Ethereum Price Forecast: ETH investors resume buying amid strong ETF inflows and low excha

June 16, 2025

- Ethereum exchange reserves have flipped toward accumulation, reaching an all-time low of 18.57 million ETH.

- Ethereum ETFs posted $583 million in weekly net inflows, their strongest performance since December.

- MEXC’s Tracy Jin gives a cautious ETH price growth prediction despite positive developments surrounding the Ethereum ecosystem.

- ETH faces rejection at the 200-day SMA after holding the $2,500 support through the weekend.

Ethereum (ETH) briefly crossed above $2,600 on Monday following a switch to accumulation in the top altcoin’s exchange reserve and $583 million in inflows into ETH investment products last week.

Ethereum resumed bullish action on Monday after its exchange reserve flipped back to a downtrend, declining from 18.72 million ETH on Saturday to an all-time low of 18.57 million ETH over the past 24 hours. As the total value of exchange reserves drops, it indicates rising buying pressure.

ETH Exchange Reserve. Source: CryptoQuant

During the period, ETH’s total value staked also grew by 80K ETH, signifying a stronger bullish sentiment among investors, according to data from Beaconcha.in.

The shift toward accumulation in ETH follows a strong week of institutional buying pressure, which pushed net inflows in global Ethereum products to $583 million last week, according to CoinShares data.

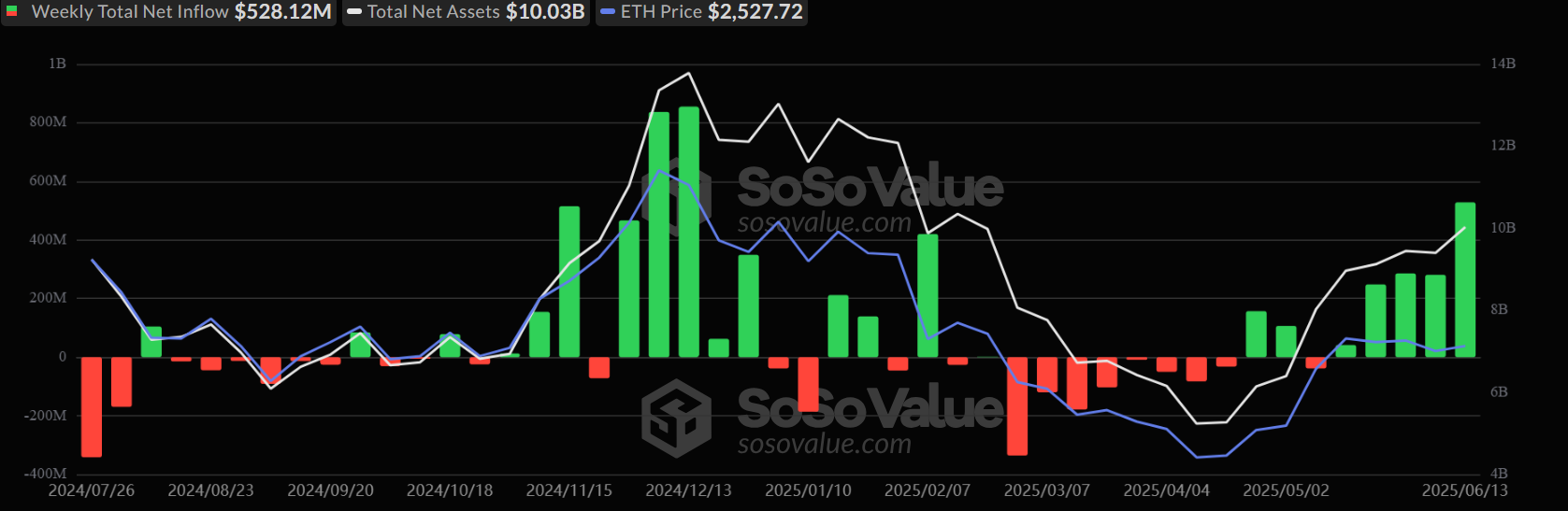

The buying pressure was spearheaded by $528.12 million inflows into US spot ETH exchange-traded funds (ETFs), their highest weekly performance since December 2024. The products recorded a 19-day run of net inflows before breaking the streak on Friday, with mild outflows of $2.18 million following the escalation of tensions in the Middle East.

US spot ETH ETF Flows. Source: SoSoValue

“Ethereum’s recovery is being supported by the ‘digital oil‘ narrative and ecosystem fundamentals, like the Pectra upgrade and increased stablecoin activity, with almost 50% of all stablecoins on the Ethereum network,” said Tracy Jin, COO of crypto exchange MEXC.

“It’s also good to see that the rules around staking and new stablecoin-related ETFs are coming into effect, which is helping to boost investor confidence,” she added.

Despite the positive developments surrounding ETH recently, Jin maintained a cautious end-of-year price prediction for ETH.

“ETH could be between $2,800 and $3,600 by the end of the year, with the possibility of going even higher if ETF staking and network developments speed up,” Jin said.

Ethereum experienced $134.04 million in futures liquidations, with long and short liquidations totaling $70.55 million and $63.49 million, respectively, over the past 24 hours, per Coinglass data.

ETH held support near $2,500 through the weekend and tested the 200-day Simple Moving Average (SMA) as dynamic resistance before experiencing a rejection. The top altcoin could test the $2,850 key resistance if it flips the 200-day SMA support. A rejection at $2,850 will imply a double-top formation.

ETH/USDT daily chart

On the downside, if the $2,500 support fails, ETH needs to hold the lower boundary of a key channel, strengthened by the 50-day SMA, to prevent a decline to the $2,260 to $2,110 support range.

The Relative Strength Index (RSI) is above its neutral level and could test its moving average line, while the Stochastic Oscillator (Stoch) is below its neutral level. A successful crossover above in both indicators will strengthen the bullish momentum.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Search

RECENT PRESS RELEASES

Related Post

-1750124822895.png)