ETFs Are Absorbing More Bitcoin Than Miners Can Produce

May 5, 2025

12h05 ▪

3

min read ▪ by

Evans S.

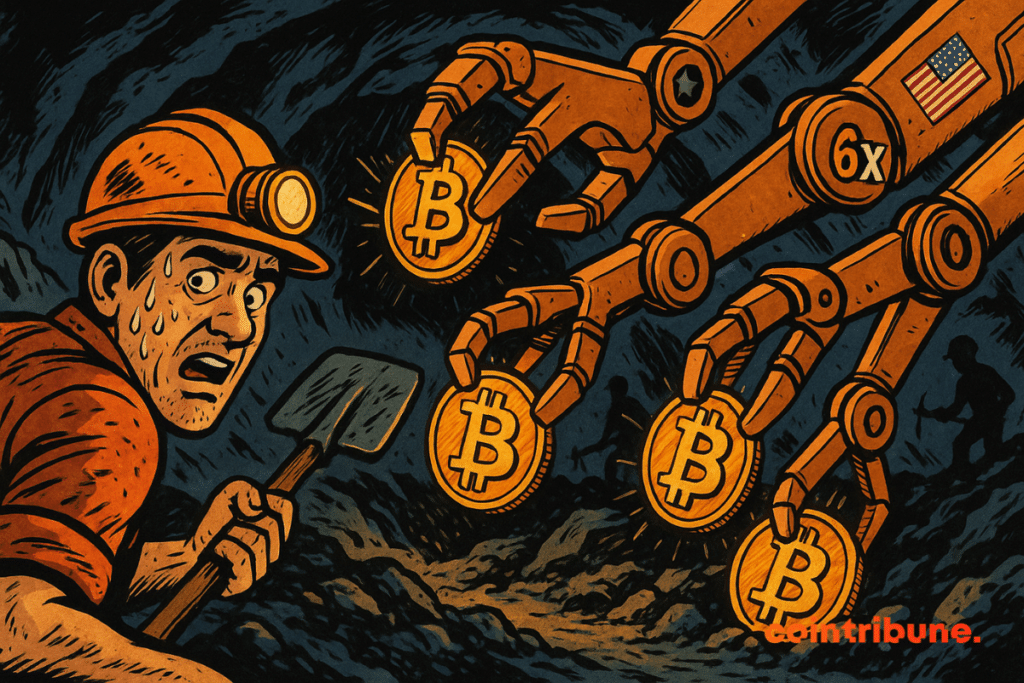

Institutional demand for bitcoin is exploding. Last week, US ETFs accumulated 18,644 BTC. In comparison, miners only extracted 3,150. An unprecedented gap is disrupting the traditional balance.

In Brief

- Institutional demand six times higher than mining supply: 18,644 vs 3,150 BTC.

- Massive flows: $1.8 billion in new capital over five days.

- Spot Bitcoin ETFs now hold over $110 billion in assets under management

US Bitcoin ETFs vs Miners: An Unprecedented Imbalance

The rush for spot ETFs on bitcoin has reached new heights. From April 28 to May 2, the exchange-traded funds bought nearly six times more BTC than mining production. According to HODL15Capital, these vehicles acquired 18,644 coins. Meanwhile, miners only extracted 3,150.

Daily production hovers around 450 BTC. Thus, institutions have absorbed the equivalent of more than 40 days of mining. This phenomenon marks a major shift. It shows that investor appetite in the spot market now exceeds the capacity to create new coins.

Capital flows confirm this imbalance. Farside Investors reports approximately $1.8 billion inflows over the last five trading days. Only a net outflow was recorded on April 30. Since April 16, outflows have been almost nonexistent. The enthusiasm of professional investors is evident.

This acceleration coincides with a surge in the bitcoin price. In early May, BTC rose 4% to reach $97,700. However, the price soon fell back to around $94,000. With supply remaining limited, each new demand moves prices. Tension therefore rises between demand and production.

Start your crypto adventure safely with Coinhouse

This link uses an affiliate program.

Implications and Market Outlook

BlackRock’s dominance is becoming clearer. Its iShares Bitcoin Trust (IBIT) raised nearly $2.5 billion in five days. Even better: IBIT has seen 17 consecutive days without capital outflows. This record illustrates asset managers’ confidence.

For Nate Geraci, president of the ETF Store, this category of ETFs has already crossed $110 billion in assets under management. And despite significant hurdles. Many wealth management platforms still prohibit access to Bitcoin ETPs. Financial advisors struggle to recommend them.

Imagine the outlook if these barriers fall. Bitcoin ETFs could trigger a new wave of massive inflows. Volume and liquidity would multiply. Consequently, pressure on miners would intensify. And bitcoin’s spot premium could soar even higher.

Faced with this wild race, bitcoin stands at a historic crossroads. The equation between limited supply and record institutional demand will define its short-term trajectory. Nothing will be the same again. Within 100 days, it is possible that it climbs to $135,000.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

Fascinated by Bitcoin since 2017, Evariste has continuously researched the subject. While his initial interest was in trading, he now actively seeks to understand all advances centered on cryptocurrencies. As an editor, he strives to consistently deliver high-quality work that reflects the state of the sector as a whole.

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

Search

RECENT PRESS RELEASES

Related Post