Ethereum (ETH) Price Prediction: Ethereum Surges to $2,600 as Bullish Momentum Builds—Top

July 3, 2025

Ethereum (ETH) is back in the spotlight, soaring over 10% this week to reclaim $2,600 as bullish momentum builds on ETF inflows, institutional demand, and Layer 2 expansion.

With new predictions pointing to a potential $10,000 Ethereum price target by 2026, investor sentiment is clearly shifting back into bullish territory.

Market Overview: ETH Breaks Out of Consolidation Zone

Following a prolonged period of sideways movement between $2,300 and $2,500, Ethereum chart analysis now points to a potential breakout. ETH rose sharply on Tuesday, touching $2,600 before stabilizing above the 50-day and 100-day Simple Moving Averages (SMAs), signaling renewed upward pressure. Technical indicators confirm the bullish momentum.

Ethereum (ETH) was trading at around $2,600, up 6.14% in the last 24 hours at press time. Source: Ethereum Liquid Index (ELX) via Brave New Coin

According to Coinglass, Ethereum witnessed $103.53 million in futures liquidations over the past 24 hours—78% of which were short positions—suggesting that the price rally caught many off guard.

The Ethereum RSI today has climbed above neutral, while the Stochastic Oscillator entered the overbought zone. The MACD is also testing its moving average for a crossover, a move that could further amplify gains if confirmed. To solidify the bullish trend, ETH needs to break through the upper edge of a symmetrical triangle visible on daily charts. Failure to do so may drag the token back into its prior range.

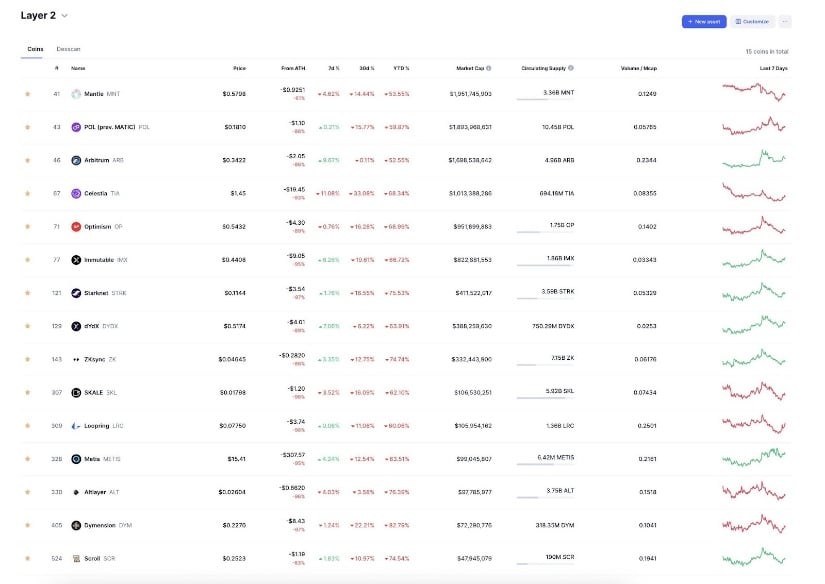

Layer 2 Ecosystem: Arbitrum, zkSync, and Tokenized Assets Fuel Adoption

Aside from price action, Ethereum’s Layer 2 growth is also the most important part of its bigger picture. With the advent of chains like Arbitrum, Optimism, and zkSync, Ethereum’s scalability has been transformed dramatically, making it more appealing to developers and institutional investors as well.

Ethereum Layer 2 list for 2025. Source: Crypto Archive via X

A key milestone was Robinhood listing tokenized stocks on Arbitrum, a sign of the growing trend for tokenization of real-world assets through Ethereum’s platform. The development comes in accordance with projections from Bitwise CIO Matt Hougan, who lately wrote, “The combination of stablecoins and stocks moving over Ethereum is an easy-to-grasp narrative for traditional investors.”

Meanwhile, the zkSync airdrop and growing L2 TVL (Total Value Locked) indicate growing user activity on Ethereum scaling solutions. This trend indicates that Ethereum is not only surviving but actively expanding its utility.

Fundamental Catalysts: Staking, Gas Fees, and ETF Demand

On the fundamentals front, Ethereum staking rewards and a reduction in Ethereum gas fees are key factors bolstering ETH’s long-term value proposition. Recent upgrades have improved validator efficiency, boosting Ethereum validator rewards and strengthening the network’s security and decentralization.

Ethereum ETF inflows reached $1.17B in June, as institutional interest grows amid rising clarity around stablecoin and tokenized asset use cases. Source: Fish4AI via X

Institutional appetite is also on the rise. Ethereum ETF news remains a dominant driver, especially as U.S. spot ETH ETFs saw $1.16 billion in net inflows in June, marking their second-best month since launch. On Tuesday alone, ETFs recorded $40.68 million in inflows, extending a three-day streak totaling $150 million, according to SoSoValue.

Matt Hougan of Bitwise predicts that Ethereum ETF inflows could hit $10 billion in H2 2025, buoyed by growing interest in tokenization and stablecoins. “Flows into Ethereum ETFs are going to accelerate significantly,” he noted.

Ethereum remains neutral on the daily chart, mirroring its 2016 accumulation phase, with potential for a major breakout toward the $7,300 target if it clears key resistance. Source: InvestingScope on TradingView

Several companies are also increasing their ETH allocations. Bit Digital added $21.4 million in ETH, while SharpLink Gaming bought 9,468 ETH, signaling a growing trend of corporate ETH treasuries—mirroring MicroStrategy’s approach with Bitcoin.

However, Coinbase analysts have warned that such strategies could introduce systemic risks if adopted en masse.

Looking Ahead: Ethereum Price Prediction and Future Outlook

With strong technicals, a growing Ethereum Layer 2 ecosystem, and growing institutional confidence, Ethereum’s future is bright. In the short term, analysts forecast the potential to move up to $2,800 in July 2025, especially if ETH succeeds in crossing above its significant resistance triangle.

Ethereum remains strong and is on track to potentially break above $10,000 this cycle. Source: CoinQuest via X

Further down the line, the consensus is steadily more bullish. Ethereum price forecasts point towards an end-of-year peak of $5,925, with some analysts looking towards $10,000 by 2026, spurred on by ETF flows, staking adoption, and practical uses such as tokenized assets.

As the momentum gains, the question now is: Will Ethereum flip Bitcoin in 2025? Speculative as it might seem, Ethereum’s mounting utility on DeFi, real-world assets, and institutional finance works well for a top spot in the next crypto cycle.

For the time being, everyone wants to know if ETH can keep this momentum going—and if its next stop is truly in five figures.

Search

RECENT PRESS RELEASES

Related Post