Why Lighter May Answer Ethereum’s PerpDEX Problem

October 9, 2025

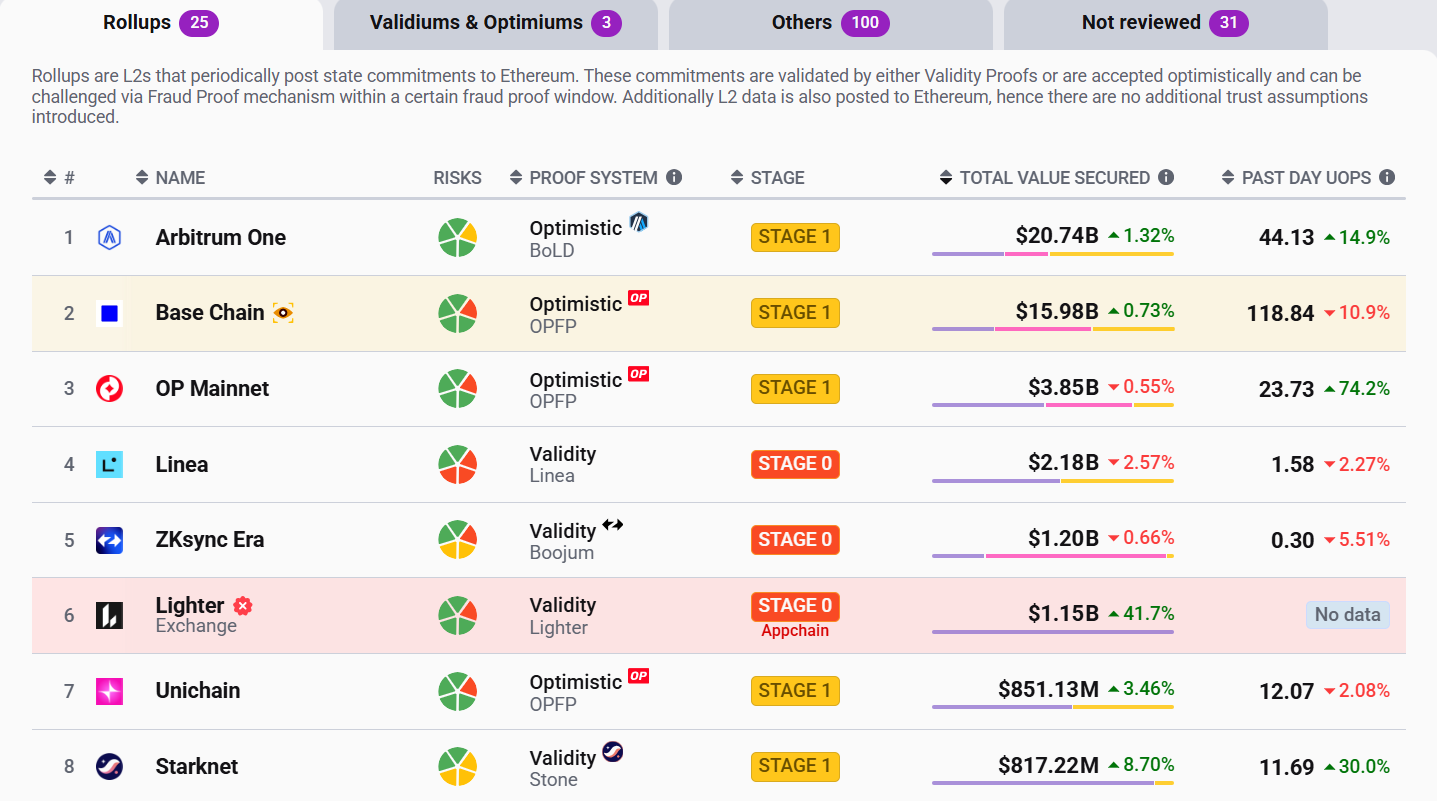

Lighter has surged ahead, overtaking major competitors to become Ethereum’s top app-chain and sixth-largest layer-2 by total value locked (TVL).

This rapid ascent makes Lighter a genuine leader among decentralized perpetual trading platforms.

SponsoredSponsored

The DEX stormed into L2Beat’s leaderboard only recently, becoming the sixth-largest Layer 2 by TVS. It is also the leading app-chain on Ethereum in record time.

Passing as Hyperliquid with Ethereum-grade property rights, Lighter’s arrival is rekindling the conversation about whether Ethereum can finally host a truly competitive Perpetuals DEX (PerpDEX) without sacrificing security or scalability.

According to Ryan Adams, founder of Bankless, Lighter’s debut is impressive. Adams cited its combination of zero token issuance costs, Ethereum-grade security, and infinite scalability.

The project is emerging as a flagbearer for the next generation of Ethereum app-chains. These comprise custom zk-based rollups that preserve Ethereum’s core principles while scaling performance to rival specialized ecosystems like Solana and Cosmos.

“Being an L1 is a bug, not a feature…An L1 is just an Ethereum L2 without any of the security and verifiability parts,” Adams stated, citing Lighter’s founder, Vladimir Novakovski.

This philosophy has struck a chord with Ethereum maximalists. Many see Lighter as proof that DeFi’s final missing piece, a native, high-performance derivatives exchange, can live on Ethereum.

SponsoredSponsored

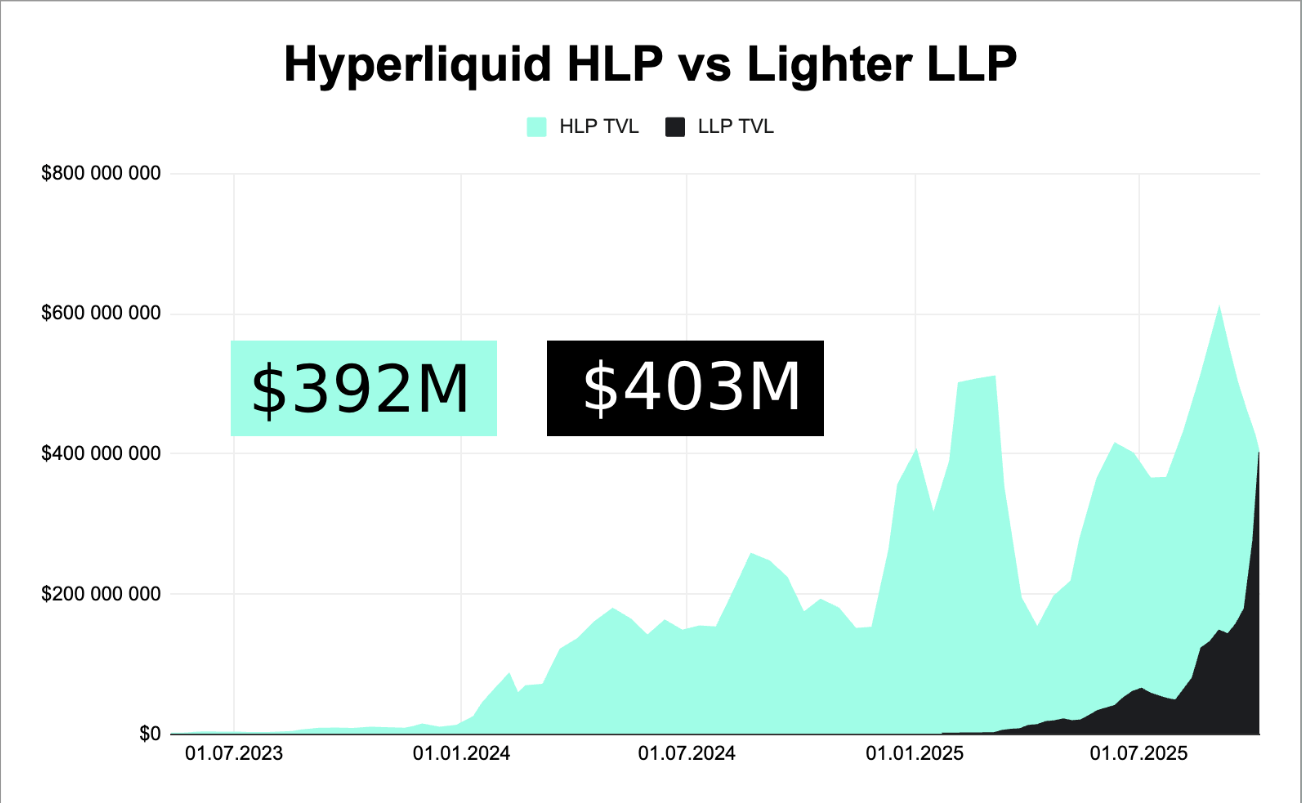

Over the past week, Lighter LLP has overtaken Hyperliquid HLP, according to data shared by analyst Eugene Bulltime.

“LLP has grown by $150 million to exceed $400 million in TVL,” he noted. “Some Hyperliquid LPs are transferring their USDC to Lighter for one simple reason—yield,” the analyst shared.

Meanwhile, Lighter’s yield rates are eight times higher than Hyperliquid’s (56% vs. 7%), with new deposits capped at 25% to maintain balance. Even under these limits, effective yields remain twice as high.

SponsoredSponsored

According to the analyst, this trend will continue. He projects that LLP could reach between $600 million and $800 million in the base case.

Such inflows suggest traders are rethinking their allegiance in the PerpDEX space. This is a rare sign of capital migration back to Ethereum after years of fragmentation across Layer-1s.

Against this backdrop, sentiment is that while Ethereum is the birthplace of all DeFi primitives, it lacked a good PerpDEX. Whoever solves this problem becomes one of the largest players in all of Web3.

“Lighter is the closest to achieving this,” Eugene articulated.

Previous contenders like dYdX and Synthetix struggled with scalability or governance issues, leading to migrations off Ethereum.

Lighter, however, claims to have cracked the code with custom zk-circuits and a new data view format. This allows it to operate as a native zk L2 with direct Ethereum interoperability.

SponsoredSponsored

According to L2Beat’s review, Lighter employs zk proofs that ensure validators cannot approve invalid withdrawals. Users can even force transactions through Ethereum L1, guaranteeing censorship resistance, a critical upgrade for decentralized exchanges.

However, L2Beat researcher Donnoh on X cautioned that the project’s zk program is not yet open source, and its Oracle authentication still needs strengthening. The team has pledged to address both in the upcoming updates.

Meanwhile, Lighter’s explosive entry mirrors a broader pattern seen with Ripple’s RLUSD, where Ethereum, not the originating network, captured most of the growth.

Just as RLUSD’s $789 million market cap highlighted Ethereum’s gravitational pull in stablecoins, Lighter’s momentum may reflect its dominance as DeFi’s ultimate settlement layer.

If early signals are right, Lighter could become more than just another Hyperliquid. It might be Ethereum’s long-awaited answer to the PerpDEX problem and the project that turns app-chains into the ecosystem’s next defining narrative.

Search

RECENT PRESS RELEASES

Related Post