A Bill Ackman investing golden rule that bullish traders might be forgetting about right n

May 11, 2025

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

-

The chart of the day

-

What we’re watching

-

What we’re reading

-

Economic data releases and earnings

I know you are feeling fabulous going into the weekend.

The warm summer weather is starting to take hold.

There is a new UK trade deal, though 10% tariffs will remain in place on most goods from our British friends.

Various Trump administration figures are doing the media rounds to talk up a potential China trade deal soon.

Though similar to the UK transaction, tariffs will likely still be in effect. Trump floated a rate of 80%, down from 145%, on social media.

And your portfolio is looking much better compared to the week after “Liberation Day.” You also have hope the good vibes will continue — am I right?

Against this backdrop, I want to highlight two things about investing I was reminded of at the Milken conference this past week.

Let them be a sanity check on the bullishness you are feeling at the moment, which to me is a little too much given the uncertain environment and the facts corporate America is bringing to the table this earnings season.

The first comes from billionaire hedge fund manager Bill Ackman of Pershing Square fame.

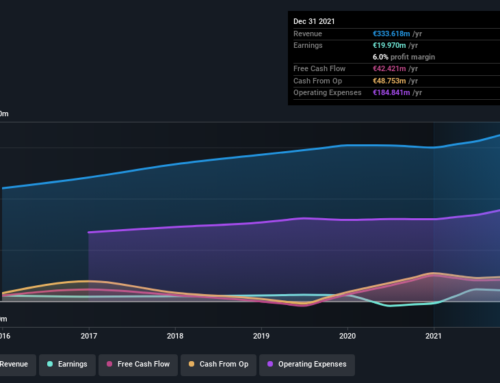

Ackman offered this up (video above) when I asked him about tariffs impacting the businesses he owns a piece of, such as Nike (NKE) and Chipotle (CMG): “So we care about the value of a business. The value of a business is the present value of the future cash flows. What’s going on now certainly could be disruptive in the short term. I don’t think it’s likely to have permanent effects.”

I think you can read this from Ackman in a few different ways.

Most of you will likely view it favorably, as it implies future cash flows of companies will be just fine even if tariffs stay in place. I, however, believe Ackman is signaling investors may be too optimistic in the short term, given how disruptive to profits and cash flows tariffs could be.

Read more: What Trump’s tariffs mean for the economy and your wallet

Keep in mind, we are getting zero indication that tariffs will be completely removed on countries, just that they may be lowered. That means more unplanned costs for a business to contend with.

The next investing reminder comes from Nuveen chief investment officer Saira Malik, who oversees $1 trillion at the giant asset manager:

“I think confusion is probably a word to describe it [the investing backdrop],” Malik said. “Investors want clarity here, and that would be helpful. You can do calculations if you know where the tariffs are going to end up. So, as an example, our calculations show that if tariffs were at about 10% for the rest of the world, it would hit GDP by 1.5%. You just skirt a recession there.”

But stocks are not out of the woods. “Earnings have been strong, but the outlooks are very murky,” she said. “Marriott just reported, and yet again, pointing to lower revenue per available room going forward. The consumer is at risk here. And then Treasury yields are something to watch. The 10-year Treasury yield back up again over the last few days at 4.3% is telling you the bond market is worried.”

Malik’s comments are a reminder of the macro facts that investors have raced to forget about in the past month.

As April economic data begins to arrive shortly, reflecting the month’s tariff onslaught, investors will be reminded of what they are dealing with. And it may not jibe too well with the post “Liberation Day” rally.

But, hey, maybe I am all wrong here! Ditto the really smart investing people I mentioned in this missive!

I am curious, though, about what stocks, ETFs, etc., you are buying right now and why. What is the single biggest factor in you hitting the buy button, knowing full well profit-busting tariffs remain in place? Drop me a line @BrianSozzi on X.

Read more about what business leaders and top political figures are saying at the 2025 Milken Institute Global Conference:

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi, Instagram, and LinkedIn. Tips on stories? Email brian.sozzi@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post