bridgewater invented the All Weather approach back in the ‘90s, originally for Ray as he was thinking about what investment portfolio to hold to preserve and compound wealth for future generations.

Ray and the Bridgewater team sought to build an approach that could thrive across different types of economic “weather,” even when equities suffered. They designed it to be as balanced as possible to how growth and inflation transpire—drawing on deep fundamental understanding of how macro conditions affect different assets, as well as expertise in engineering portfolios to minimize risk without sacrificing return.

For over two decades, the strategy has grown to invest in nearly every major liquid market in the world, including many that didn’t exist back in the ‘90s. Since then, a wide range of pension funds, endowments, and foundations have utilized it to deliver strong and resilient returns and compound wealth for future generations.

Important Disclosures and Other Information

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, Bridgewater’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. Any such offering will be made pursuant to a definitive offering memorandum. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice. No discussion with respect to specific companies should be considered a recommendation to purchase or sell any particular investment. The companies discussed should not be taken to represent holdings in any Bridgewater strategy. It should not be assumed that any of the companies discussed were or will be profitable, or that recommendations made in the future will be profitable.

The information provided herein is not intended to provide a sufficient basis on which to make an investment decision and investment decisions should not be based on illustrative information that has inherent limitations. Bridgewater makes no representation that any account will or is likely to achieve returns similar to those shown. The price and value of the investments referred to in this research and the income therefrom may fluctuate. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur. Investments in hedge funds are complex, speculative and carry a high degree of risk, including the risk of a complete loss of an investor’s entire investment. Past performance is not a guide to future performance, future returns are not guaranteed, and a complete loss of original capital may occur. Certain transactions, including those involving leverage, futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Fluctuations in exchange rates could have material adverse effects on the value or price of, or income derived from, certain investments.

Bridgewater research utilizes data and information from public, private, and internal sources, including data from actual Bridgewater trades. Sources include Absolute Strategy Research, BCA, Bloomberg Finance L.P., Bond Radar, Candeal, CEIC Data Company Ltd., Ceras Analytics, China Bull Research, Clarus Financial Technology, CLS Processing Solutions, Conference Board of Canada, Consensus Economics Inc., DTCC Data Repository, Ecoanalitica, Empirical Research Partners, Energy Aspects Corp, Entis (Axioma Qontigo Simcorp), Enverus, EPFR Global, Eurasia Group, Evercore ISI, FactSet Research Systems, Fastmarkets Global Limited, The Financial Times Limited, Finaeon, Inc., FINRA, GaveKal Research Ltd., GlobalSource Partners, Gordon Haskett Research Associates, Harvard Business Review, Haver Analytics, Inc., Institutional Shareholder Services (ISS), Insync Analytics, The Investment Funds Institute of Canada, ICE Derived Data (UK), Investment Company Institute, International Institute of Finance, JP Morgan, JSTA Advisors, LSEG Data and Analytics, MarketAxess, Medley Global Advisors, Metals Focus Ltd, MSCI, Inc., National Bureau of Economic Research, Neudata, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Pitchbook, Political Alpha, Renaissance Capital Research, Rhodium Group, RP Data, Rubinson Research, Rystad Energy, S&P Global Market Intelligence, Sentix GmbH, SGH Macro, Shanghai Metals Market, Smart Insider Ltd., Sustainalytics, Swaps Monitor, Tradeweb, United Nations, US Department of Commerce, Visible Alpha, Wells Bay, Wind Financial Information LLC, With Intelligence, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, YieldBook. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy. Data leveraged from third-party providers, related to financial and non-financial characteristics, may not be accurate or complete. The data and factors that Bridgewater considers within its investment process may change over time.

This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability, or use would be contrary to applicable law or regulation, or which would subject Bridgewater to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of Bridgewater® Associates, LP.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.

Search

RECENT PRESS RELEASES

Related Post