Tech and health care rally in a flat market — plus, Amazon’s Alexa gets smarter

September 30, 2025

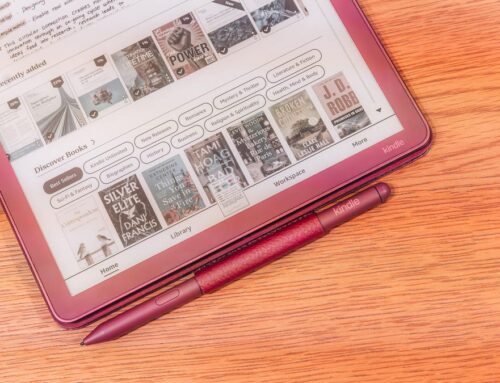

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. Market moves : Stocks were lower on Tuesday following slight gains for the S & P 500 on Monday. Unless a last-minute funding deal is reached, the federal government will shut down at midnight. As discussed during Tuesday’s Morning Meeting , a government shutdown is a bad reason to sell stocks or make changes to your investment strategy. There is no clear trend for what happens to the market during a shutdown. Bank stocks : The financials were one of the hardest hit sectors Tuesday, with the banks rolling over shortly after 10 a.m. ET on consumer confidence falling to a five-month low. As a leading player in the subprime market, customers of Capital One are likely to feel the effects of a slowdown in the economy first. That’s why American Express shares were faring slightly better. However, we think the drop of 6% in Capital One shares is an overreaction since the company’s credit quality has been steadily improving. The credit card issuer also has plenty of capacity to buy back stock. Tech stocks : The technology trade and AI infrastructure rally continued Tuesday after Meta Platforms and Coreweave signed a $14 billion deal for computing power, and analysts at Citi raised their AI hyperscaler capital spending forecast through 2029. Coreweave jumped more than 12% on the news, while Meta, the one spending, saw its shares fall modestly. Event updates: Amazon announced a bunch of new hardware products at its Devices & Services event. The most anticipated update was the new Alexa+ integrated Echo smart speakers. Alexa+ is Amazon’s next-generation personal assistant that’s powered by generative AI. Amazon management has touted the capabilities of Alexa+ on previous earnings calls, noting its difference from other generative AI chatbots, like ChatGPT. “The Alexa+ experience is so much better than I think our prior Alexa experience,” CEO Andy Jassy said on Amazon’s second quarter 2025 earnings call in July. “She is much more intelligent than her prior self. She’s much more capable. And, I would say, unlike the other chatbots that are out there today, who are good at answering questions, but really can’t take any action for you, Alexa+ can take a lot of action for you, which is very compelling.” One of the best outcomes for the Alexa+ is making it simple for customers to buy goods and groceries on Amazon’s marketplace. That’s how the Amazon flywheel works: the company develops products and services that drive more sales of other offerings. Another development from Tuesday’s event was an expanded partnership between Amazon Prime Sports and the betting site FanDuel. The two companies are teaming up to enhance the viewing experience for NBA betters. Healthcare rally : Health care was the top-performing sector Tuesday after Pfizer struck a deal with the Trump administration to lower drug prices and invest in U.S. manufacturing. In response, the president said the drugmaker will be exempt from pharmaceutical tariffs for three years. Other pharma stocks rallied on this news as investors viewed it as a potential blueprint for more deals. The White House said Eli Lilly is in talks to reach an agreement with the administration, especially since it has already announced plans to build several multi-billion-dollar manufacturing plants in the United States. Bristol Myers Squibb should follow in Pfizer’s footsteps, too. Interestingly, Danaher was also one of the biggest gainers in the sector — up more than 5%. As a provider of life sciences and biotechnology tools needed to make medicines, it should benefit from all this onshoring/reshoring activity in the pharmaceutical industry. But the timeline for when this activity will meaningfully benefit Danaher’s outlook remains uncertain, as it will take years for the new plants to become fully operational. Still, we’re encouraged by the relief rally in a stock we added to just last week. Up next: Nike reports earnings after Tuesday’s close, and the most important thing we are looking for is continued signs of a turnaround, driven by improvements to innovation, relationships with wholesale partners, and inventory levels. Conagra before the opening bell on Wednesday. On the data side, the schedule for Wednesday includes weekly mortgage applications, ADP’s private-sector employment report, and ISM manufacturing. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust, including COF, META, AMZN, LLY, BMY, DHR.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

Search

RECENT PRESS RELEASES

Related Post