Energy Inflation

June 26, 2025

Our economy depends on low-cost power.

Manufacturers need it to compete with China. Residential consumers need it to live and thrive. And just about every business in the country would take a hit if Americans’ energy costs go up: it would mean less spending on groceries, health care, entertainment, etc.

This is why Congress subsidizes almost every form of energy. Oil and gas companies have received lavish subsidies through the tax code since at least 1913. No nuclear plant would have ever been built without massive government support. The Investment Tax Credit for solar was established in 2005 by a trifecta Republican government, with an overwhelming majority of Republican votes in both the House and Senate. It was signed into law by President Bush. The energy efficiency tax credits also went into place that year, driving gigawatts-worth of savings through reduced energy waste.

Why do we have so many energy subsidies? Because low-cost energy is a good thing. It stimulates economic growth and helps Americans maintain a higher quality of life. Removing them would obviously make energy more expensive and more expensive energy is extremely unpopular among voters of all ideological backgrounds.

If the federal budget reconciliation bill passes in its current form, we will still build renewable power in the United States and in Texas — but developers will build less of it, andit will be more expensive.

The financial advisory firm Lazard reaffirmed last week that renewables remain the cheapest form of energy: “On an unsubsidized $/MWh basis, renewable energy remains the most cost-competitive form of generation.”

In other words, if Congress removes clean energy tax credits — even maintaining myriad other energy subsidies for just about every other form of energy — renewables will still be built, but electricity will cost a lot more.

What does that mean? Your energy bills would go up.

Anti-clean energy activists blithely suggest that the nation can just build a lot of new gas and nuclear power; market realities tell a different story. Even the staunchest nuclear proponents don’t think it can scale up before 2032.

And Lazard wrote that “turbine shortages, rising costs, and long lead times are expected to drive steep [cost] increases for gas technologies in the near term.”

More than ever, the U.S. needs renewables — even if only to cover current and near term needs, counter the cost pressure that’s already building, and buy time for other technologies to catch up. Renewables and storage are, at the very least, a bridge fuel to other forms of power. There simply aren’t available alternatives in the next few years.

Without renewables, costs will rise much faster and voters will be angry. Rising costs are already pissing off voters and Congress is considering throwing gas on the fire.

As Bloomberg put it recently, “Electricity is the new eggs.”

There is a better way. The Senate, rather than going along with the House of Representatives’ reckless and self-defeating energy cuts, could allow the tax credits to phase out over a longer period of time. That also would reduce the whiplash that employers, consumers, investors, and developers have experienced as changing administrations abruptly change policies that impact the very foundations of our economy.

Recognizing how deeply unpopular and damaging it would be to immediately wipe out renewables incentives, the Senate took a step toward a more gradual phaseout last week. But that wasn’t even a half-measure: it would still spell a drastic reduction in desperately needed new power sources across the country — and it would still cause consumer prices to rise dramatically.

How much will bills go up?

Solar power — the dominant sources of newly installed energyglobally and in the US over the last several years — will continue to be built, but it’ll cost roughly 30% more (the Investment Tax Credit, or ITC, is worth 30%). Developers will keep building but at a markup to replace the incentive.

This comes at a time when distribution infrastructure costs (the poles, wires, and other equipment that delivers electricity to homes and businesses) are also skyrocketing. If the budget bill passes in any of its current forms, the dark blue bars below, showing production costs, will also turn sharply upward, following delivery costs.

The EIA writes: “Spending to produce electricity fell 24% from 2003 to 2023, mainly due to lower fuel costs and, to a lesser extent, the retirement of older, costlier-to-maintain fossil fuel plants. Fuel costs, the main operating expense, make up most of the production costs.” Renewable power, of course, has no fuel costs.

Distribution costs “increased by $31.4 billion, or 160%, from 2003 to 2023.”

Those increases were almost entirely offset by the decrease in production costs. But that would all be wiped out by the federal budget bill if it passes the Senate in its current form.

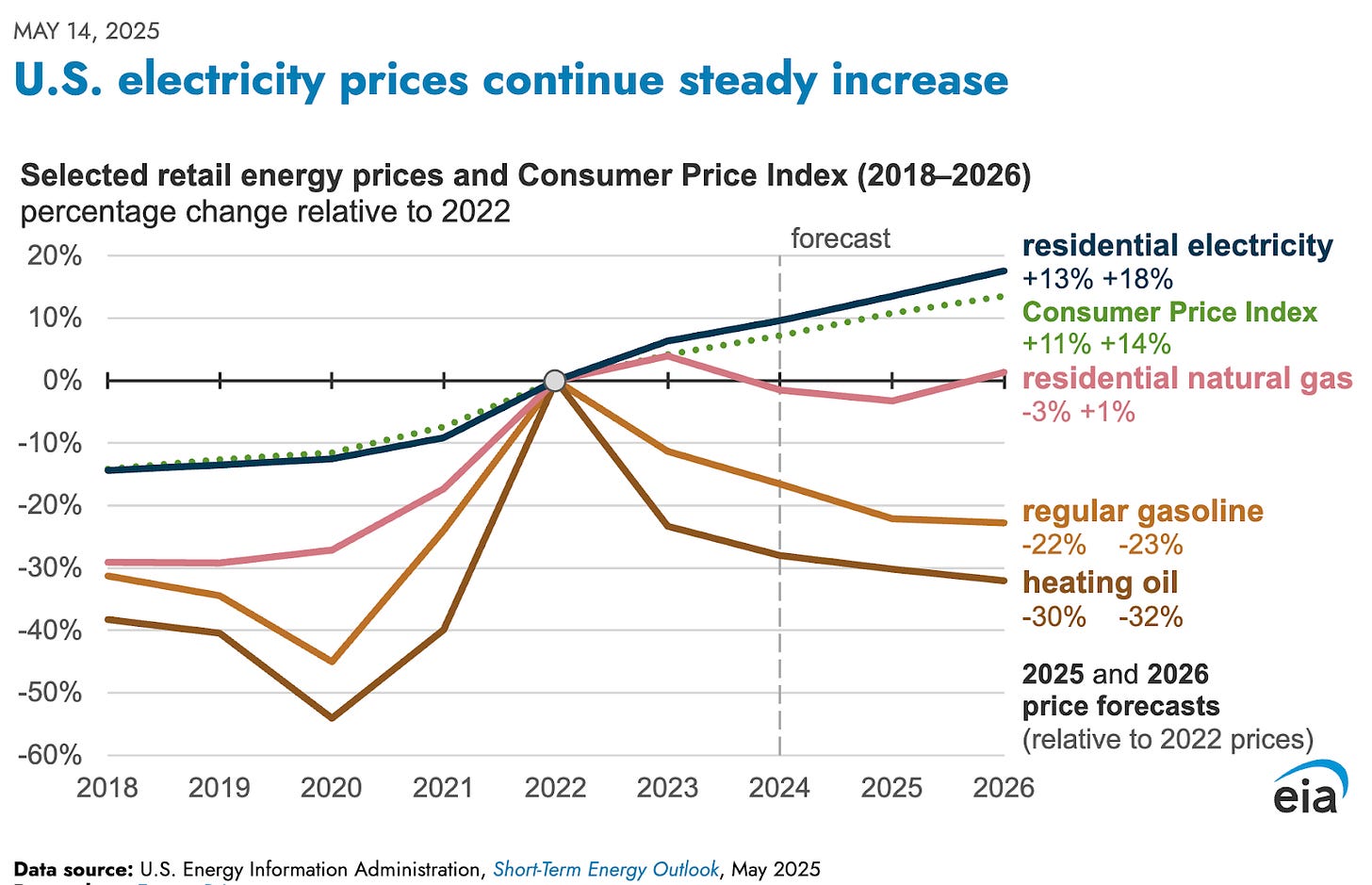

Largely because of the distribution cost increases shown above, the cost of power for residential consumers already outpaces inflation:

But you ain’t seen nothing yet. If Congress starts picking winners and losers and cancels incentives for certain kinds of energy, consumers — and voters — will pay a lot more for power.

Inflation helped decide the 2024 campaign, and energy is one of the biggest inflation triggers.

Multiple studies of the so-called “One Big Beautiful Bill Act” show energy costs will spike upward if the bill passes:

-

Princeton’s REPEAT Lab shows an annual increase of $25 billion within four years, a 17% increase in Texas by 2030

-

NERA, an energy economics firm, projects a 7% increase next year and a 10% increase in 2029

-

Resources for the Future forecastsa 6-10% increase over the next four years

-

Energy Innovation models showed “an increase of $60 billion in fuel and O&M costs in 2030, rising to $110 billion in 2035.” That would translate to hundreds of dollars per family in just a few years.

Votes in Congress Have Consequences

This bill would be a political disaster for Republicans. It’s already wildly unpopular before electric bills start going up.

Voters have a long history of blaming presidents for things like rising gas prices, even when bigger macroeconomic forces drove the increases. But in this case, policymakers would be directly responsible for these needless cost increases.

Voters already think the bill would be bad for their families.

They’re right. Repealing the clean energy tax credits would cost households up to $300 a year by 2030 and $900 per year by 2035.

The public has a sense of what’s coming — and they don’t support it. A Washington Post-Ipsos poll found strong opposition to repealing wind and solar tax credits:

One-in-Six

Of course, some people will feel the pain of higher energy costs more sharply than others.

Already, right now, 1-in-6 Americans are behind on their energy bills. Collectively, they owe more than $20 billion to utilities for a resource that people simply can’t live without. A similar number of Americans report keeping their thermostats at unsafe levels when it’s hot.

Those aren’t just statistics: they’re human tragedies waiting to happen. And the anti-energy proposals in Congress would make them much, much worse.

Again, there’s a reason we subsidize energy of all kinds, including oil, gas, nuclear, and renewables: energy is necessary for life.

Americans are already hurting. The “Big, Beautiful Bill” would deepen the pain.

Cliff or Ramp

The House-passed reconciliation bill would do away with the clean energy tax credits for any project that doesn’t commence construction within 60 days of enactment. That’s tantamount to an immediate cancellation and significant economic pain for consumers.

The Senate softened that a little bit, but not much — its version shrinks credits to 60% next year, 20% in 2027, and zero in 2028.

At the bottom of that cliff, mangled from the fall, are struggling consumers and the US economy.

The House also would require the projects to be completed by 2028 to get any tax credit, but developers don’t always have control of the completion date (grid operators and utilities often cause delays). So the practical effect could be even worse.

A gradual ramp-down would achieve the goal of ending the incentives — without the massive disruption and damage to the economy and American pocketbooks.

This would provide predictability and regulatory certainty. It would give the industry time to find efficiencies. And it could still decisively end the credits in a bipartisan and durable way without devastating consumers and employers.

Leveling the Playing Field

Anti-clean energy zealots, in Texas and nationwide, talk a lot about level playing fields. What they seem to mean is ending renewable incentives while continuing the generous subsidies that have flowed to other energy sources literally for generations.

There are over $100 billion in deficit reductions by 2035 available to Congress if they end fossil fuel subsidies. The anti-clean energy crowd insists that mature industries shouldn’t need subsidies; coal, oil, and gas are all pretty mature industries, wouldn’t you agree?

But that’s not going to happen.

The truth is that incentives exist because consumers demand — and the economy requires — low energy costs. Every resource is incentivized in the tax code because the alternative would be higher energy prices and no one wants that. Oil and gas have enjoyed trillions in subsidies over the last century for this reason.

Renewables and storage are just stronger competitors right now and they’re winning. They’re delivering faster and cheaper power than anything else. Again, just ask China — the world’s first electrostate according to the Financial Times — about how important renewables and battery energy storage are.

Let’s eliminate all energy tax breaks, and without any subsidies, renewables are still positioned to power the future. But you’ll pay more — a lot more.

Renewables will continue to grow; that’s not really in question. The main questions are how much will they grow and how much will your energy bills grow?

And how much will voters put up with it?

If Congress insists on ending renewable energy incentives, they’re going to find out.

Thank you for reading. This was a free post but for access to the full archives and paid-only content, and to support this publication, please become a paid subscriber today.

Search

RECENT PRESS RELEASES

Related Post