Ethereum Wallet Activity Spikes 10% as Golden Cross Buzz Builds Up—Bullish Signal?

April 24, 2025

- Ethereum’s active addresses surged from 306K to 336K in just 48 hours.

- Developer commits show Ethereum leads in blockchain development by a wide margin.

- A Golden Cross forms on ETH charts, signaling a possible shift in market momentum.

The momentum is back in Ethereum. Active wallet activity spiked nearly 10% in just 48 hours, while technical Golden Cross pattern suggests bullish sentiment. With strong developer engagement, ETH may be in a new phase of network and market strength.

According to on-chain data from CryptoQuant, Ethereum’snumber of active addresses increased from 306,211 to 336,366 between April 20 and April 22, 2025. It represents a 9.85% rise in just 48 hours. Active wallet count stood at 306,211 on April 20 alone, which is below the 14-day moving average of 345,913, but it started to increase in the following days.

Even as the price fell to $1,585.70 on April 20, this rise in address activity took place. This may seem contradictory, but it generally implies that users are using ETH more or interacting with it more, regardless of short-term price. Past trends indicate that higher on-chain activity could indicate future price movement or renewed interest from investors.

Ethereum’s price also rebounded after April 20 to $1,756 on April 22. It’s up 24% from the local low. This is in line with the address activity pickup, which implies a possible correlation between more user activity and price support.

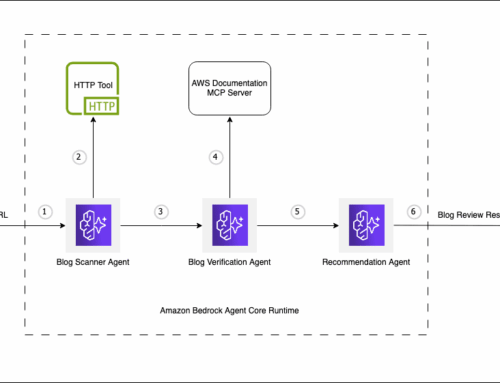

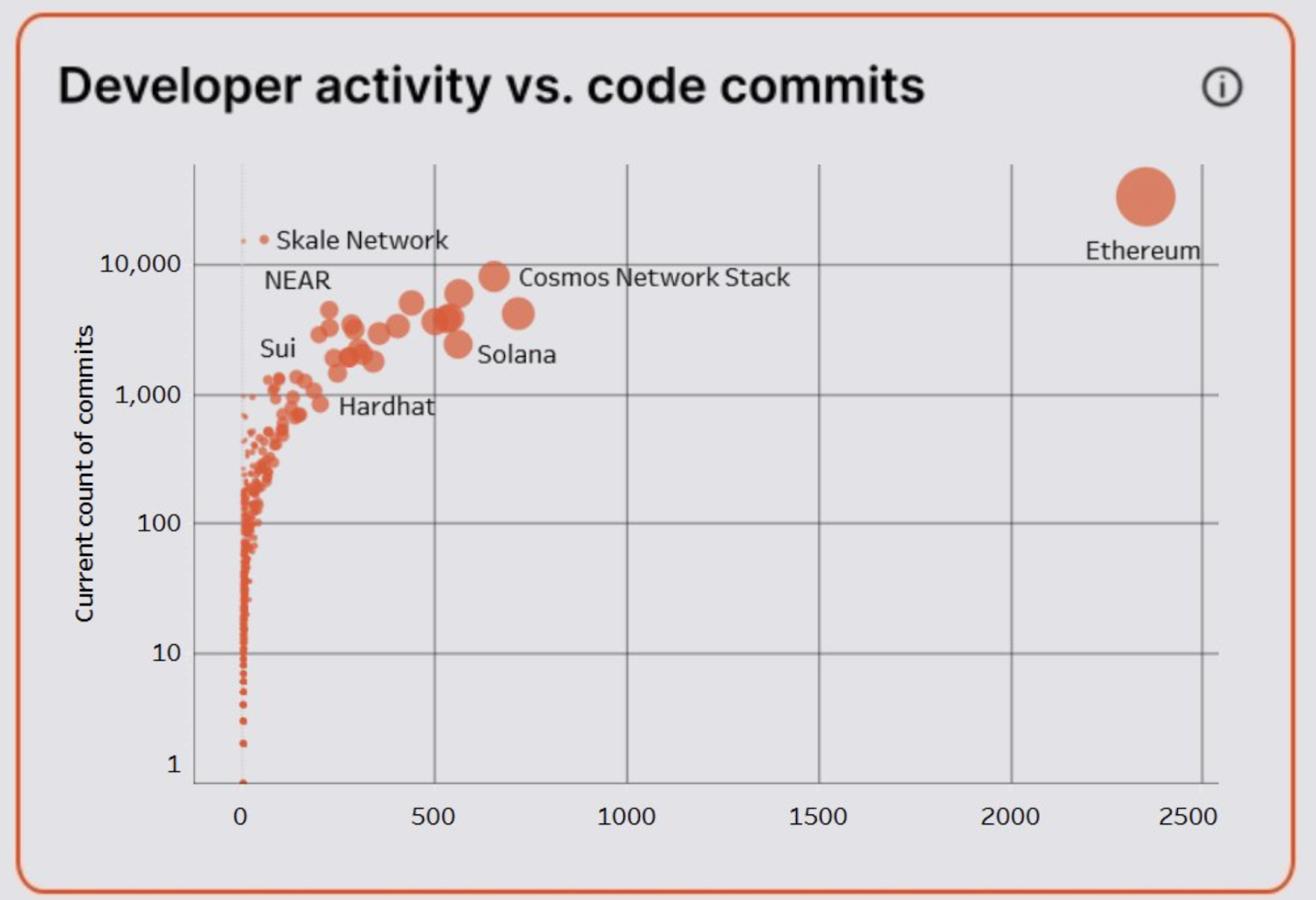

Additionally, developer engagement around Ethereum is still higher than other blockchain projects beyond address activity. Ethereum is the clear leader in a scatter plot tracking developer activity versus code commits.

Ethereum still leads in the development of blockchain infrastructure, with nearly 2,500 recent code commits and the most active developers.

Solana, Cosmos, NEAR and Sui are also growing, but they are behind in both scale and volume of contributions. For example, Solana has less than 1,000 commits, Cosmos and NEAR are around 1,200–1,500.

This is important because high developer engagement indicates that the network is still improving and growing. This also implies that Ethereum’s ecosystem is likely to remain competitive and robust for users and projects building on it.

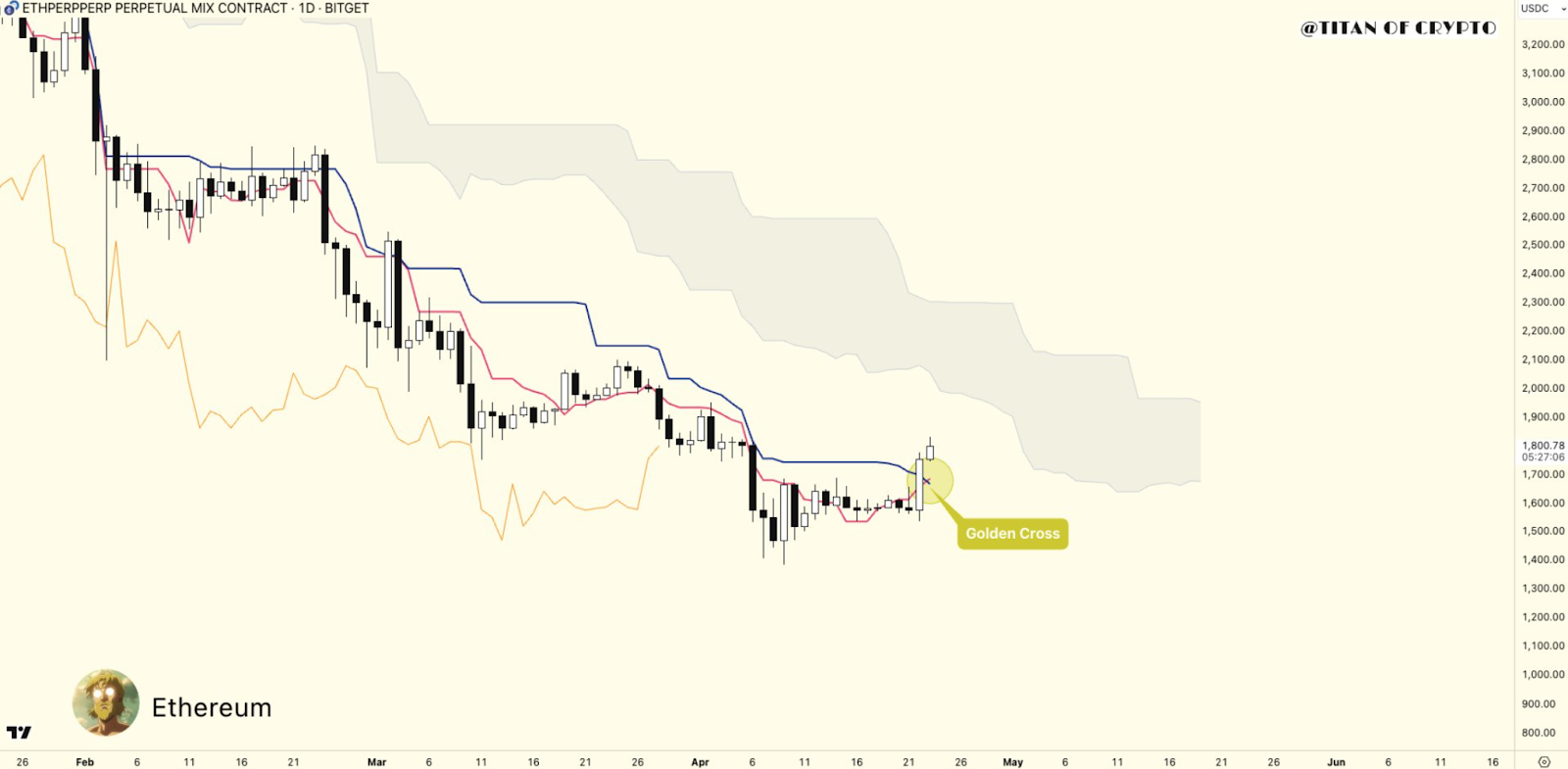

Adding to the bullish case, according to a technical analysis chart by Titan of Crypto, a “Golden Cross” pattern has recently been formed on Ethereum’s daily chart. It happens when a short-term moving average crosses above a long-term moving average, which is sometimes seen by traders as a possible indication that momentum is moving to the upside.

When this pattern last emerged, Ethereum went on to have a steady climb in price over the coming weeks. Past results do not ensure future performance, but many traders consider the Golden Cross a reliable bullish indicator. This could also account for the rise in address activity and renewed interest in the market.

The chart shows that ETH has broken above key resistance levels and moved into the lower band of the Ichimoku Cloud, which is an area that is usually linked to trend reversals. If it continues up and breaks out of the cloud, some traders may use it as a confirmation of a longer-term trend.

Ethereum’s movement is being noticed more as Bitcoin consolidates. Ethereum is often viewed as a precursor to broader altcoin momentum by traders. Ethereum’s grabbing activity and price action can be a sign of a wave of interest in the broader crypto market.

As of the time of writing, Ethereum is trading at $1,730, still below its yearly high but recovering. The combined growth in active addresses, strong developer commitment, and bullish technical signals could mean Ethereum is in a new phase of engagement.

In this article, the views, and opinions stated by the author, or any people named are for informational purposes only, and they don’t establish the investment, financial, or any other advice. Trading or investing in cryptocurrency assets comes with a risk of financial loss.

Search

RECENT PRESS RELEASES

Related Post