Thailand’s Draft Regulation on Direct Power Purchase Agreements via Third Party Access for

October 11, 2025

Overview

On June 25, 2024, the National Energy Policy Council (NEPC) approved a pilot policy intending to enable data centers to directly procure renewable energy through Direct Power Purchase Agreements (Direct PPAs), facilitated by Third Party Access (TPA) through the national grid for up to 2,000 MW. Please also refer to Hunton’s client alert published back in September 2024 when the Direct PPA and the TPA Code were introduced, the client alert can be accessed here.

The initiative is being jointly implemented by the Energy Regulatory Commission (ERC), Energy Policy and Planning Office (EPPO), Board of Investment Thailand (BOI), and the governmental utility operators, i.e., the Electricity Generating Authority of Thailand (EGAT), the Metropolitan Electricity Authority (MEA), and the Provincial Electricity Authority (PEA).

On October 3, 2025, 16 months after the NEPC’s approval of the Direct PPAs pilot policy, the ERC finally released draft regulations on the Direct PPAs (Draft Direct PPA Regulation) and the draft TPA Code. While the release of both drafts represent important steps in market reform in Thailand, our current focus is on the Draft Direct PPA Regulation.

It is important to note that the Draft Direct PPA Regulation and the draft TPA Code are currently in draft forms and remain subject to revision through the public hearing and legislative processes. Stakeholders should be aware that the provisions outlined here may evolve as part of ongoing regulatory consultations.

Purpose and Policy Intent

According to BOI data published on March 17, 2025, between 2022 and 2024, 27 projects in data centers and cloud services applied for investment promotion, representing a combined investment value of over THB 290 billion.

This increase reflects Thailand’s strategic positioning as a regional hub for digital infrastructure and its commitment to enabling large-scale, sustainable operations through regulatory and energy market reforms. In addition, according to Krungsri Bank’s Industry Outlook 2025–2027: Data Center Industry, the total revenue of Thailand’s data center industry is projected to grow at an average annual rate of 7.5–8.5%.

With the industry predicting substantial growth, data center operators are scrambling to secure energy at competitive prices, especially renewable energy that will also help them align with various ESG goals. As part of Thailand’s ongoing efforts to support the development of the data center ecosystem in the country, Thailand continues to refine various laws and regulations to align with the country’s strategic objective to position the country as a regional hub for digital infrastructure. Thailand’s policy movements on the energy front not only facilitate individual project development but also contribute to the broader ecosystem necessary for sustainable growth in this sector.

The implementation of the pilot framework is designed to support BOI-promoted data centers in meeting global sustainability mandates by allowing the data centers to sign direct power purchase agreements to quickly procure renewable energy throughout the country. As such, companies producing renewable energy will be able to supply power to data centers via Thailand’s national grid, promoting market liberalization and competition in Thailand’s energy industry.

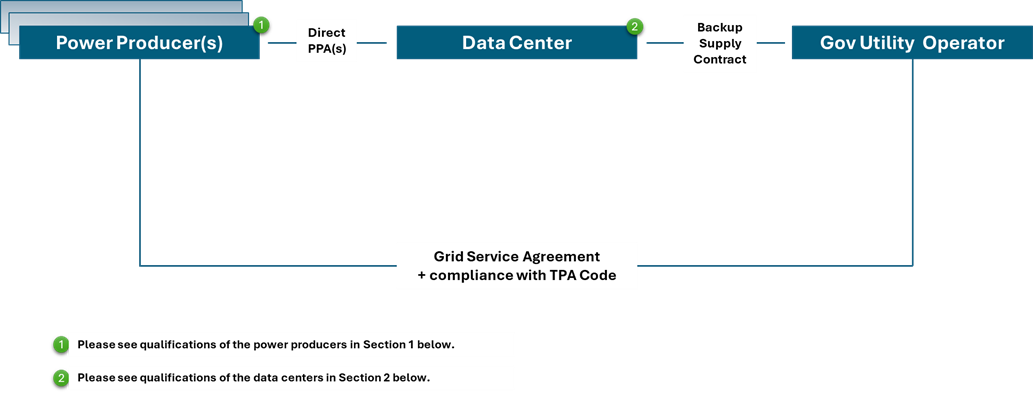

At a Glance: Contractual Structure for Direct PPA Scheme

The chart below illustrates contractual structure under the Direct PPA scheme as contemplated by the Draft Direct PPA Regulation.

1. Qualification of the Power Producer and Power Plant

- Power producers must only use renewable energy sources. Based on our discussion with an ERC officer, a combination of renewable energy sources with battery energy storage system is permissible. The power plant must be a newly established generating facility without any pre-existing PPAs whether with a private offtaker or a governmental utility operator.

- Each generating facility must have an installed capacity of at least 1,000 kVA and must have successfully secured a feeder capacity check by the governmental utility operator.

- There are no restrictions on foreign ownership; however, foreign investors must ensure compliance with the Thailand’s Land Code, which generally prohibits foreigners (including a foreign majority-owned Thai company) from owning plots of land. However, if a foreign investor receives BOI promotion, land ownership may be permitted if it has been approved by the BOI.

- Based on the draft TPA Connection Code, if the installed capacity of the generating facility is at least 6 MW, the generating facility must pass a system study conducted by EGAT.

2. Qualification of the Data Center

The eligible data center must be owned and operated by an entity that:

- Receives an investment promotion by the BOI for its data center project (which includes server colocation and data hosting services.

- Intends to utilize renewable energy for 100 percent of its power demand.

- Is mandated by its group to use renewable energy and to align with its investments in other jurisdictions.

- Has a minimum IT base load of 50 MW per building and submits a comprehensive ten-year electricity plan detailing proposed Direct PPAs, grid usage, and total load projections.

- Has not yet generated income from such data center project as at the date on which it submits an application to ERC for the Direct PPAs quota.

- Has secured a backup supply contract with the relevant governmental utility operator to provide backup supply during off-peak periods or times of excess demand.

- Has developed a work plan and obtained a commitment from a power producer to utilize this Direct PPA regime. From our discussion with ERC officers, the commitment could be in the form of a non-binding MOU or LOI, where the relevant power producer expresses intention to sell electricity to the data center through the TPA and a Direct PPA.

3. Other Key Conditions and Compliance

- Power producers must comply with both the governmental utility operator’s Grid Code and the TPA Code.

- Power producers are required to enter into grid service agreements for the full Direct PPA capacity within specified timelines. If they fail to do so, the data center will be forfeited of any unused Direct PPA quota.

- A single data center may be supplied by multiple power producers.

- No specific form of Direct PPA is prescribed by the ERC; it is subject to commercial terms and negotiations between the power producers and the data center. A data center may be considered a “large scale customer” and therefore the power purchaser agreements must at least contain provisions related to rights and obligations of the parties pursuant to the ERC Notification on Standards of Contracts on Power Service Provision for Large Power Users B.E. 2561 (2018).

- The grid service agreement between the power producer and utility must follow the format provided under the TPA Code.

Implications and Future Prospect

- For data centers, it facilitates compliance with global renewable energy mandates while strengthening sustainability credentials.

- Renewable energy producers benefit from expanded market opportunities, reducing dependence on government-backed PPAs.

- Governmental utilities operators must prepare for the operational demands of wheeling services and system balancing under TPA Code.

- An expert at the Thailand Development Research Institute (TDRI), a leading policy think tank, notes that clean energy is critical for global trade competitiveness. While the current ERC regulation limits Direct PPAs to data centers, the introduction of the TPA Code creates a pathway for expanding this scheme to other industries aiming for carbon neutrality and Net Zero. This evolution could strengthen Thailand’s export potential and overall competitiveness.

Next Steps

Stakeholders are encouraged to review the Draft Direct PPAs Regulation and TPA Code, and prepare for compliance and implementation.

It is anticipated that government agencies, such as ERC, BOI and the governmental utility operators, will issue further guidance as the pilot project advances, prescribing criteria, procedures, and conditions.

This article was drafted by Chumbhot Plangtrakul, Thaphanut Vimolkej, Ronnarit Ariyapattanapanich, Jidapa Songthammanuphap, and Joseph Willan.

Search

RECENT PRESS RELEASES

Related Post