The cost of tariffs visualized: What 5 charts say about the future of ad spend

April 10, 2025

President Donald Trump’s tariffs are already warping the outlook for ad spending, casting a long, uncertain shadow over the year ahead. The full impact remains to be seen — especially since he delayed most tariffs for another 90 days — but early projections point to a market that’s already bracing for impact.

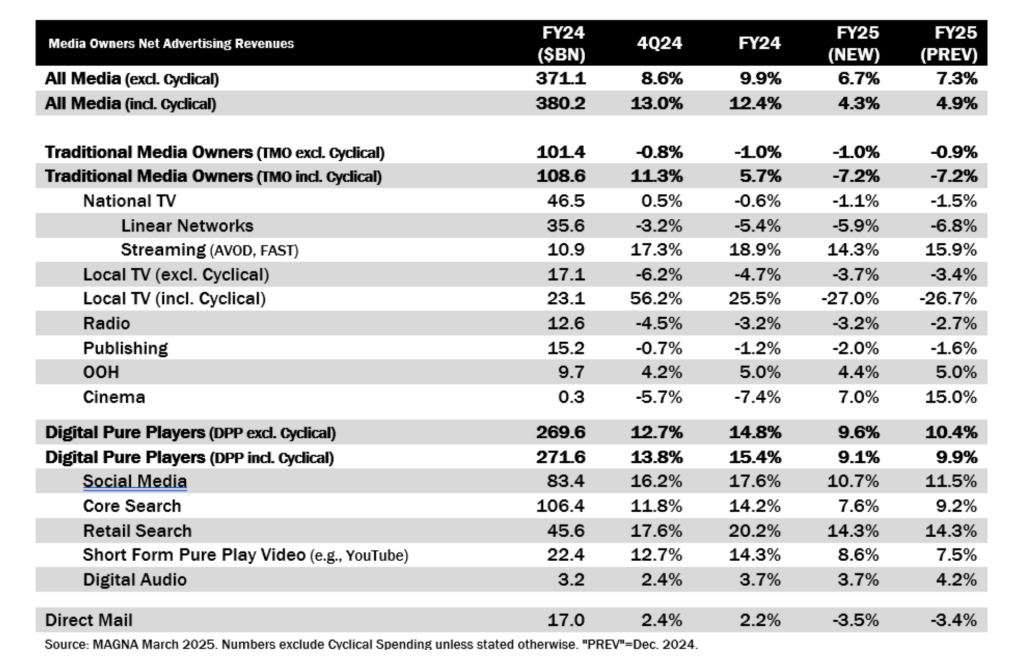

Magna’s latest forecast paints the picture: the digital heavyweights — Google, Meta, Amazon and others — collectively brought in $271 billion in U.S. ad revenue last year. These so-called “digital pure players”, spanning search retail media, social, video and audio are now projected to grow by 9.1% in 2025. That’s a subtle but telling dip from the previously expected 9.9%.

Social media, often the bellwether for digital ad health, is especially losing pace. The sector brought in $83 billion last year and is not forecast to grow by 10.7% down from 11.5% — an early sign of advertisers finishing in an uncertain climate.

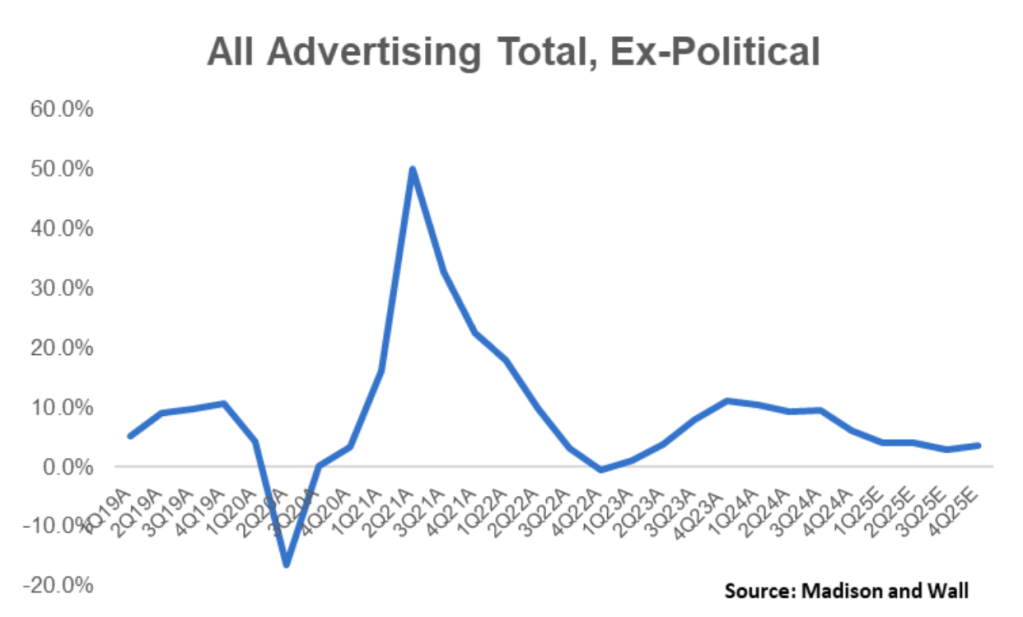

Brian Wieser of Madison & Wall also believes a slowdown is coming, having revised his original forecast for the year down.

Advertisers, for their part, are feeling the pressure. According to the IAB, 94% of 100 U.S. advertisers surveyed in February said they were concerned about the impact of tariffs on this year’s spending. Sixty percent anticipated budget cuts between 6% and 10% while nearly a quarter expected deeper reductions of up to 20%.

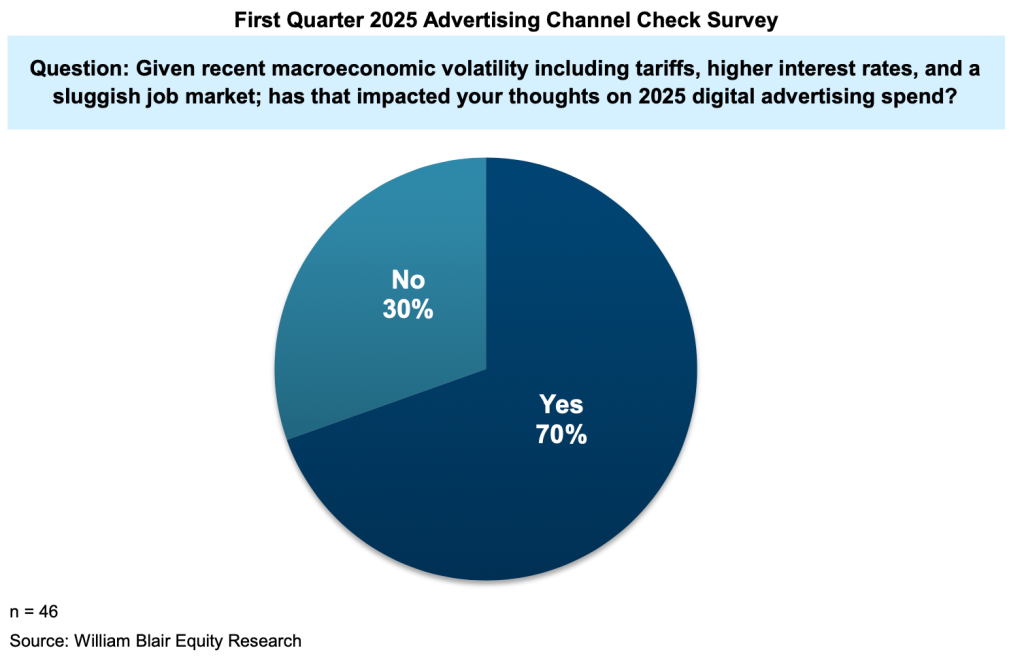

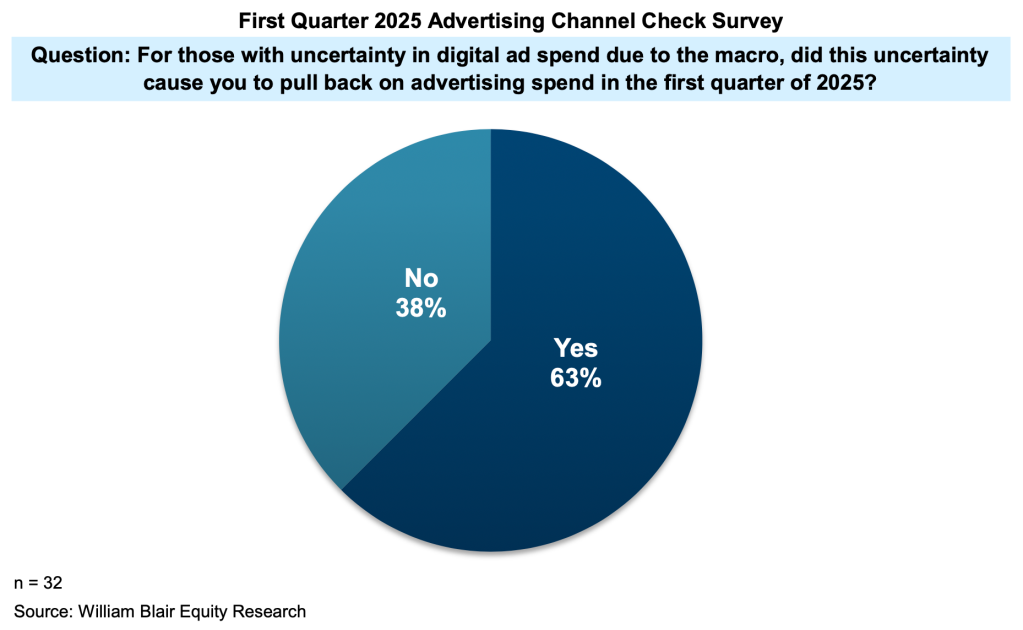

That caution is already showing up in actual spending. In William Blair’s first quarter 2025 Proprietary Digital Advertising Executive survey published on April 7, nearly 70% of the 50 advertising execs surveyed said they had revised their digital ad plans in a response to the latest macro volatility. On average, 63% said they’d already pulled back 7% of spend during the first three months of the year.

The message from the market is clear: optimism is taking a back seat.

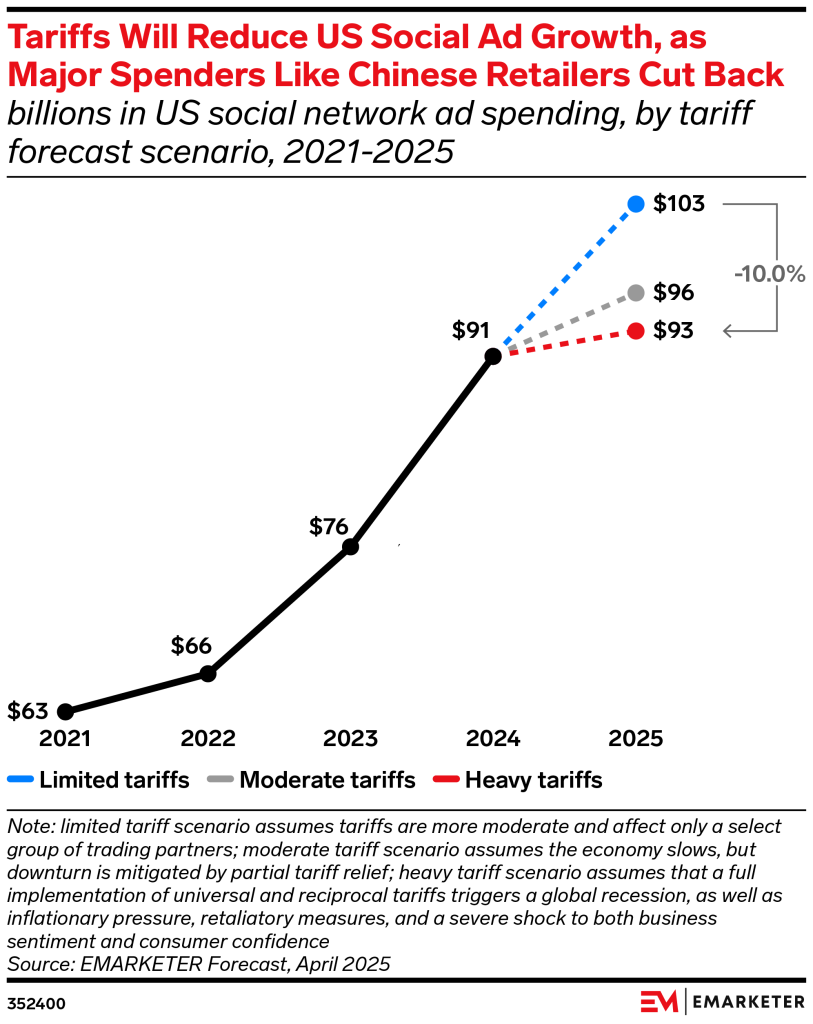

The imminent downturn will be especially pronounced in social advertising. eMarketer had projected social ad spending to hit $103 billion earlier this year — a milestone moment. But that projection came before the tariffs threw a wrench into the plans of major Chinese advertisers like Shein and Temu.

Now, eMarketer estimates that tariffs could cut U.S. social ad spending by as much as $10 billion in 2025. If tariffs are light and targeted, growth could still push toward the original $103 billion, but under a moderate tariff scenario that projection slips to $96 billion. In the event of heavy broad tariffs triggering a global recession, the number drops further to $93 billion.

A new era of uncertainty has arrived and marketers are already playing defense.

Unsurprisingly, tech giants Google, Meta and Amazon are expected to be the most resilient to a recession, thanks to their performance advertising capabilities, according to New Street Research.

Still, as eMarketer’s vp and principal analyst, social media and the creator economy Jasmine Enberg posted on LinkedIn, Meta is heavily exposed to the China tariffs because China-based advertisers accounted for 11% of Meta’s ad revenues in 2024.

“A pullback by those advertisers could hurt Meta, which we expect will account for 72.5% of US social ad spending this year,” she wrote.

Next in line is the ever popular TikTok, which has spent time improving its advertiser offering, including launching its AI-powered campaign tool Smart+ last October during Ad Week. But the ongoing uncertainty around a U.S. ban has meant advertisers fall into one of two buckets: those on the more cautious side have chosen to put their contingency plans into motion, pulling spend from the platform, while others have opted for the “ride or die” approach, taking advantage of lower CPMs, and ultimately staying with the platform for as long as it exists.

The platforms which are likely to be the least resilient to a recession, according to New Street, are the tier two platforms: Pinterest, Reddit and Snapchat. And Digiday would even put X into this same category. Their lower user bases and ad revenue already put them below the tier one platforms for most social media mixes during normal economic circumstances. But throw a recession in the mix and they’ll face bigger challenges due to budget cuts and advertisers reverting back to their “old faithfuls”: Google and Meta, which provide an almost guaranteed ROI.

Search

RECENT PRESS RELEASES

Related Post