Greif Acquisition and Analyst Upgrade Might Change the Case for Investing in Packaging Cor

September 28, 2025

- Earlier this month, J.P. Morgan initiated coverage on Packaging Corporation of America with an Overweight rating, shortly after the company’s US$1.2 billion acquisition of Greif’s containerboard assets.

- This move was highlighted as strengthening PKG’s scale, industry leadership, and positioning amid tightening supply conditions and evolving industry dynamics.

- We’ll now explore how PKG’s expanded capacity through the Greif acquisition shapes its longer-term investment narrative and outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

Advertisement

Packaging Corporation of America Investment Narrative Recap

To see value in Packaging Corporation of America, an investor needs to believe the company can translate its market leadership and recent capacity expansion into consistent revenue and earnings growth, even as industry supply tightens. J.P. Morgan’s positive coverage and the Greif acquisition may support the company’s main catalyst, sustained demand and rising box shipments, but economic uncertainty and operational costs remain serious risks. For now, the acquisition does not appear to materially lessen short-term earnings vulnerability if demand weakens.

A recently announced earnings guidance for Q3 2025, projecting $2.80 per share, stands out as highly relevant, as it provides a near-term test for the benefits of expansion and pricing power. This offers investors a closer look into how quickly new capacity can potentially improve margins and top-line performance, which will be central to the investment case in coming quarters.

However, while momentum is building, it’s important to recognize that rising operational costs and rail contract rates remain potent risks that investors should be alert to if…

Read the full narrative on Packaging Corporation of America (it’s free!)

Packaging Corporation of America’s narrative projects $9.5 billion revenue and $1.1 billion earnings by 2028. This requires 3.2% yearly revenue growth and a $201.6 million earnings increase from $898.4 million.

Uncover how Packaging Corporation of America’s forecasts yield a $216.11 fair value, in line with its current price.

Exploring Other Perspectives

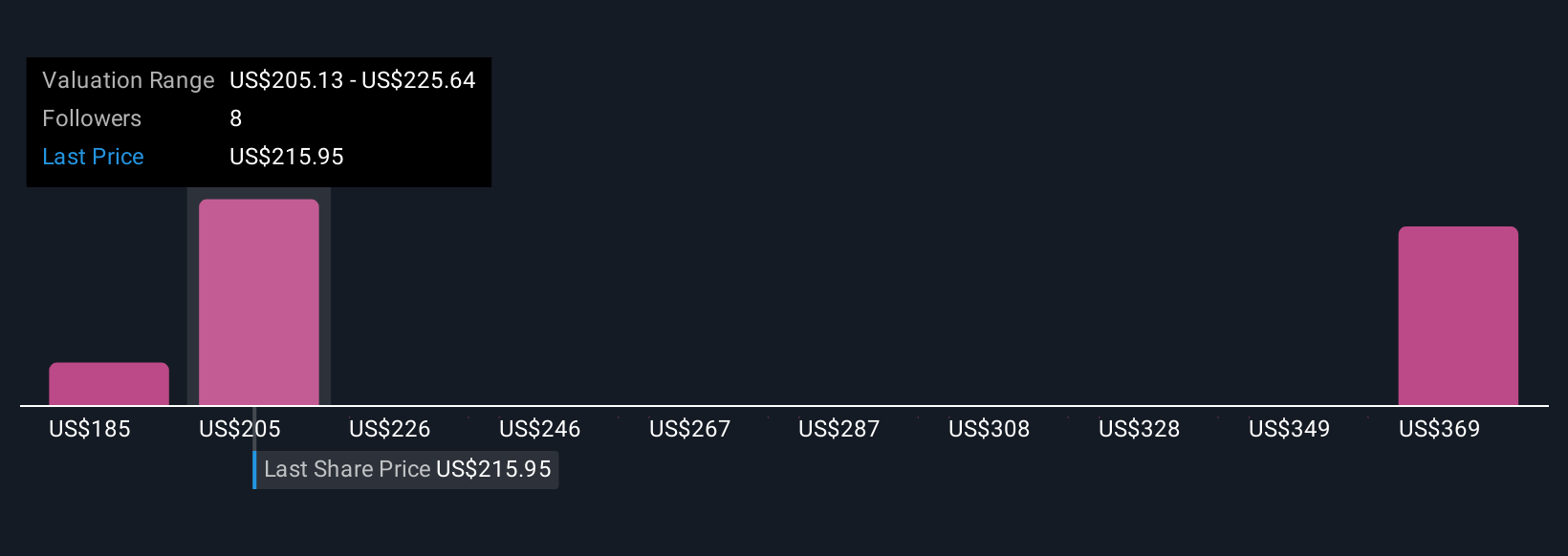

Simply Wall St Community members estimate PKG’s fair value from US$184.63 to US$389.67, showing a wide spread across four detailed perspectives. Yet, with rising operational costs still weighing on results, it’s clear opinions on future performance vary widely, review different viewpoints for a more informed stance.

Explore 4 other fair value estimates on Packaging Corporation of America – why the stock might be worth 15% less than the current price!

Build Your Own Packaging Corporation of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

- A great starting point for your Packaging Corporation of America research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Packaging Corporation of America research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Packaging Corporation of America’s overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post