How Recent Developments Are Shaping the Dow Investment Story

October 10, 2025

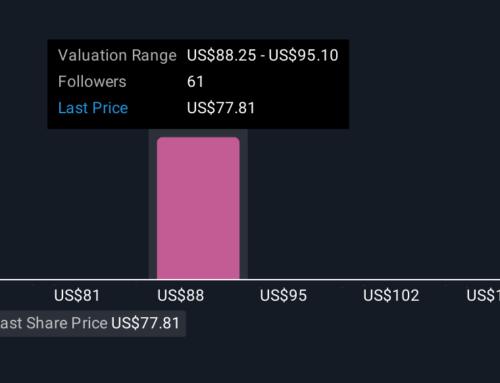

Dow’s fair value estimate has recently been adjusted downward from $28.24 to $27.82. This change reflects updated assessments of the company’s near-term prospects. The slight reduction captures a more conservative outlook, particularly in light of modestly reduced revenue growth expectations and ongoing export risks. Stay tuned to discover how monitoring these valuation shifts can help you stay ahead of emerging trends in Dow’s investment landscape.

Recent commentary from leading Wall Street analysts presents a nuanced picture of Dow’s current trajectory. Amid ongoing market pressures, analysts have provided both favorable and unfavorable assessments reflecting a mix of optimism and caution regarding the company’s execution and future prospects.

🐂 Bullish Takeaways

-

Bullish analysts commend Dow’s disciplined execution and its robust cash management strategies, which have played an important role in maintaining financial resilience during volatile conditions.

-

There is recognition of the company’s progress in cost control and operational transparency, enhancing confidence in management’s ability to navigate challenging markets.

-

Optimists see strategic flexibility as a critical asset and note that growth momentum could accelerate if global trade dynamics improve.

-

Jenna Martinez from Milton & Co. recently reiterated an “Overweight” rating and held her price target at $34. She noted that Dow’s forward-looking approach positions it well for a long-term recovery, while acknowledging that much of the upside may already be reflected in current valuations.

🐻 Bearish Takeaways

-

More cautious analysts are concerned by persistently weak earnings prospects, which they argue continue to restrain the company’s valuation and highlight challenges to near-term performance.

-

Ongoing export headwinds, primarily due to global tariffs, are seen as a significant risk to Dow’s revenue growth potential and overall market competitiveness.

-

Jacob Lin of Tiller Point Securities lowered his target price from $29 to $26. He underscored concerns about a possible dividend cut and signaled that management’s conservative guidance may further pressure income-focused investors.

-

Concerns remain that recent management actions have not yet delivered clear progress on key issues, leaving doubts about execution quality and the timeline for operational improvement.

Do your thoughts align with the Bull or Bear Analysts? Perhaps you think there’s more to the story. Head to the Simply Wall St Community to discover more perspectives or begin writing your own Narrative!

-

Dow has introduced DOWSIL EG-4175 Silicone Gel, a new material engineered to support higher voltage and temperature demands in electric vehicle batteries and renewable energy systems. The product is noted for its self-healing ability and energy-efficient curing.

-

The company has entered into a partnership with Gruppo Fiori to support recycling of polyurethane waste from end-of-life vehicles, aiming to enhance automotive supply chain circularity and assist manufacturers in meeting regulatory requirements.

-

A class action lawsuit was recently filed against Dow. Claims allege that the company overstated its capacity to manage economic and tariff pressures. This legal development follows weaker-than-expected financial results and a significant dividend reduction, which have contributed to a notable decline in Dow’s stock price.

-

Dow’s Board of Directors announced a quarterly dividend of 35 cents per share. The payment is scheduled for September 2025 and reflects the company’s planned dividend decrease.

-

Fair Value Estimate: Lowered slightly from $28.24 to $27.82. This reflects updated market assessments.

-

Discount Rate: Remained steady at 9.56%.

-

Revenue Growth: Reduced from 0.77% to 0.68%. This indicates more conservative sales expectations.

-

Net Profit Margin: Increased modestly from 4.05% to 4.07%.

-

Future P/E Ratio: Declined slightly from 15.74x to 15.49x. This signals a mild adjustment in forward earnings multiples.

Narratives are a smarter, story-driven way to make investment decisions. On Simply Wall St, a Narrative lets you share or follow the real story behind a company’s numbers by connecting forecasts for revenue, earnings, and margins directly to a fair value. Narratives are easy to use, always up-to-date as news breaks, and help millions of investors quickly see if it’s time to buy or sell by comparing Fair Value to the current Price, all within the Community page.

Read the original Dow Narrative to see why following along matters:

-

Stay informed about Dow’s capital adjustments, asset sales, and aggressive cost cuts, all designed to support cash flow and strengthen financial flexibility in a volatile environment.

-

Get timely perspectives on how margin pressures, delayed projects, and regulatory challenges could shape Dow’s earnings potential and keep you alert to risks before they hit the price.

-

Follow analysts’ evolving fair value estimates and see what they’re watching. This allows you to react quickly to changes and make smarter portfolio moves as new information emerges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include DOW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post