Should You Buy the Dip on Apple Stock?

June 4, 2025

Apple (AAPL 0.55%) shareholders haven’t had the best year. While the market (as measured by the S&P 500 (^GSPC 0.28%) index) is essentially flat for the year, Apple’s stock has dropped by 20%. Additionally, it’s by far the worst-performing “Magnificent Seven” stock.

With the stock underperforming both the market and its peers, there are two interpretations: Either Apple is undervalued and should be bought on the dip, or there are good reasons why the stock is down. Let’s take a look and figure out what investors should be doing with their Apple shares.

Image source: Getty Images.

Apple’s sales have been poor over the past three years

This business needs no introduction. Apple has built the premier personal-device hardware brand, and its products are quite popular both in the U.S. and worldwide. However, there are a few issues with its most important product: the iPhone.

Years ago, Apple used to release exciting new features that drove many consumers to purchase a new phone every year, or at least every two years. Now, those upgrade-driving features seem to be absent. Whether that’s from a lack of technological innovation or from Apple essentially maxing out what’s possible in a phone is irrelevant; consumers just aren’t upgrading their phones as often.

However, one area where it’s losing the technological race is artificial intelligence (AI). Apple is light-years behind on launching AI features on the iPhone, compared to its Android peers. While this hasn’t resulted in a mass-scale exodus from Apple’s products, it may in the future.

Regardless, Apple’s sales aren’t increasing much, as evidenced by trailing-12-month revenue being essentially flat over the past three years:

AAPL Revenue (TTM) data by YCharts.

In the most recent quarter, Apple seems to have broken out of that trend, which is a good sign for investors. But Wall Street analysts project it will grow revenue at a pace of 4.1% in fiscal 2025 (which will end in September) and 5.9% in fiscal 2026. That’s not jaw-dropping growth.

Another way Apple could be a compelling investment is by increasing its margins and earnings per share (EPS) at a market-beating rate. However, as it moves some production to the U.S. and some to India, these margins are sure to come under pressure — there was a reason why companies like Apple were manufacturing the bulk of their products in China in the first place.

Apple is struggling to grow its revenue as it is. And with margin pressure brewing thanks to tariffs, investors clearly don’t want to own this stock. But the company is strong, and will eventually figure things out.

So has this sell-off been deep enough to warrant buying now, with hopes that Apple will recover in three to five years?

Apple’s stock is still expensive

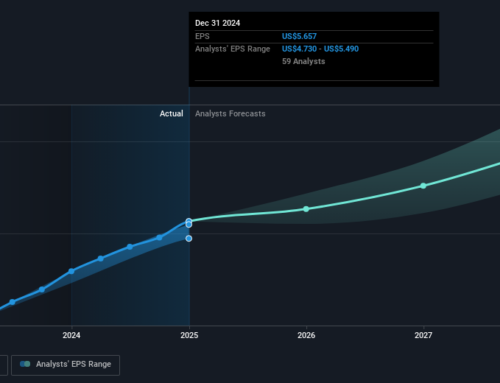

From a forward price-to-earnings (P/E) standpoint, the stock still isn’t cheap, at nearly 28 times forward earnings:

AAPL PE Ratio (Forward) data by YCharts.

That’s an expensive price tag for most stocks, let alone one with hardly-growing revenue. For comparison, the S&P 500 currently trades at 22.1 times forward earnings, so Apple still fetches a premium to the broader market despite its growing headwinds.

As a result, I don’t think Apple is a great stock to buy on the dip. Plenty of other big tech stocks are growing revenue rapidly and trading at cheaper prices. I’d rather look at those than consider Apple; it needs to show meaningful growth before I’d consider investing in it again.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.

Search

RECENT PRESS RELEASES

Related Post