Is Meta’s (META) Strong Q2 and Global Signal Exchange Deal Shaping Its AI-Driven Investmen

August 11, 2025

- Meta Platforms reported strong second-quarter 2025 earnings, posting US$47.52 billion in sales and US$18.34 billion in net income, alongside joining the Global Signal Exchange partnership announced by GSE to combat online scams and abuse with Microsoft and over 30 other global companies.

- The collaboration places Meta at the forefront of industry-wide efforts to address cybercrime at scale, while robust earnings highlight the business momentum from AI-driven user engagement and advertising growth.

- We’ll examine how Meta’s expanded AI initiatives and participation in global digital safety partnerships could reshape its investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Advertisement

Meta Platforms Investment Narrative Recap

To own shares in Meta Platforms today, an investor needs conviction in the company’s ability to extend its dominance in digital advertising and social platforms, particularly through AI-driven innovation and user engagement. The recent announcement of Meta joining the Global Signal Exchange, alongside strong second-quarter earnings, underscores leadership in AI and digital trust but does not materially change the biggest short-term catalyst: continued advertising revenue growth from enhanced AI personalization. The most significant risk remains the potential impact of regulatory actions, especially in Europe, on Meta’s core advertising model and profit sustainability.

Of Meta’s recent announcements, the Q2 earnings results stand out as most relevant to this theme, reflecting ongoing momentum in both sales and net income. These results validate that the company’s investments in AI are translating into ad conversion gains, higher ad impression growth, and robust financials, aligning directly with the near-term catalysts for sustained topline expansion.

However, investors should also be aware that even with these positive signals, the threat of regulatory headwinds, particularly from evolving EU privacy laws, means …

Read the full narrative on Meta Platforms (it’s free!)

Meta Platforms’ outlook anticipates $275.3 billion in revenue and $92.0 billion in earnings by 2028. This projection implies 15.5% annual revenue growth and a $20.5 billion earnings increase from current earnings of $71.5 billion.

Uncover how Meta Platforms’ forecasts yield a $858.63 fair value, a 12% upside to its current price.

Exploring Other Perspectives

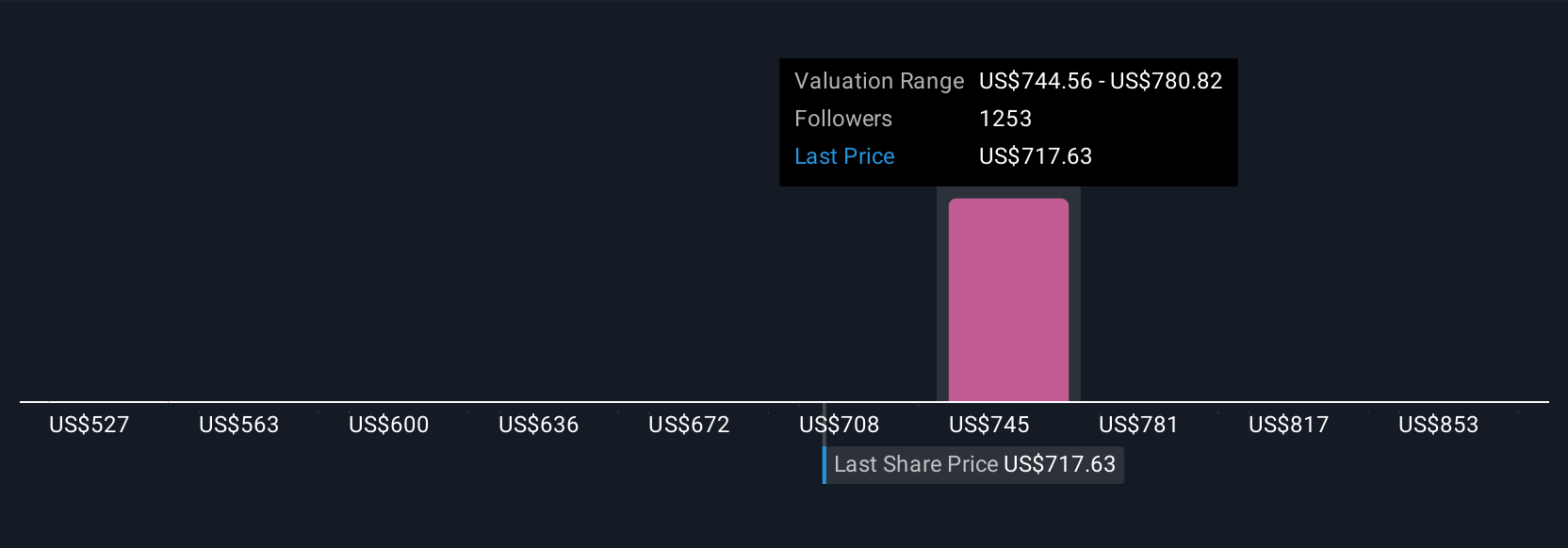

Community estimates for Meta Platforms’ fair value span a wide range, from US$527 to over US$1,056, based on 90 separate Simply Wall St Community viewpoints. With enhanced AI capabilities driving revenue and ad performance, the company’s path forward could surprise both optimists and skeptics, explore what your peers think next.

Explore 90 other fair value estimates on Meta Platforms – why the stock might be worth as much as 37% more than the current price!

Build Your Own Meta Platforms Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Meta Platforms research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Meta Platforms research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Meta Platforms’ overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they’re targeting before they’ve flown the coop:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post