Ethereum Price Nears $4,000 Psychological Level

July 20, 2025

Ethereum has continued its impressive climb, with its price now at a 7-month high of $3,745. The altcoin surged 27% over the past week, gaining momentum as investors aggressively accumulate ETH.

While the market shows strong signs of growth, this rapid pace is pushing Ethereum toward a saturation point that could determine its next move.

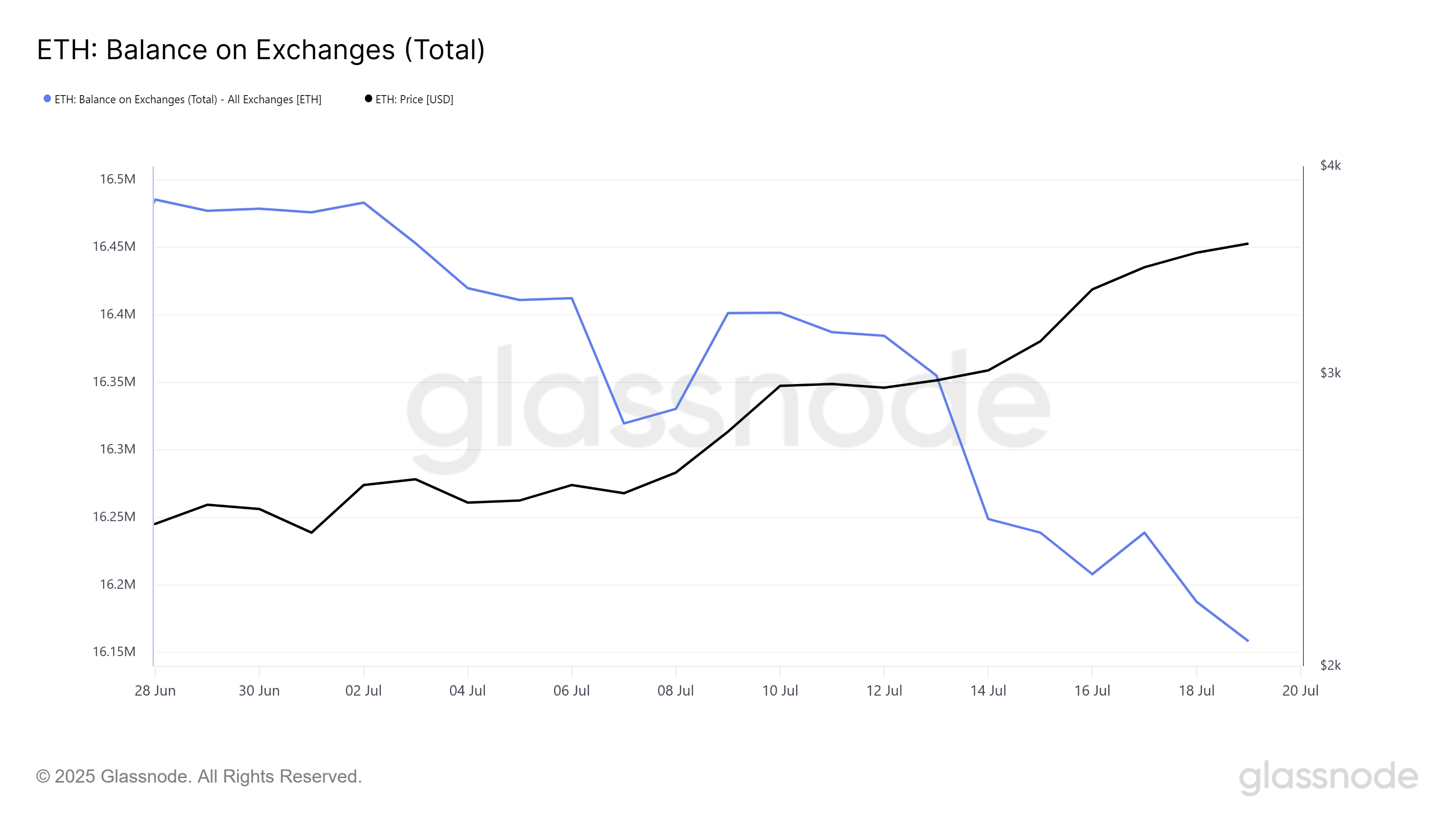

Since the start of July, the balance of Ethereum on exchanges has dropped by over 317,000 ETH. This amount, valued at more than $1.18 billion, reflects the scale at which investors are withdrawing their holdings, reducing available supply.

The decline indicates strong confidence that the price will continue rising.

This accumulation trend is driving the rally, as demand outweighs supply. Such aggressive behavior suggests that many market participants believe ETH could soon breach $4,000, adding more bullish pressure to its price trajectory.

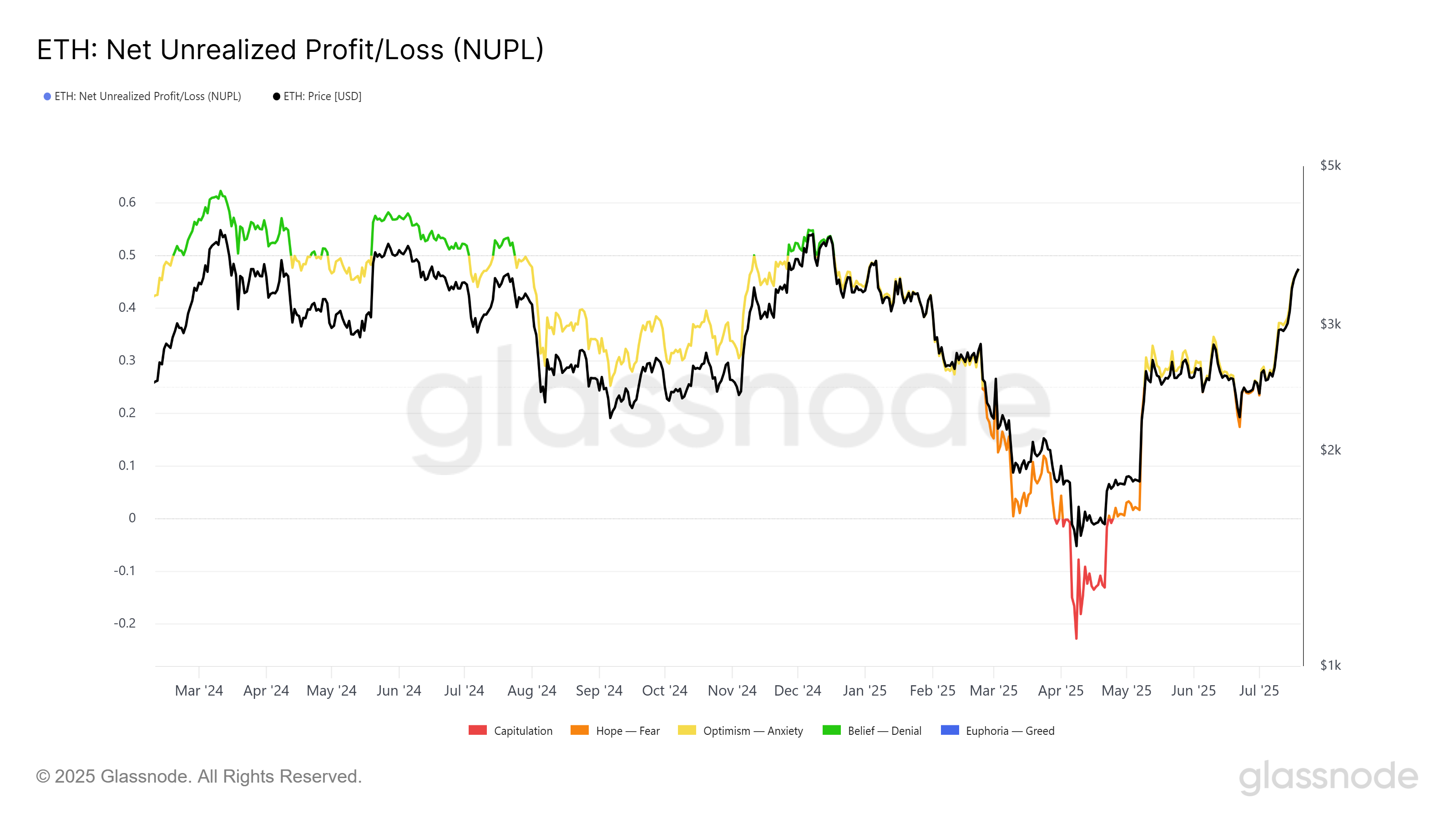

Ethereum’s Network Value to Transactions (NUPL) ratio is now approaching the “Belief-Denial” zone. This metric signals whether investors are in profit and helps identify potential reversal zones.

Historically, whenever NUPL entered this area, Ethereum’s price experienced a short-term correction.

The belief-denial level often acts as a saturation point where optimistic investors begin to secure profits. If Ethereum crosses $4,000, this psychological level may trigger significant selling pressure.

This pattern has repeated over the last 16 months and could repeat if ETH’s bullish run continues without correction.

At the time of writing, Ethereum is trading at $3,745, just 6.8% shy of hitting the $4,000 mark. This level has acted as a strong psychological resistance in previous bull runs. The current rally puts ETH in a solid position to test this barrier in the coming days.

However, if the market enters a phase of profit-taking, Ethereum could fail to break through $4,000. A resulting pullback may send the price down to $3,530. Losing this support could extend losses to $3,131, wiping out recent gains and confirming the onset of a short-term reversal.

On the flip side, if accumulation continues to dominate, Ethereum could invalidate the bearish outlook. A clean break above $4,000 would support the ongoing uptrend, enabling ETH to push toward new highs.

This scenario depends largely on the strength of investor conviction and broader market cues.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Search

RECENT PRESS RELEASES

Related Post