Billionaire Terry Smith, “the English Warren Buffett,” Has 31% of His Hedge Fund’s Portfol

May 10, 2025

These longtime Fundsmith holdings are still great buys today.

If you read Fundsmith’s Owner’s Manual, the influence of Warren Buffett on Terry Smith’s hedge fund is plainly obvious. Smith references the Oracle of Omaha’s wisdom and Berkshire Hathaway‘s success no fewer than six times in the 17-page document.

Smith has received the nickname “the English Warren Buffett” because his investment style echoes that of the great American investor. Smith follows a simple formula for buying and holding great companies. He’s simply looking for “a good company with good products or services, strong market share, good profitability, cash flow and product development.”

Like Buffett, he’s also not shy about sharing his fund’s historic performance. At the top of each annual letter to shareholders, Smith shows the fund’s annual and cumulative performance since its inception in 2010. Through 2024, the fund has returned 607.3% for investors. His benchmark index, the MSCI World Index, has returned a total of 403.4%. While it might not be quite as impressive as Buffett’s massive outperformance of the S&P 500 during his 60 years at Berkshire Hathaway, it’s still quite impressive considering Fundsmith’s growing size.

Image source: Getty Images.

With a portfolio of $24 billion, Smith’s focus on good companies with good products or services has led him to a concentrated portfolio. Just three companies account for 31% of the fund’s investments, and they’re all exceptional stocks.

1. Meta Platforms (11.25% of assets)

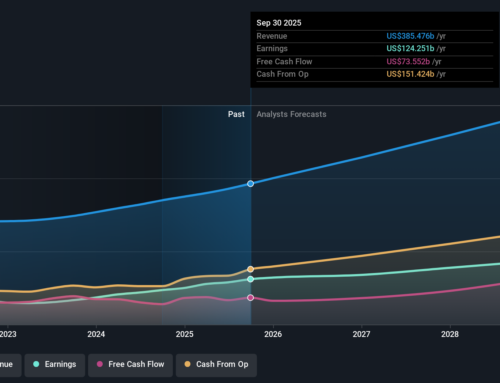

Smith established a position in Meta Platforms (META -0.91%) in 2018 when it was still known as Facebook, and it’s been one of the fund’s more controversial holdings. But Smith pointed to the financial numbers the company was reporting — high margin, high return on capital, and high revenue growth. He also pointed out that despite growing spending on research and development and capital expenses, the company’s free cash flow was still set to grow. He also liked the fact that its valuation was roughly in line with the S&P 500.

Since that initial investment, Meta has appeared in the top five contributors to Fundsmith’s performance in four of the last seven years. Meta’s numbers still look great, too. Last quarter, it reported 16% revenue growth and expanded its operating margin to 41%. Meta’s heavy spending on artificial intelligence (AI) development is weighing a bit on free cash flow, but that didn’t stop it from posting its eighth straight quarter of generating over $10 billion in excess cash for shareholders.

Meta’s continued growth is supported by two sources of competitive advantages. First, it has dominant scale. It counted over 3.4 billion unique users across its Family of Apps in March. That makes it a universal destination for advertisers no matter what audience they’re targeting.

Meta’s advertising capabilities are unparalleled in the industry. That’s further supported by its investments in AI. Meta’s algorithms make it easy for marketers to get their ads in front of the right users at the right time, and they continue to get better as Meta spends more on AI.

Ad impressions increased 5% last quarter (an indication that Meta’s showing more relevant and engaging content to users). Ad prices increased 10% (an indication that marketers are willing to pay for that higher engagement). Meta is one of just a handful of companies with the capacity to invest the tens of billions of dollars necessary to stay at the forefront of AI development, giving it a huge competitive advantage.

Meanwhile, Meta’s stock valuation is still appealing. Its forward price-to-earnings (P/E) ratio of 23 is slightly above the S&P 500, despite offering considerably higher-than-average earnings growth potential over the long run.

2. Microsoft (11.25%)

Smith notes that Fundsmith’s investment in Microsoft (MSFT 0.07%) has also attracted its fair share of criticism since he first started a position in the company in 2011. Smith first bought shares of the stock for around $25. Smith has sold off shares of Microsoft since the start of 2022, cutting the fund’s exposure in half. Nonetheless, it still accounts for more than 11% of his portfolio.

Microsoft has transformed itself into a cloud computing and AI juggernaut in the 14 years since Smith first bought the stock for the fund. Microsoft Azure is one of the three leading public cloud platforms, and it’s driven Microsoft’s revenue growth. Azure revenue increased 33% year over year last quarter.

AI is the most recent driving force behind Microsoft’s growth. In the cloud, Azure AI services offer businesses and developers access to leading-edge foundation models and tools to create new AI-powered software. That segment accounted for nearly half of Azure’s growth in the third quarter, and management said it remains capacity-constrained as demand outstrips supply. As a result, Azure revenue growth should remain at a similar pace next quarter and well into next year.

Microsoft is also seeing success with its AI agent solutions under the Copilot brand. Its GitHub Copilot is an increasingly capable coder, while its Sales Agent helps chat reps close more deals. Its Copilot Studio allows businesses to build their own AI solutions based on internal data and workflows. Management counts 230,000 organizations using Copilot Studio, including 90% of the Fortune 500. That’s helped push Microsoft’s enterprise software business revenue higher, producing double-digit revenue growth for the mature business.

Microsoft stock might be dubbed “expensive” based on its forward P/E of 32.3. However, with a business producing tens of billions in free cash flow each quarter and management’s share repurchases pushing the earnings per share (EPS) even higher, investors are getting good value at this expensive price.

3. Stryker (8.5%)

Smith’s investment in Stryker (SYK -0.40%) goes back to Fundsmith’s inception. The medical device maker was one of the biggest contributors to the fund’s annual performance on numerous occasions, which led Smith to make the oft-repeated remark, “So much for the theory that no one ever did badly by taking a profit.”

Smith has, for the most part, maintained very high exposure to Stryker over the years, and it’s paid off handsomely. The stock is up 666% since Fundsmith’s inception as of this writing.

Recently, the stock has been hurt by fears of an economic slowdown (leading to a decline in elective surgeries) and potential cuts in Medicaid (leading to a decline in patients who can afford surgery). High import tariffs could also negatively affect its margins. But management allayed most of those fears with its first-quarter earnings report. It guided for higher sales growth of 8.5% to 9.5% for the full year. It did say tariffs will affect earnings by roughly $200 million this year, but guided for adjusted EPS between $13.20 and $13.45, up 9.3% at the midpoint. Tariffs could weigh more on the business in 2026 and beyond, though.

Stryker’s broad portfolio of equipment beyond orthopedics gives it a significant growth driver, especially as it has shown its ability to innovate and consistently introduce new product improvements. That’s been a key competitive advantage for Stryker, but it also benefits from high switching costs, as surgeons are reluctant to adopt and learn different equipment. As a result, Stryker is mostly protected from long-term declines, even if fewer patients are having surgeries in the short term.

Shares of the stock trade for about 28.3 times forward earnings. That’s a fair price to pay for a business with strong competitive positioning that should enable it to expand operating margins over the long run while investing in further innovation for future revenue growth.

Search

RECENT PRESS RELEASES

Related Post