Is Constellation Energy Corporation (CEG) Among The Most Undervalued Renewable Energy Stoc

May 1, 2025

We recently published a list of 10 Most Undervalued Renewable Energy Stocks To Buy Right Now. In this article, we are going to take a look at where Constellation Energy Corporation (NASDAQ:CEG) stands against other most undervalued renewable energy stocks.

In 2024, global energy demand increased by 2.2%, quicker than the average over the last decade. Electricity use rose significantly, up 4.3% from last year, primarily due to hotter temperatures, electrification, and the growing digital sector. Renewables were the biggest contributors to the higher energy supply, followed by natural gas and coal. Most of the demand growth came from emerging economies, especially China and India. Natural gas had the strongest growth among fossil fuels, while oil demand softened, plunging below 30% of the energy mix for the first time in 50 years. According to the International Energy Agency, more than 80% of new electricity generation came from renewables and nuclear power in 2024. Solar and wind energy hit new records, and EV sales skyrocketed past 17 million units.

Solar capacity grew by 88% last year, helping it overtake hydropower and nuclear as the fourth largest source of installed capacity. While wind power faced hurdles like supply chain issues and permitting delays, it still set a new generation record and even outperformed coal for two straight months. Battery storage also saw impressive growth, rising by 64%, as utilities used it to store extra wind and solar energy. Looking ahead to 2025, Deloitte expects clean energy demand to grow even more, driven by the rise of clean tech manufacturing, data centers, and carbon capture projects, all of which are increasingly relying on 24/7 clean power.

The American nonprofit organization, Resources for the Future, noted that clean energy saw a major boost with a record $2 trillion invested in technologies like renewables and energy-efficient infrastructure during 2024. This sped up the global energy transition, especially in solar and wind power. While renewables are now some of the cheapest energy sources, fossil fuels, especially coal and gas, still make up a big part of global energy use. Coal is expected to decline significantly by 2050, while the role of gas depends on how ambitious climate policies become. Regions like the United States, Europe, and especially China have led solar growth, but other countries are starting to catch up. However, high costs and financial risks in developing countries could slow things down.

A close up of a wind turbine producing electricity as the sun sets.

For this article, we made a list of all renewable energy stocks listed on American exchanges and picked the 10 stocks with the lowest P/E ratios to compile this list. We have also mentioned the hedge fund sentiment around the holdings, as per Insider Monkey’s Q4 2024 database, ranking the list from least to most hedge fund holders.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

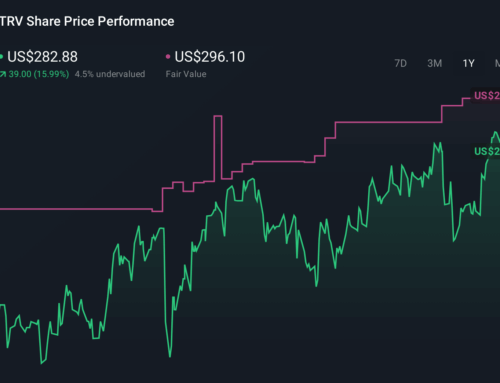

PE Ratio as of April 30: 19.05

Number of Hedge Fund Holders: 85

Constellation Energy Corporation (NASDAQ:CEG) is a Maryland-based company that delivers energy services across the United States. The company offers electricity, natural gas, and renewable energy solutions, using nuclear, wind, solar, natural gas, and hydroelectric sources. It ranks first on our list of the most undervalued stocks.

On April 9, Citi analysts led by Ryan Levine upgraded Constellation Energy Corporation (NASDAQ:CEG) to Buy from Neutral, slashing the price target to $232 from $334. After a recent dip in Constellation Energy’s stock, analysts are now more optimistic, seeing it as a better risk-reward at $184.94, down from its high of $352. The primary factors driving this optimism include potential colocation deals, natural gas projects in Texas, and the cushion from Production Tax Credits.

Constellation Energy Corporation (NASDAQ:CEG) declared a $0.3878 per share quarterly dividend on April 29. The dividend is distributable on June 6, to shareholders on record as of May 16.

According to Insider Monkey’s fourth quarter database, 85 hedge funds were bullish on Constellation Energy Corporation (NASDAQ:CEG), compared to 78 funds in the last quarter. Philippe Laffont’s Coatue Management was the biggest stakeholder of the company, with 6.63 million shares worth nearly $1.5 billion.

Overall, CEG ranks 1st among the most undervalued renewable energy stocks to buy right now. While we acknowledge the potential of CEG as an investment, our conviction lies in the belief that AI stocks hold greater promise for delivering higher returns, and doing so within a shorter time frame. There is an AI stock that went up since the beginning of 2025, while popular AI stocks lost around 25%. If you are looking for an AI stock that is more promising than CEG but that trades at less than 5 times its earnings, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. This article is originally published at Insider Monkey.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post