Ethereum Price Outperforms Bitcoin (BTC) in Highest Ever Q3 Rally: What’s Next?

October 1, 2025

Key Notes

- Treasury managers accumulated 3.4 million ETH worth $14.6 billion during Q3, favoring yield-bearing assets over Bitcoin.

- Ethereum’s market cap reached $522 billion, closing the gap with Bitcoin’s $2.3 trillion valuation by capturing 10% share.

- Technical indicators show bullish momentum with resistance at $4,500 and potential upside targets toward $4,750 in October.

ETH

$4 334

24h volatility:

4.2%

Market cap:

$523.13 B

Vol. 24h:

$39.78 B

price closed trading at $4,150 on Sept. 30, before advancing another 5% to $4,320. Historical trading patterns show ETH has now outperformed Bitcoin

BTC

$117 346

24h volatility:

2.7%

Market cap:

$2.34 T

Vol. 24h:

$68.19 B

for the second consecutive month, driven by investor demand for yield-bearing assets.

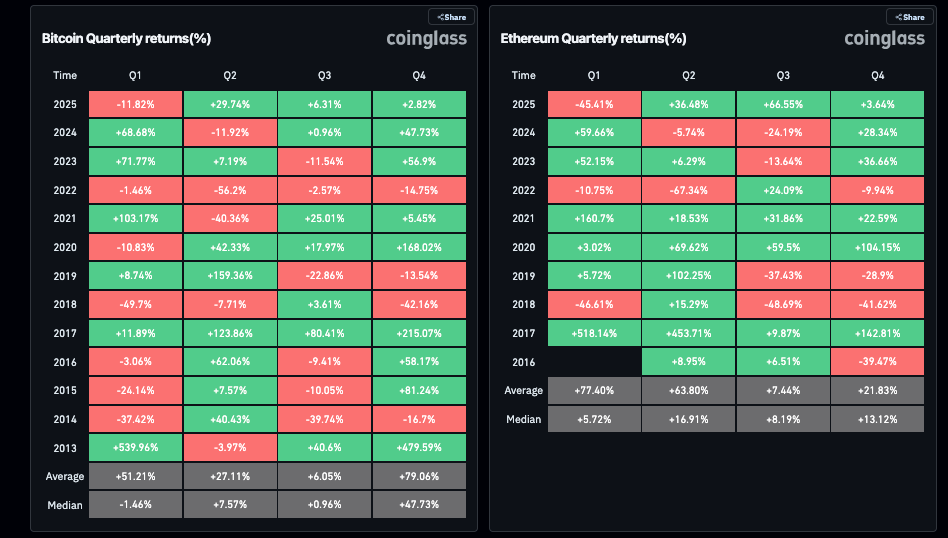

Ethereum (+66.8%) Outperforms Bitcoin (+6.3%) in Q3 2025 | Source: Coinglass

According to Coinglass data, Ethereum surged 66.8% in Q3 2025, building on a 36.5% rally in Q2. By contrast, Bitcoin delivered only 6.3% in Q3, closing around $114,000 on Sept. 30, despite broader macroeconomic optimism and institutional flows.

The disparity in ETH and BTC price movements signals investors appear willing to accept greater volatility in exchange for yield income and higher upside potential on long-term holdings.

$14.6B Treasury Inflows Propelled Ethereum Price Above BTC in Q3

In terms of key value drivers, Ethereum has witnessed strong fundamentals from network updates, treasury inflows and heightened speculative demand.

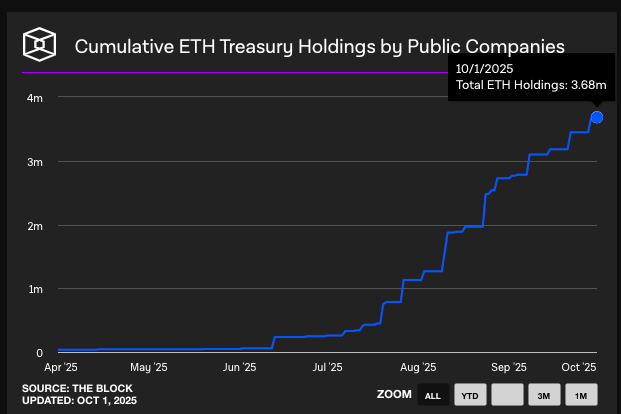

Ethereum treasury inflows remained steady in Q3, propelling ETH momentum ahead of BTC. According to data from TheBlock, Ethereum treasury firms held cumulative balances of 3.68 million ETH as of Oct. 1, having opened with only 257,830 ETH as of July 1.

Ethereum Cumulative Treasury Inflows as of Oct. 1, 2025 | Source: TheBlock

This represents a quarterly net accumulation of 3.4 million ETH, equivalent to $14.6 billion at $4,300 per coin.

With ETH offering yield on locked assets, treasury managers have increasingly allocated funds to Ethereum over BTC. If this preference persists, Ethereum’s $522 billion market cap could continue closing the gap on Bitcoin’s $2.3 trillion valuation after encroaching 10% market share in September.

Related article: Bitcoin Price Surge Leads the ‘Uptober’ Rally with Strong Start to Q4

Moreover, following the leadership shuffle in March 2025, Ethereum Foundation researchers concluded an inquiry into critical challenges within the ecosystem. The team published findings in the Project Mirror report on Sept. 29, further strengthening long-term outlook.

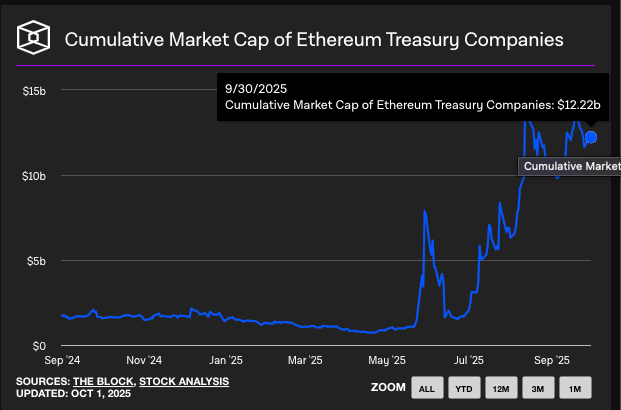

Led by Bitmine (BMNR), the cumulative market cap of the active Ethereum treasury firms rose from $1.6 billion in mid-July to $12.2 billion at press time.

Ethereum Treasury Firms’s Cumulative Market Cap | Source: TheBlock

Such high unrealized gains could attract new entrants, while existing Ethereum treasury firms now sit in stronger financial position to fund future purchases. This places ETH price in line for more gains in October as markets anticipate more rate cuts following the latest US jobs data readings on Oct. 1.

Ethereum Price Forecast: What’s Next For ETH in October?

Ethereum price held at $4,318 on Oct. 1, adding 5% uptick, after outperforming Bitcoin with a strong 66.8% rally in Q3. The weekly chart below highlights key Ethereum price targets to watch as traders weigh whether momentum can extend toward new highs.

The MACD crossover remains firmly bullish at 501.88, trending above the red signal line at 440.26. Also, the Price Volume Trend (PVT) at 14.04M signals consistent ETH accumulation despite recent volatility, reflecting the $14.6 billion treasury inflows in Q3.

Ethereum (ETH) Technical Price Analysis | Source: TradingView

On the upside, Ethereum price faces resistance at the $4,500 order block zone, marking the upper wedge line. A clean breakout above this level could accelerate gains toward $4,750.

On the downside, immediate support rests at $4,050, coinciding with the lower wedge of the higher order block. A break below this level could trigger a slide toward $3,800, where the last major demand cluster provided relief. Failure there risks a sharper retracement to $3,600, erasing a significant portion of the 66.8% Q3 gains.

Snorter Bot (SNORT) Presale Gains Momentum

As Ethereum continues its strong momentum following a 66.8% Q3 rally, a newcomer, Snorter Bot (SNORT) is quietly drawing attention. This Telegram-based crypto trading assistant mixes the viral energy of meme coins with practical on-chain trading tools, aiming to streamline how traders manage tokens.

Designed for simplicity, Snorter Bot lets users discover, snipe, and trade coins directly inside Telegram. The first rollout targets the Solana network, chosen for its fast settlement and low fees, while plans are already in place to expand across Ethereum and BNB Chain. With a total supply capped at 500 million, the project seeks to bring high-speed decentralized trading to everyday crypto users and meme coin fans alike.

Presale Snapshot

Token Price: $0.1065

Funds Raised: $4.211 million

Token Symbol: $SNORT

Network: Solana

Snorter Bot is positioning itself as a good option for traders looking for the best crypto presale to invest in new projects. Want to learn more? Explore our Snorter Bot price prediction.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Ibrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.

Search

RECENT PRESS RELEASES

Related Post