How to invest in Nvidia successfully during Trump tariff turmoil

April 16, 2025

Listen and subscribe to Opening Bid on Apple Podcasts, Spotify, YouTube or wherever you find your favorite podcasts.

Not too long ago, Nvidia (NVDA) seemed unstoppable.

If recent market woes and the Nvidia pullback have investors down, they should consider the bigger picture, according to Lawrence “Larry” McDonald, founder of the Bear Traps Report.

“You can make a lot of money by investing in the power infrastructure plays,” he told Yahoo Finance Executive Editor Brian Sozzi for an episode of the Opening Bid podcast (see the video above or listen below).

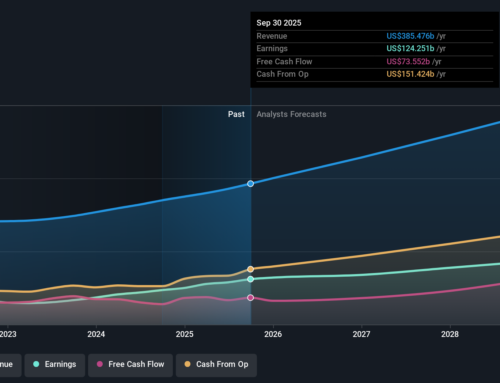

He added that Nvidia’s forecasts include $3 trillion in growth and that copper has a bright future related to it. “If you really, really listen to Jensen [Huang] and the Nvidia gods, the only way they get to their growth trajectory is with a lot more copper.”

“If you look at the copper or oil names, they’re down 30, sometimes, 25% off the highs,” he said. “The future looks great for them because the valuation setup is so skewed.”

McDonald is no stranger to helping the average investor through turbulent market moments.

Among other things, the Bear Traps Reportaims to demystify political policy risk for investors and related investment strategies. McDonald is also the author of two books, including 2024’s “How to Listen When Markets Speak.”

Plenty of speculation and concern had gripped investors related to Trump’s tariffs and their impact on technology. Markets have responded accordingly.

Read more: The latest news and updates on Trump’s tariffs

The boost to 145% tariffs earlier this month on Chinese goods resulted in consumers bracing for sticker-shock prices on items such as iPhones. Meanwhile, Apple (AAPL) reportedly flew $2 billion worth of iPhones from India in March just before the first round of tariffs took hold.

Nvidia had to take a $5.5 billion charge this week because of fresh restrictions on its AI chip exports to China.

In an April 10 note, Citi analyst Atif Malik maintained a Buy rating on Nvidia but lowered estimates “to align with our revised hyperscaler capex model of +35%/+15% spend reflecting mostly lower Microsoft capex concerns and higher risk of pause in enterprise investments amid uncertainty around the global economy due to ongoing trade war,” he wrote.

McDonald said despite his interest in copper as a way to play AI, Nvidia remains poised for AI greatness. It may just take a bit for the stock to work higher again.

“You can make a lot of money by investing in the power infrastructure plays,” he said.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post