Why Bitcoin Could Break Its All-Time High Sooner Than Most Expect

October 2, 2025

Leading digital asset Bitcoin is up 3% today, driven by renewed optimism across the broader crypto market. The rally comes as the US government shutdown weighs on the dollar, prompting significantly higher inflows into BTC over the past day.

With buy-side pressure strengthening, the king coin could be on its way to reclaiming its all-time high.

Sponsored

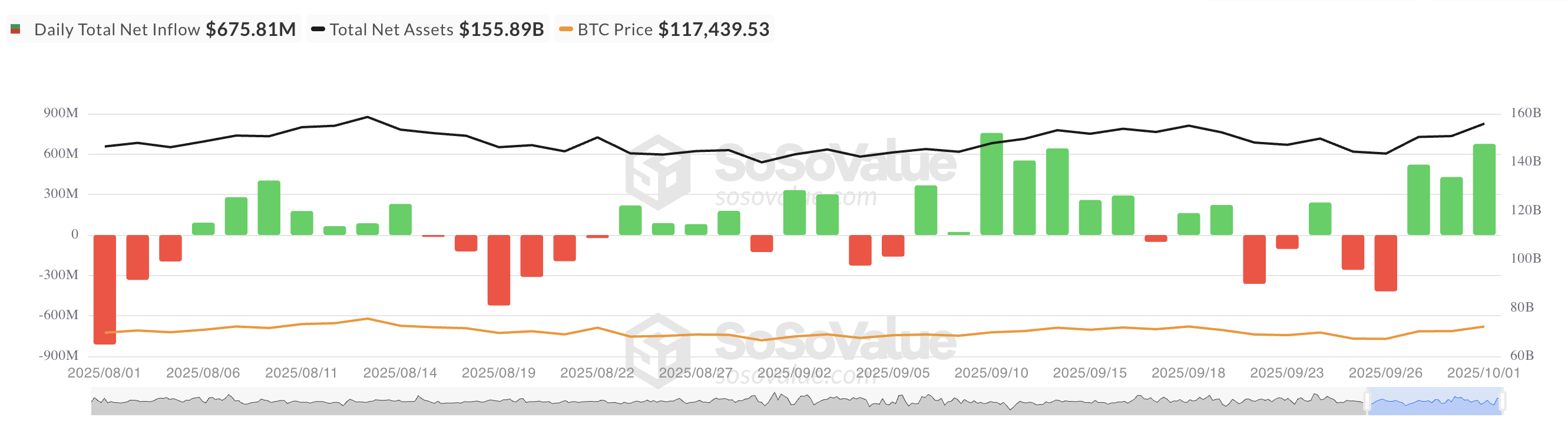

Against the backdrop of a falling US dollar, global investors have begun to rotate their capital into other assets like BTC. According to SosoValue, net inflows into spot BTC exchange-traded funds (ETFs) surged to a multi-week high of $675.81 million yesterday, indicating notable institutional participation.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

This rebound in flows marks a sharp contrast to last week’s subdued market, when over $900 million exited these same funds.

The renewed capital inflows now suggest that institutional appetite for BTC may be returning, as market participants weigh how long the US government shutdown will persist and its broader implications for risk assets.

Sponsored

If inflows persist, BTC could follow its historical Uptober trend, putting the asset on track to reclaim its all-time high and reach new record peaks.

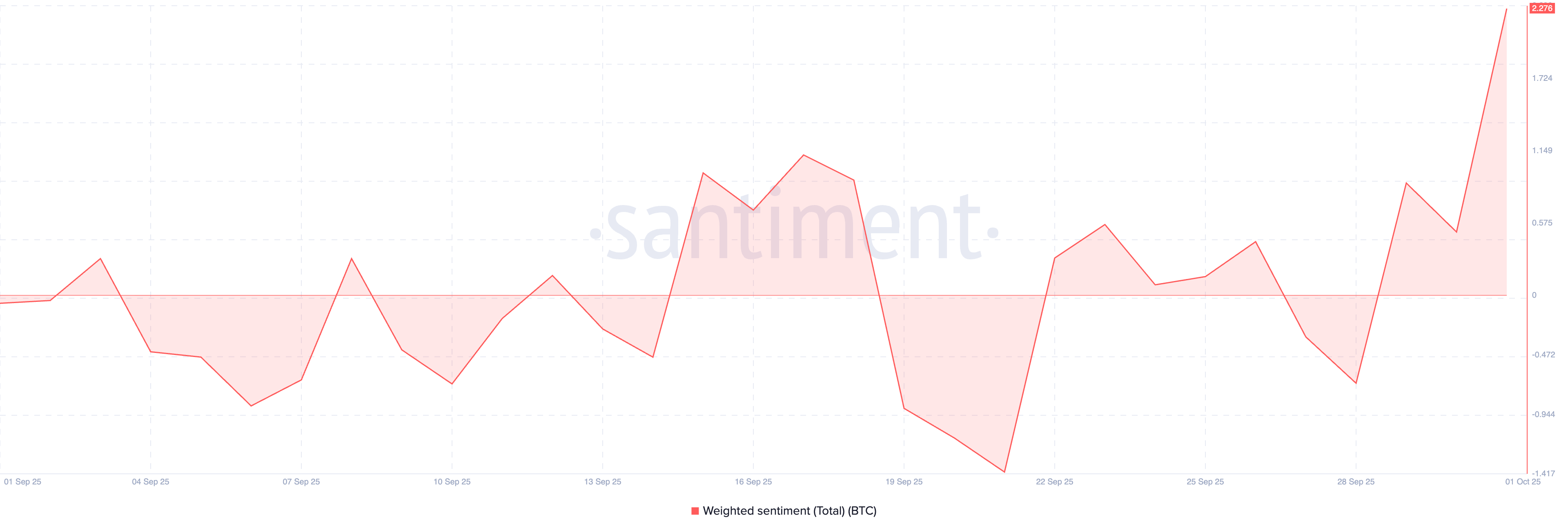

Further, according to Santiment’s data, the coin’s Weighted Sentiment is climbing, reflecting a renewed wave of trader confidence. At press time, this sits at 2.27 and is in an upward trend.

Weighted Sentiment tracks discussions about an asset across social media and online platforms. It measures the volume of mentions and the balance of positive versus negative comments.

When the metric is positive, it signals that traders and investors are generally optimistic, with bullish narratives dominating market chatter. Conversely, when it turns negative, bearish views take the upper hand, reflecting fear or caution among participants.

Sponsored

This latest uptrend in BTC’s weighted sentiment is particularly significant. Throughout much of last month, the metric oscillated sharply between spikes and steep declines, mirroring the volatility that troubled the broader market.

The current steady climb suggests that optimism is gradually returning and gaining momentum. If this improving sentiment continues to build, it could sustain BTC’s ongoing rally.

On the daily chart, BTC’s Aroon Up Line has returned to 100%, a reading that often confirms the strength of bullish trends.

Sponsored

The Aroon indicator measures the strength and direction of an asset’s trend by analyzing the time since an asset’s recent highs (Aroon Up) and lows (Aroon Down).

When an asset’s Aroon Up Line is at or near 100%, it signals that its price is consistently setting new highs and confirms the likelihood of a sustained uptrend.

If BTC demand rockets, the king coin could revisit its all-time high of $123,731. But for this to happen, it must break above the resistance at $120,144.

On the other hand, if demand falters, BTC’s price could resume its decline and plunge under $115,892.

Search

RECENT PRESS RELEASES

Related Post