Meta (META): Is There More Value Ahead After Recent Share Price Pullback?

October 5, 2025

Meta Platforms (META) shares dipped around 2% today, reflecting a modest pullback after weeks of steady trading. With no major headlines driving the move, investors seem to be assessing ongoing valuation levels as summer trading settles in.

See our latest analysis for Meta Platforms.

Meta’s recent dip is a minor blip compared to its outsized run over the past year. The company’s total shareholder return sits at nearly 20%, reflecting continued strength even as momentum cools slightly in the summer months. Recent rallies have kept Meta well ahead of its longer-term growth pace, and the latest move likely reflects investors re-checking their conviction at current valuation levels.

If Meta’s performance has you rethinking your watchlist, now’s the perfect moment to discover See the full list for free.

With solid returns and continued financial growth, the question now centers on whether Meta remains undervalued, or if its current price fully reflects all that is on the horizon for the company and leaves little room for upside.

Advertisement

Most Popular Narrative: 17.7% Undervalued

Meta’s most widely discussed fair value estimate sits noticeably above the current share price, spotlighting ongoing debate over whether the market is missing a bigger story beneath the surface. With analysts now forecasting stronger revenue and margin dynamics than previously assumed, the stage is set for a major repricing if these projections materialize.

“Advances in AI-driven ad targeting and content delivery are significantly improving ad performance and personalization, with Meta reporting material increases in ad conversions (for example, 5% more on Instagram, 3% on Facebook) and advertiser ROI. This suggests the company’s ongoing investments will further boost revenue growth and operating leverage over the long term.”

Want a glimpse into why numbers-loving analysts remain so bullish? The narrative’s fair value leans heavily on sharper profitability, relentless revenue ascent, and an earnings trajectory that seems laser-focused on beating even the boldest of forecasts. The source of this optimism and which financial assumptions are driving the conviction? That is where the plot thickens. There is more to uncover when you read the full narrative.

Result: Fair Value of $863 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, unexpected surges in AI spending or stricter privacy regulations could easily pressure Meta’s margins. This could cast doubt on the current bullish narrative.

Find out about the key risks to this Meta Platforms narrative.

Another View: Multiples Offer a Different Perspective

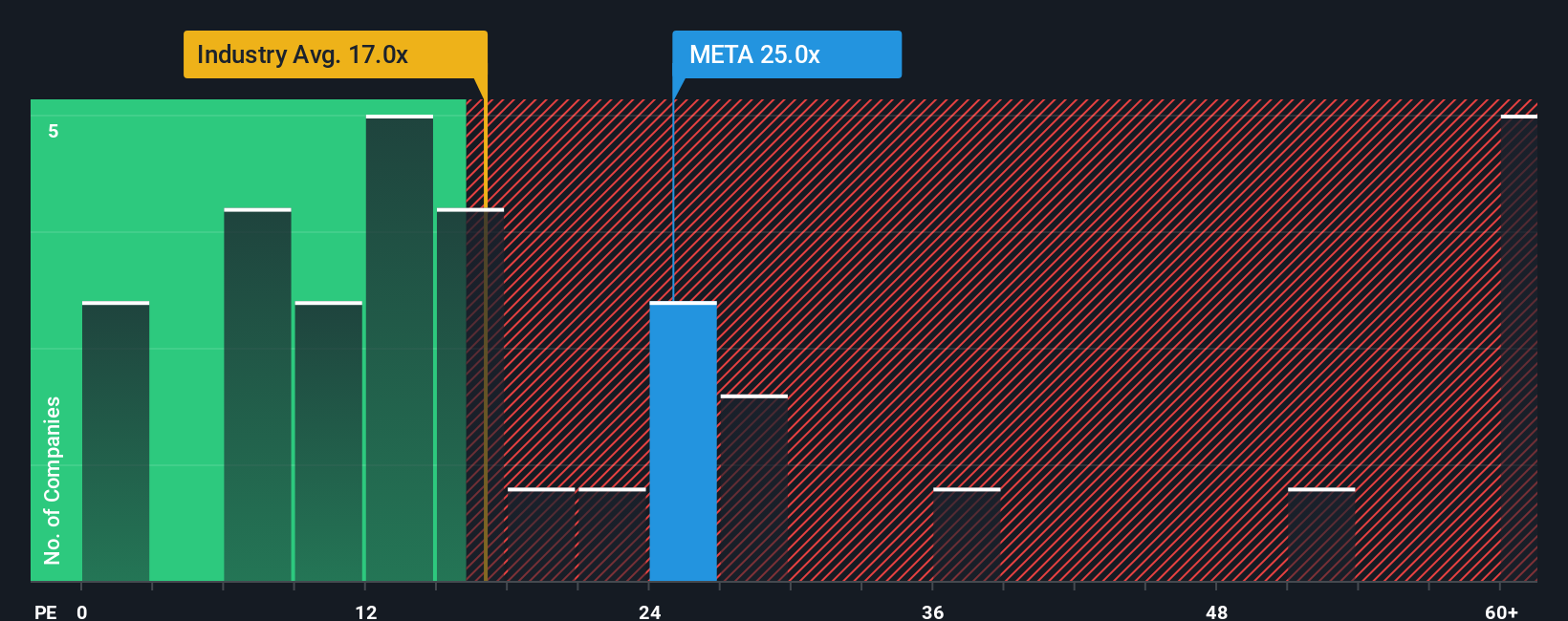

Looking at price-to-earnings, Meta trades at 25x, which is well above the US Interactive Media and Services industry average of 17x. However, it remains comfortably below the fair ratio of 38.9x and its peer average of 37.5x. This leaves investors wrestling with whether the premium reflects true quality or signals caution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Meta Platforms Narrative

If you are inclined to question these assumptions or want to dig into the details yourself, crafting a personal narrative is quicker and easier than you might think. The process often takes just a few minutes. Do it your way

A great starting point for your Meta Platforms research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one angle. If you want to unlock fresh opportunities that others might miss, the Simply Wall Street Screener makes it simple to spot what is next.

- Grow your portfolio with reliable income by checking out these 19 dividend stocks with yields > 3%, which features stocks that consistently pay attractive yields above 3%.

- Tap into tomorrow’s innovations by browsing these 24 AI penny stocks, where artificial intelligence leaders are transforming industries and capturing mindshare.

- Seize value before the crowd by reviewing these 896 undervalued stocks based on cash flows, which is packed with stocks trading below their fair worth based on real cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post