2 stocks Jim Cramer says investors must pounce on in this oversold market

March 7, 2025

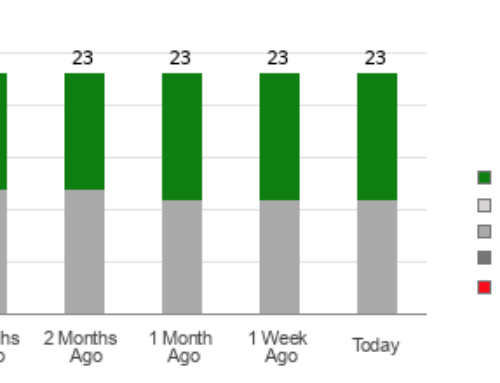

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Friday’s key moments. 1. The selling on Wall Street continued Friday, with the tech-heavy Nasdaq sinking further into correction territory. In an overlooked glimmer of hope, the latest jobs report was not as bad as anticipated. The U.S. economy added 151,000 nonfarm payrolls versus the 160,000 expected. Hourly earnings were also “really terrific,” Jim Cramer said during the Morning Meeting. “We had a jobs number that I thought was about as perfect as you can get. There’s no recession. There’s no inflation.” The numbers show the Federal Reserve may not have to worry as much about the labor market, Jim added. A greater impact from President Donald Trump ‘s government downsizing is expected in the March jobs report. 2. Broadcom had a strong quarter with both revenue and earnings better than expected. AI revenue rose 77% to $4.1 billion. The chipmaker has also added new customers for custom chips in addition to the two they mentioned last quarter and the three they are currently shipping in volume. Current customers include Club names Alphabet , Meta Platforms , and TikTok-owner Bytedance. Jim said investors who don’t own Broadcom need to “pounce on the stock” if it were to come down to $182 or $183 per share. Broadcom’s year-to-date loss of nearly 20% is a reflection of the negative sentiment toward semiconductors. 3. Costco also came in hot, proving itself to be a winner yet again. The company’s earnings report was “picture perfect,” Jim said. February sales are strong and have not been impacted in comparison to other retailers. Costco is managing tariffs as a third of its sales are imported from other companies. Thankfully, less than half of those imports come from China, Mexico, or Canada. The retailer is also starting to see the benefits of its recent membership increases. “When this stock is down $75 [in Friday trading] you are going to get a chance to buy,” Jim said. 4. Stocks covered in Friday’s rapid fire at the end of the video were: Hewlett Packard Enterprise , Gap , and Bank of America . (Jim Cramer’s Charitable Trust is long Costco and Broadcom. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

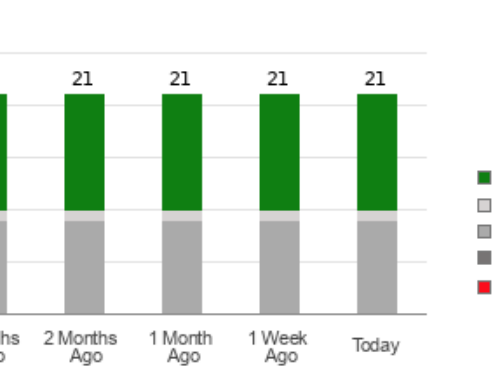

Every weekday the CNBC Investing Club with Jim Cramer holds a “Morning Meeting” livestream at 10:20 a.m. ET. Here’s a recap of Friday’s key moments.

Search

RECENT PRESS RELEASES

Related Post