Ethereum Foundation Makes 30,098 ETH Liquidation Play on Maker: Details

March 11, 2025

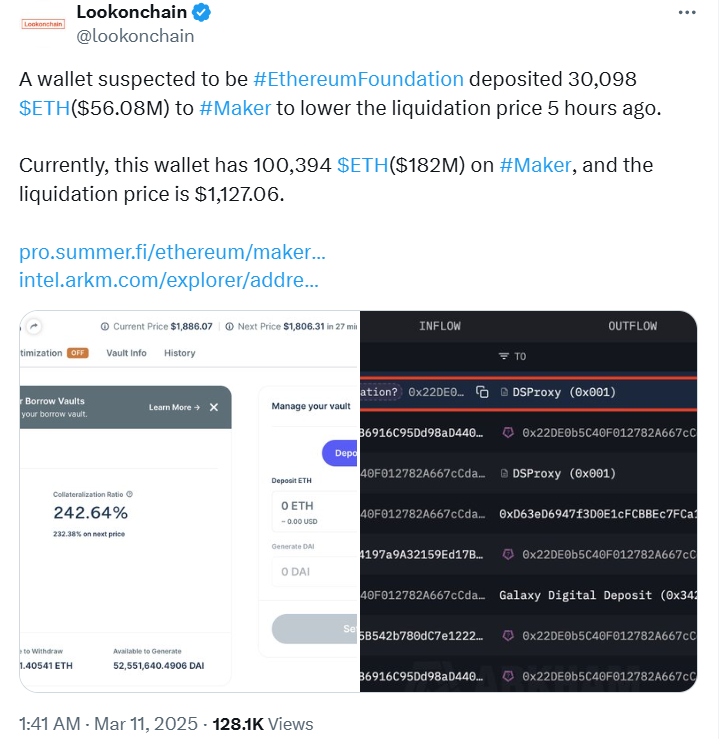

Concerns about leverage and liquidations in the Ethereum ecosystem took a new twist with a spotlight from Tron Founder Justin Sun. In a significant development, a wallet suspected to belong to the Ethereum Foundation deposited 30,098 ETH into a MakerDAO vault earlier today.

Advertisement

Ethereum Foundation averts liquidation risk

According to the update from Lookonchain, the deposit, valued at $56.08 million, was made to lower the liquidation price of its ETH on the DeFi protocol. The wallet now holds 100,394 ETH worth $189 million on Maker, with a liquidation price of $1,127.06.

Against the initial assumption that the liquidation risks are tied to the Ethereum Foundation, independent Journalist Colin Wu clarified that an address at risk of liquidation likely belongs to an early ETH investor, not the EF.

In addition, two popular Ethereum developers, eric.eth and sassal.eth, have also released a statement that the wallet does not belong to the Ethereum Foundation.

Ethereum price outlook

The transfer is a testament to the Ethereum Foundation’s role in stabilizing the ETH price in the DeFi ecosystem. Notably, this became even more necessary following the market volatility that followed the Bybit hack earlier in February.

Meanwhile, data from on-chain analytics platform IntoTheBlock shows that $1.8 billion worth of ETH left exchanges last week, the highest weekly amount since December 2022.

Historically, Ethereum has seen different price fluctuations. In November 2021, ETH reached an all-time high of 4,878.26. However, the altcoin has since struggled to reclaim that peak.

As of press time, CoinMarketCap data shows that the ETH price has dropped below $1,800 as leverage concerns hit their peak. Just like the Ethereum Foundation stepped in to avert a liquidation crisis on Maker, Justin Sun has advised a more defined solution to the leverage issuer challenging the protocol.

For now, the broader market trend masks the overexposure in the ETH price, an outlook analysts note may be unsustainable in the near future.

Search

RECENT PRESS RELEASES

Related Post