Meta Platforms (META) Eyes Major Investment in Scale AI

June 8, 2025

Quick Insights:

- Meta Platforms is reportedly negotiating an investment exceeding $10 billion in Scale AI, potentially marking a significant move in AI.

- The average analyst price target for Meta is $705.61, a slight upside from the current stock price.

- GuruFocus estimates suggest a 23% overvaluation, highlighting potential risks.

Meta Platforms’ Strategic AI Investment

Meta Platforms (NASDAQ: META) is reportedly on the brink of a groundbreaking investment, as the tech giant considers channeling over $10 billion into Scale AI. This data-labeling startup has emerged as a pivotal player in the artificial intelligence sector. If completed, this could rank among the largest private investments ever recorded, underscoring Meta’s intensified focus on AI advancements.

Analyst Price Projections for Meta

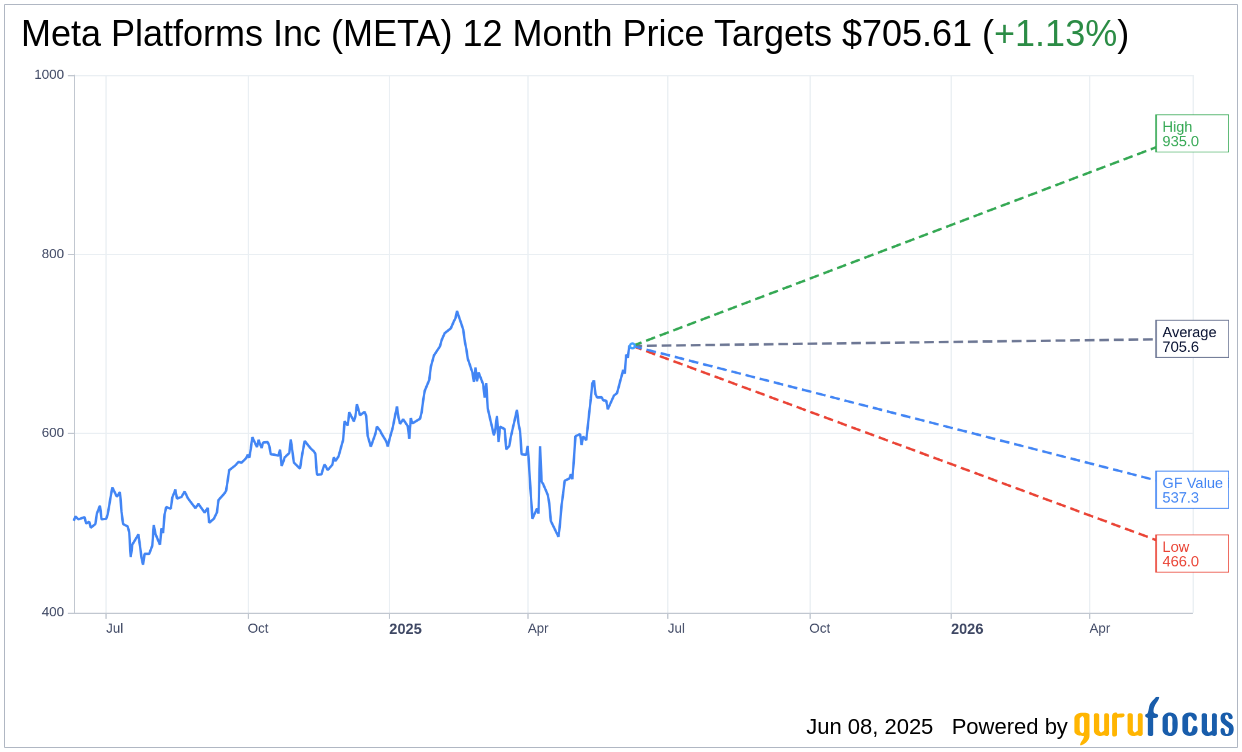

Wall Street analysts have set a one-year average price target of $705.61 for Meta Platforms Inc (META, Financial), with predictions ranging from a low of $466.00 to a high of $935.00. This average target indicates a modest upside of 1.13% from the current market price of $697.71. For a deeper dive into these projections, visit the Meta Platforms Inc (META) Forecast page.

Brokerage Firm Recommendations

The consensus from 72 brokerage firms positions Meta with an average recommendation of 1.8, signifying an “Outperform” status. This rating operates on a scale from 1, indicating a Strong Buy, to 5, a Sell.

Evaluating Meta’s GF Value

According to GuruFocus, the estimated GF Value for Meta Platforms Inc (META, Financial) is $537.25 in the coming year. This estimation signals a potential downside of 23% from Meta’s current trading price of $697.71. The GF Value represents GuruFocus’ fair value estimate, calculated through historical trading multiples, past growth trends, and forecasted business performance. For comprehensive metrics, refer to the Meta Platforms Inc (META) Summary page.

Search

RECENT PRESS RELEASES

Related Post