Latest XRP News: Ethereum ETFs Continue To See Millions In Outflows, Is ETH Price Set To F

September 28, 2025

Disclaimer: This is a Press Release provided by a third party who is responsible for the content. Please conduct your own research before taking any action based on the content.

Established blue-chips are suffering from a devastating lack of conviction in traditional finance, evidenced by the persistent, painful outflows from Ethereum ETFs. This institutional retreat is the primary vector driving the bearish sentiment and threatening to send the ETH price spiraling back toward the $3,000 abyss.

While ETH traders look at its price predictions and worry about a sub-$3,000 tag, Layer Brett is building a fortress of utility and returns on Ethereum Layer 2, offering a presale entry at a steal—just $0.0058.

The Institutional Exodus: Why The ETH Price Is Suffering

The market was promised a flood of new capital when the Ethereum ETFs launched. Instead, we’ve witnessed a trickle that quickly turned into a steady, demoralizing stream of redemptions.

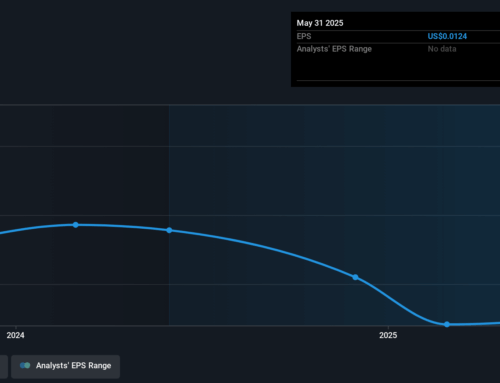

Recent data is brutal, showing a multi-day streak of net outflows. This is not casual profit-taking; this is institutional de-risking, and it’s having a chilling effect on the entire ecosystem. Every time a major asset manager pulls the plug, it intensifies the selling pressure on the underlying asset, making the battle to hold the ETH price above critical support levels an uphill struggle.

The fear is palpable: with institutional support failing, a full retest of the $3,000 mark for ETH is no longer a fringe prediction—it’s a likely scenario. Traders who piled into ETH on the ETF narrative are now holding bags as the promise of a sustained institutional bull run fades. This dynamic is a perfect demonstration of why chasing already-priced-in news is a low-alpha strategy.

The smart rotation is already underway, moving away from assets struggling under the weight of Wall Street’s indecision and toward the high-octane growth of Layer Brett.

Layer Brett: The True Ethereum L2 Alpha

While ETH is playing defense, Layer Brett is redefining what a Layer 2 meme coin can achieve. $LBRETT isn’t just a community narrative; it’s a high-performance, real-world, scalable utility, making it an entirely new category of investment. It fixes the inherent problems of the main Ethereum chain—slow, expensive transactions—to create a lightning-fast, dirt-cheap environment for its community. This technological foundation is the engine for its explosive growth potential.

The Layer Brett presale is the single biggest alpha drop of the cycle. Buying now secures your tokens at the initial price of $0.0058, a price that will be a distant memory once the project hits exchanges.

More critically, the staking rewards are an absolute game-changer. The Layer Brett APY is still above 620%. Backers earn passive $LBRETT at a rate that dwarfs anything from holding ETH or any traditional DeFi protocol. This compounding effect, combined with the rock-bottom entry price, has traders calling Layer Brett the one project that can deliver multi-thousand-percent returns this year.

Final Alpha: The Choice Is Clear

The divergence in the market has never been sharper. You can bet on a struggling mega-cap, but the Ethereum ETF outflows are continuously suppressing the ETH price, creating an environment of modest expectations and high volatility. Or, you can make the definitive degen move into Layer Brett.

The technical backbone of Layer Brett, combined with its massive community momentum, its ground-floor presale price, and a massive APY, positions it as the only logical play for huge returns.

Don’t let institutional investors dictate your portfolio’s fate. The time to secure your $LBRETT is now, before the presale locks out the best price forever.

Discover More About Layer Brett ($LBRETT):

Presale: LayerBrett | Fast & Rewarding Layer 2 Blockchain

Telegram: View @layerbrett

X: Layer Brett (@LayerBrett) / X

Disclaimer: This media platform provides the content of this article on an “as-is” basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

/div>

Search

RECENT PRESS RELEASES

Related Post