Will Tilray (TLRY) Leaning Into Premium Cannabis Boost Its Edge in Canada’s Crowded Market

September 21, 2025

- Earlier in September 2025, Tilray Brands launched BC Selects, a limited-edition premium cannabis flower line under its Broken Coast craft brand, making the first strain, Sprits 26, exclusively available in British Columbia and unveiling a modern Blue Dream offering in both whole flower and pre-roll formats.

- This rollout spotlights Tilray’s push into small-batch, high-potency products and unique genetics, aiming to set itself apart within the premium segment of Canada’s cannabis market.

- We’ll examine how Tilray’s focus on exclusive premium offerings could influence its long-term revenue growth and market positioning outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Advertisement

Tilray Brands Investment Narrative Recap

To be a shareholder in Tilray Brands, one must believe in the company’s ability to differentiate itself with premium cannabis offerings, scale its diversified product range, and eventually achieve sustainable profitability. The launch of BC Selects sharpens Tilray’s focus on premium craft products, but given ongoing industry price compression and the company’s structural losses, this development does not materially address the critical near-term challenge of returning to profitability, nor does it offset Tilray’s biggest risk: persistent unprofitability and cash outflow.

Recent European expansion highlights, notably the August introduction of new EU-GMP certified medical cannabis strains for Germany, reinforce Tilray’s efforts to grow international revenue, which analysts see as a key catalyst for top-line improvement. However, the premium segment rollout in Canada and new launches in Germany both arrive against a backdrop of mounting financial losses and the need for operating discipline.

In contrast, investors need to remain attentive to the ongoing risk of heavy net losses and negative cash flow, especially since…

Read the full narrative on Tilray Brands (it’s free!)

Tilray Brands’ narrative projects $940.4 million revenue and $193.4 million earnings by 2028. This requires 4.6% yearly revenue growth and a $2.4 billion increase in earnings from -$2.2 billion today.

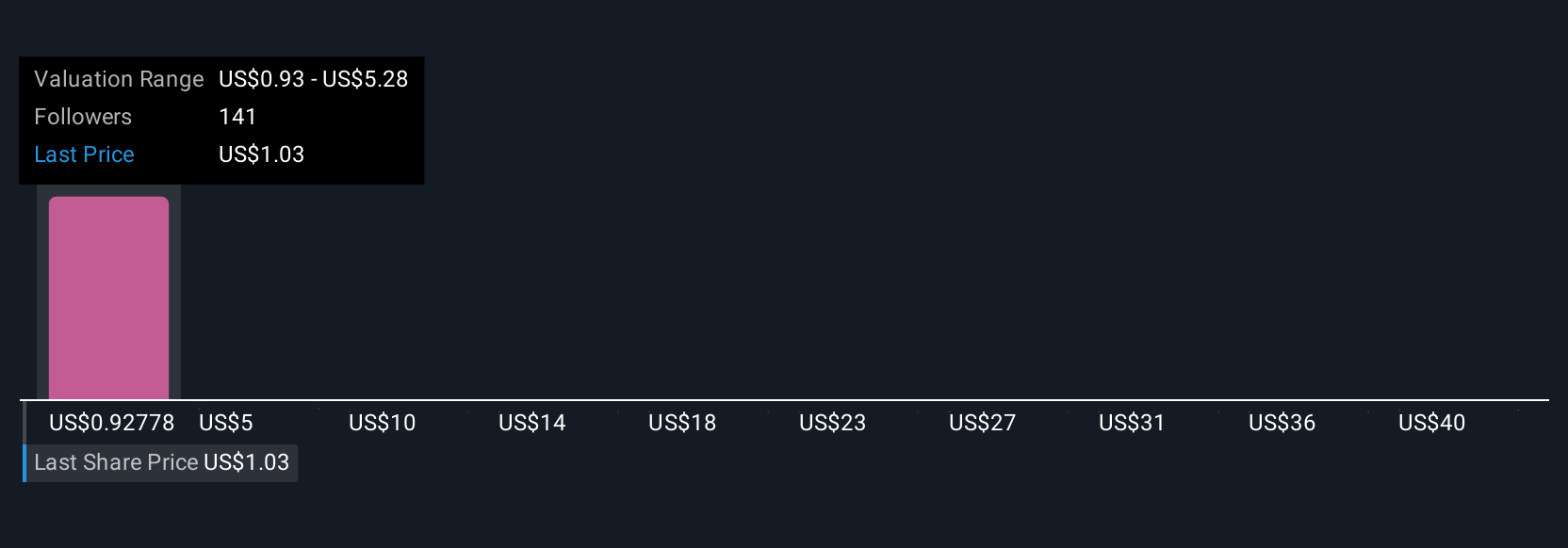

Uncover how Tilray Brands’ forecasts yield a $0.983 fair value, a 19% downside to its current price.

Exploring Other Perspectives

Eighteen members of the Simply Wall St Community assessed Tilray’s fair value between US$0.98 and US$44.45, signaling significant divergence in growth outlooks. While some expect global expansion to drive revenue, others see persistent operating losses as an urgent, unresolved obstacle for the business.

Explore 18 other fair value estimates on Tilray Brands – why the stock might be worth 19% less than the current price!

Build Your Own Tilray Brands Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tilray Brands research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Tilray Brands research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Tilray Brands’ overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Tilray Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post