The $160 Billion Fund Behind Novo Nordisk Puts Investing on Hold

April 28, 2025

The $160 billion fund behind Ozempic-maker Novo Nordisk A/S says President Donald Trump’s tariff war has created so much economic uncertainty that it now sees little likelihood it will move ahead with any big investments.

Article content

(Bloomberg) — The $160 billion fund behind Ozempic-maker Novo Nordisk A/S says President Donald Trump’s tariff war has created so much economic uncertainty that it now sees little likelihood it will move ahead with any big investments.

Article content

Article content

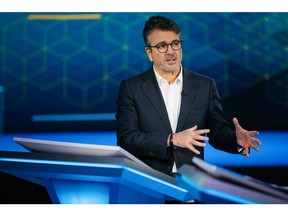

“Until there is more clarity on the prospects for economic growth, we will slow down our investment activities,” Kasim Kutay, chief executive officer of Novo Holdings, said in an interview. “We’re in the midst of uncharted waters.”

Article content

Story continues below

Article content

Since launching his trade war on April 2, Trump has subjected markets to a constant stream of headlines that have left investors lurching from deep selloffs to sudden rebounds. The long-term fallout, however, looks set to leave a significant dent in the global economy. Bloomberg Economics estimates the tariff war could wipe about $2 trillion off the world’s economic output by the end of 2027.

Article content

Article content

Novo Holdings, whose investments comprise life sciences and other ventures identified as having sustainable goals, had been intending to exit “some assets,” Kutay said. But those plans will now probably need to be postponed to later in the year or even into 2026, he said.

Article content

“I mean, who’s going to IPO an asset in this environment? Unless you have to, it’s probably not advisable,” Kutay said. “The view on interest rates, which is a key barometer and a driver of how and when to invest, is all over the place.”

Article content

Story continues below

Article content

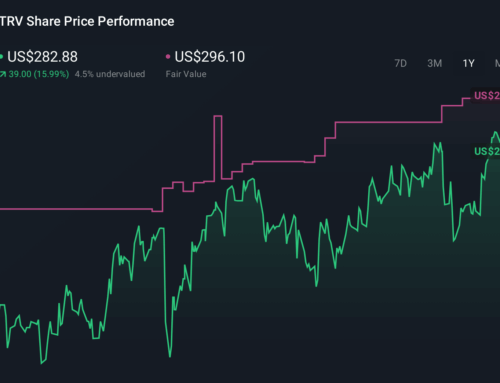

The pullback follows a record year for Novo Holdings, which allocates funds on behalf of the Novo Nordisk Foundation. Last year, its investment portfolio generated a return of 18%. In addition, the investor manages the foundation’s holdings in Novo Nordisk. (It owns just over 28% of the drugmaker’s capital and a little more than 77% of its voting rights.)

Article content

After soaring well over 200% between the end of 2020 and the end of 2023, Novo Nordisk saw its value slide 11% in 2024. The company’s weight-loss treatments increasingly face challenges from competitors including Eli Lilly & Co., while US efforts to rework drug pricing models are also weighing on the company’s share price.

Article content

Though a number of Trump’s policies are at odds with many of the values held at Novo Holdings, Kutay says the investor isn’t planning to pull investments from America. That’s despite the US government’s campaign of attacks against investment strategies that target environmental, social and governance goals.

Search

RECENT PRESS RELEASES

Related Post