Tesla’s Quarter-Life Crisis – and Why Bitcoin Looks Bullet-Proof

July 7, 2025

Tesla once wore the crown jewel of the car business: top-shelf tech, sky-high multiples, and customers who treated every Elon tweet as gospel. Today, that halo’s slipped. Vehicle deliveries tumbled 14 % in Q2, the worst year-on-year slide since the Model 3 ramp-up days. The safety net that kept the profit sheet green – U.S. regulatory credit sales – is about to vanish, thanks to President Trump’s freshly signed “Big Beautiful Bill.” Analysts project the loss of those credits chops as much as $2 billion out of annual earnings.

Musk vs. Trump: the bromance is dead

The bill torpedoes the $7,500 federal EV tax credit, scraps CAFE penalties, and pares back most renewable-energy perks. It also left nothing for Trump’s crypto supporters. Musk blasted the legislation as “an abomination” and, in true Tony-Stark-after-three-espressos style, announced plans for a third political force, the America Party. Trump responded by calling the idea “ridiculous” while dangling the threat of yanking SpaceX and Starlink contracts.

An ex-Tesla executive told the FT that Musk has only just “woken up” to the scale of the political own-goal: “It’s everything together – tariffs, the $7,500 credit, manufacturing and charging incentives… talk about a day late and a dollar short.” The market agrees; Tesla stock opened 7 % lower the morning after Musk’s political party stunt.

It’s not all bad news, Elon says his political party will support Bitcoin, Source: X

Cash flow on life support

In Q1 2025, Tesla eked out a profit only because regulatory credits jumped 35 % year-over-year to $595 million. Strip those out, and the quarter would have gone red. Now, with U.S. credits headed for the shredder, the company is scrambling to hawk carbon allowances in Europe just to paper over the hole.

Wedbush analyst Dan Ives summed up the mood: shareholders “thought Tesla just got back its biggest asset – Musk – but that relief lasted a very short time.” If deliveries keep sliding and the credit spigot dries up, boardroom rumours about a CEO search won’t stay buried for long.

Brand in the blender

Politically homeless is a bad look for a car brand. Democrats began cooling on Tesla when Musk cozied up to Trump; now Republicans are souring as the bromance implodes. With legacy automakers flooding the market with cheaper EVs (many still eligible for foreign credits), Tesla’s once-rabid fan base is shrinking from both ends of the spectrum. The existential question: who’s left to buy the cars?

Meanwhile, on Planet Bitcoin…

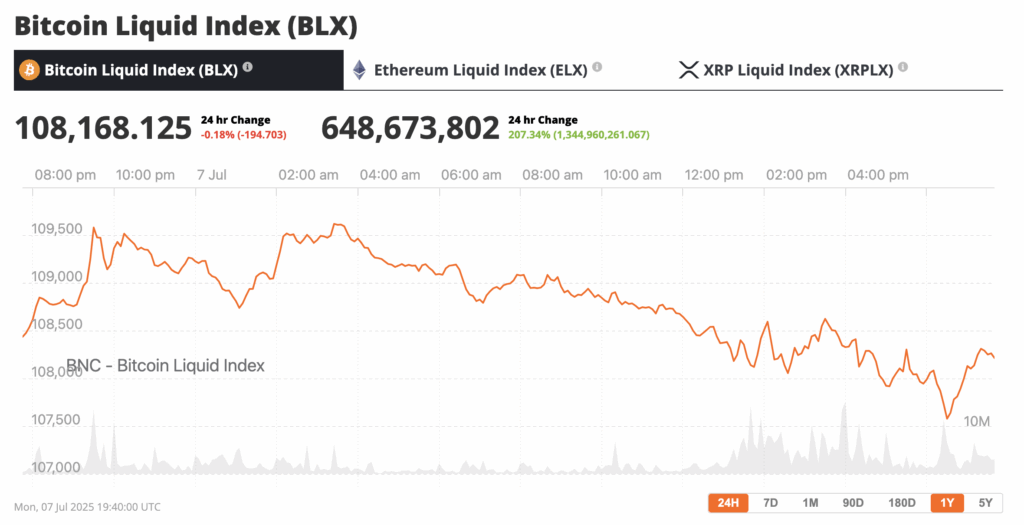

While Tesla’s narrative combusts, Bitcoin has quietly front-run a different script. Price hovers around $108,000, a stone’s throw from its $112,000 all-time high, even after a sluggish June. Whales (wallets ≥1,000 BTC) have switched to net accumulation this week, absorbing coins from jittery retail traders.

Bitcoin was down on Monday following the new round of Trump Tariffs, Source: BNC Bitcoin Liquid Index

Institutional pipes are wide open: net inflows into U.S. spot Bitcoin ETFs now exceed $14.4 billion YTD, and BlackRock’s IBIT just logged $1.31 billion in a single week. Standard Chartered still waves its $200 k year-end price target, pointing to ETF demand and a new wave of corporate treasury adoption. Macro tailwinds – a Fed expected to ease by Q4 and an administration that, love it or hate it, sees strategic value in a national Bitcoin reserve – add octane.Yes, it is a good time to buy Bitcoin and crypto.

Why the dip is a gift

- Scarce asset, growing pipes. ETF inflows plus whale hoarding equals supply squeeze. There will never be more than 21 million coins, and roughly 93 % are already mined.

- Regulatory clarity (finally). The GENIUS Act’s sandbox provisions give U.S. institutions a green light to hold BTC on balance sheets, nudging corporate treasurers off zero

- Flight from tech single-stock risk. Tesla bulls nursing a 30 % drawdown may rotate into the digital “flight to quality” trade—sound money with no management risk, no board, no late-night tweets.

- Halving tailwinds still playing out. The April 2024 halving cut miner issuance to 3.125 BTC per block, historically boosting price over 12–18 months. We’re only 15 months in.

- Trump’s fiscal fireworks. If the “Big Beautiful Bill” supercharges deficits, a hard-capped, non-sovereign asset looks ever more attractive to investors wary of fiat debasement.

Bottom line

Tesla’s turbulence is a cautionary tale: even cult brands can’t outrun math or politics. Musk’s side quests have collided with Trump’s deficit-hawking populism, and the collateral damage lands squarely on Tesla’s balance sheet. Bitcoin, by contrast, is humming along under its own monetary policy, soaking up institutional demand and edging toward price discovery 2.0.

Contrarian take: If you still want exposure to Musk, buy a Starlink subscription. For exposure to digital, scarce, censorship-resistant value – and fewer 3 a.m. heart palpitations – Bitcoin looks like the better bet.

Finally, traders waiting for alt season remain in the shadows, patiently waiting… and waiting… Source: X

Search

RECENT PRESS RELEASES

Related Post