Why Gold Price Is Falling the Most Since 2020? The Crash Is Dragging Bitcoin Down Too

October 22, 2025

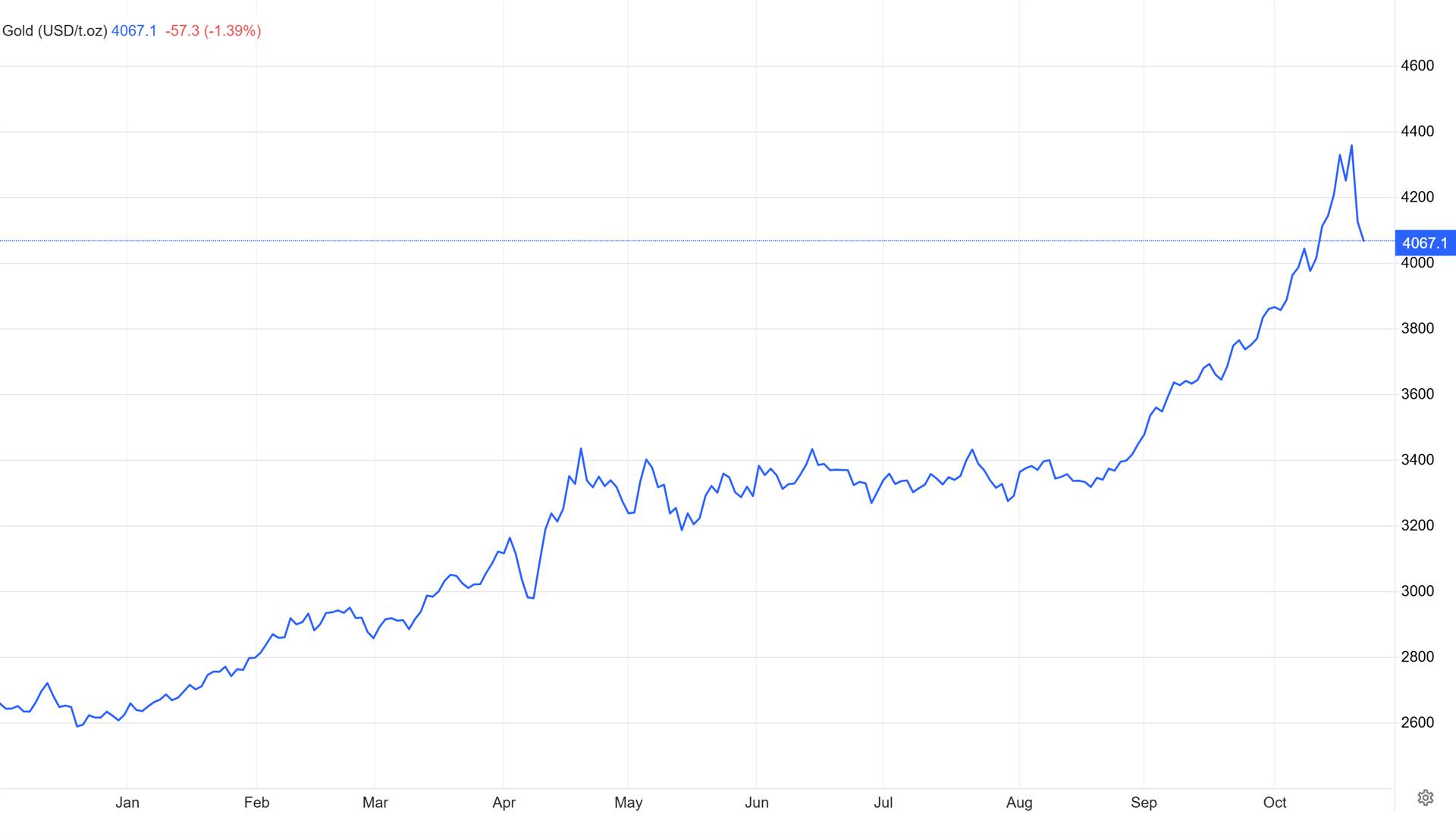

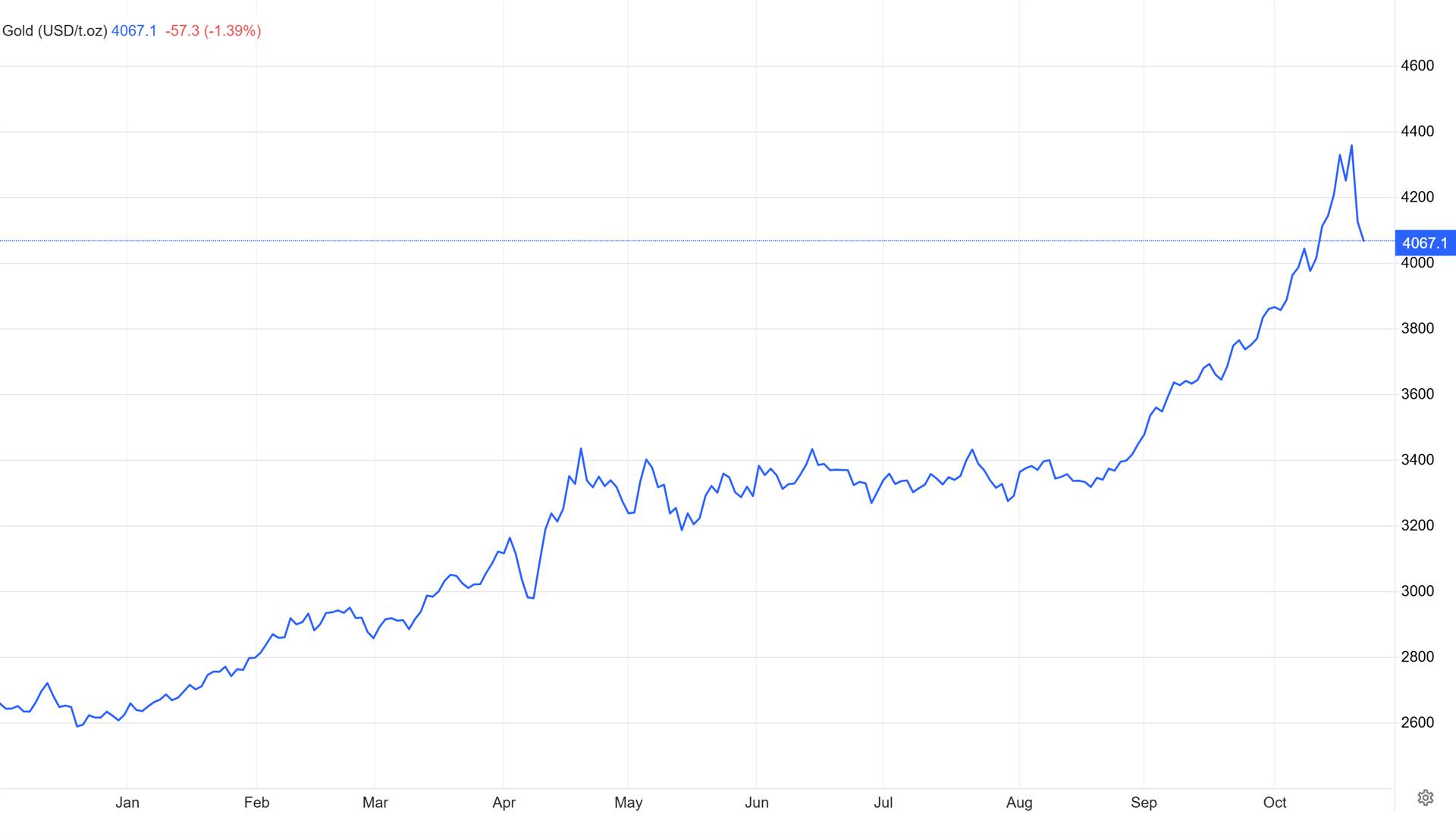

Gold price experienced

its most severe single-day collapse in over five years this week, plunging more

than 5% from record highs and dragging Bitcoin (BTC) lower in a synchronized

selloff that erased billions in market capitalization.

The

precious metal fell from Monday’s all-time peak of $4,381 per ounce to an

intraday low of $4,082, marking the steepest decline since August 2020’s 5.7%

crash. Bitcoin simultaneously dropped over 2%, falling from $110,000

levels to test critical support at $108,000 as the correlation between

digital and physical safe-haven assets reached 0.85.

The gold

crash followed an unsustainable rally that saw

prices surge 60% throughout 2025 and 25% in just the previous two

months, creating what analysts described as “stratosphere” conditions

ripe for correction.

Standard

Chartered analyst Suki Cooper characterized the movement as a “technical

correction” after record-breaking precious metals inflows totaling

$34.2 billion over ten weeks pushed the market into severely overbought

territory. Bart Melek, global head of commodity strategy at TD Securities,

confirmed dealers were “realizing gains after a strong

rally” that proved unsustainable long-term.

Profit-taking

accelerated as

the US dollar index strengthened 0.4%, making gold more expensive for

international buyers and reducing its appeal against competing assets. The

timing coincided with renewed optimism over US-China trade negotiations, with

President Trump expressing confidence about reaching a deal with Chinese

President Xi Jinping at their scheduled meeting. This easing of geopolitical

tensions diminished safe-haven demand that had propelled gold to consecutive

record highs.

Physical

demand also weakened following the conclusion of the Diwali festival in India,

the world’s second-largest gold consumer, removing a significant source of

buying pressure. Silver crashed even harder at 8.7% in its

worst single-day drop since February 2021, while platinum fell 5-7%,

confirming the broad-based precious metals correction.

Why Bitcoin Price Is Going

Down Today?

Bitcoin’s

decline mirrored gold’s weakness as the strengthening correlation

between the two assets, currently at 0.85, near the all-time high of 0.9

reached in April 2024, caused synchronized selling pressure. The cryptocurrency

ended Tuesday’s session at $108,342, dropping over 2% and retesting local

support around the $108,000 level that coincides with late August lows and

marks the lower boundary of the months-long consolidation range.

From my

technical analysis of Bitcoin’s chart, the price attempted to strengthen

on Monday before ultimately pulling back sharply in direct reaction to

gold’s crash. Bitcoin tested the critical support zone around $108,000,

which aligns with late August lows and represents the lower boundary of the

consolidation drawn since mid-October.

Importantly,

the 200-day exponential moving average continues to provide support,

meaning we remain technically in a bull trend. However, a breakdown below

this range would open the door to further declines and a test of the

$100,000 level, a major psychological support zone.

Paul Howard

from Wincent noted that “many analysts follow technical trends

including M2 money supply, gold, stock2flow models plus other metrics as

ways to predict Bitcoin’s next move. Arguably many now indicate a big

upswing and with so many leveraged longs and shorts liquidated, and a positive

global macro environment may see Bitcoin as a gold laggard”. The

comment highlights how Bitcoin’s underperformance relative to gold’s

earlier rally may reverse following the liquidation cleanup.

Please also check my previous articles including Bitcoin and gold price predictions:

Key Market Indicators for

Gold and Bitcoin

|

Metric |

Value |

Change |

Significance |

|

Gold Price (Oct 22) |

$4,082 |

-5.6% |

Worst drop since August 2020 |

|

Bitcoin Price (Oct 22) |

$108,342 |

-2.1% |

Testing August support levels |

|

Silver Price |

$51.89 |

-8.7% |

Worst drop since February 2021 |

|

Gold-Bitcoin Correlation |

0.85 |

Near ATH |

Explaining synchronized selloff |

|

US Bitcoin ETF Flows |

-$40.47M |

Outflows |

Institutional caution |

|

Crypto Market Cap |

$3.76T |

-2.3% |

Broad-based decline |

Gold-Bitcoin Correlation

Drives Synchronized Selloff

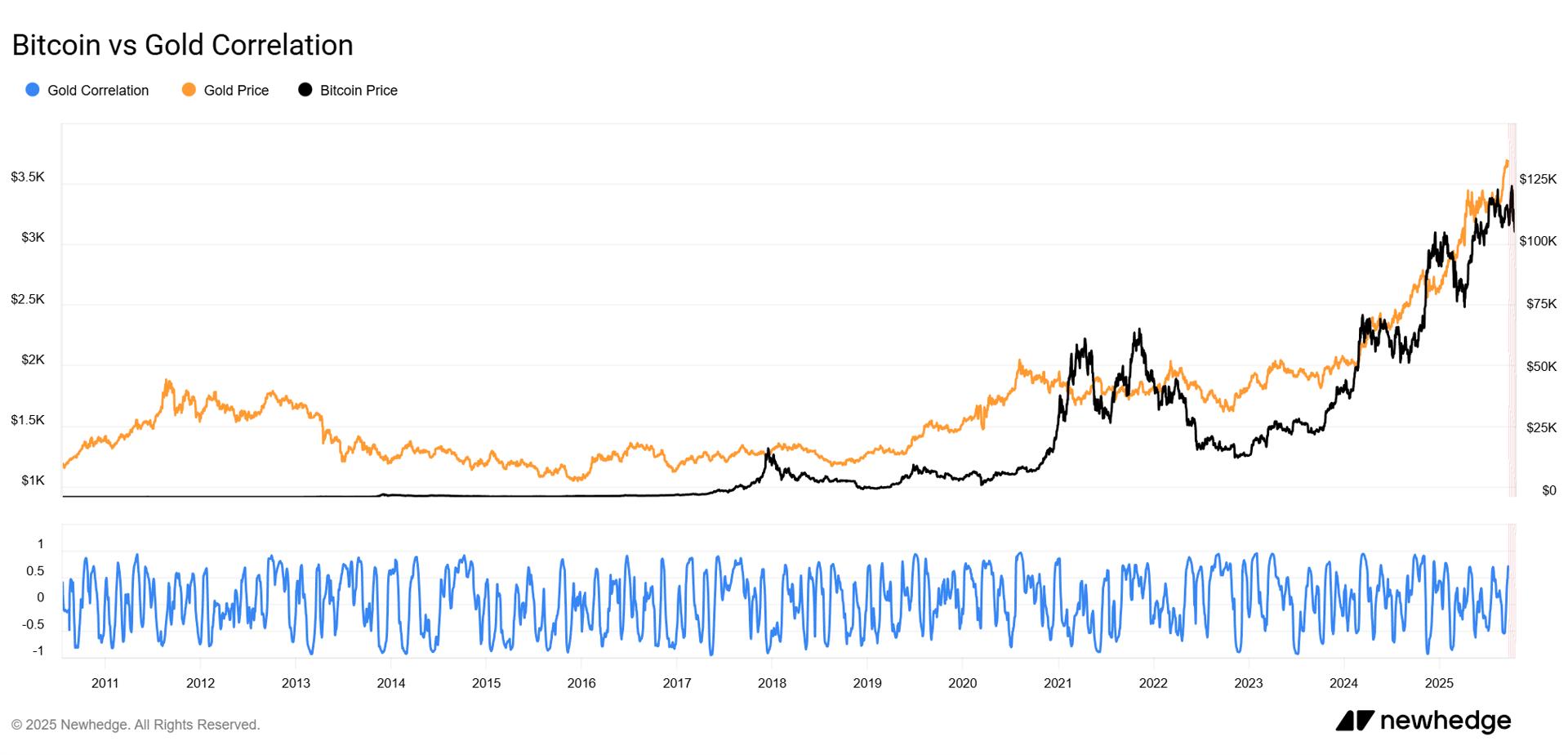

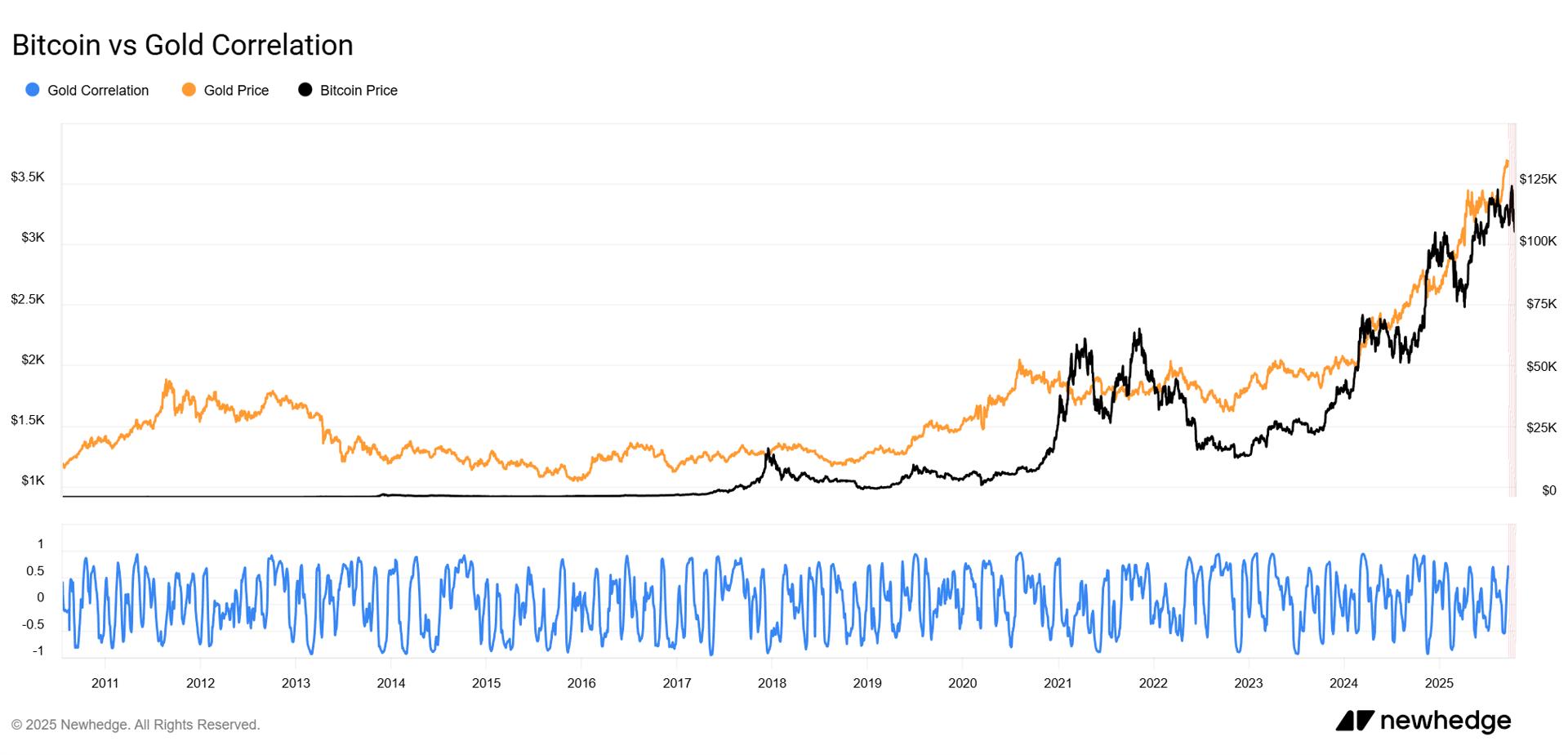

The

increasingly tight correlation between gold and Bitcoin, rising from

negative 0.8 in October 2021 to current levels of 0.85, explains why

both assets experienced simultaneous pressure.

Mostafa

Al-Mashita, Co-founder & Director of Sales and Trading at Secure

Digital Markets, provided exclusive analysis: “Gold’s loss of neutrality

and Bitcoin’s rise as a borderless asset mark a fundamental shift in

global value dynamics. The recent gold sell-off, though expected after an

extended rally, underscores how traditional havens are becoming tools

of policy rather than stores of neutrality”.

He

continued: “Nations like China, India, and Turkey are stockpiling gold

to reduce reliance on the US dollar, turning it into a geopolitical

instrument tied to state agendas. Bitcoin, though increasingly adopted by

institutions and states, remains structurally decentralized and resistant to

control. It signals economic independence while functioning as both a

volatile trading vehicle and a modern store of value. This isn’t simply

gold versus Bitcoin; it’s a broader reallocation of trust, with

governments asserting sovereignty through gold and individuals and institutions

seeking autonomy through Bitcoin”.

Initially

on Tuesday, Bitcoin actually surged as gold crashed, briefly jumping above

$113,000 as traders rotated capital from precious metals into crypto. Analyst

Ash Crypto declared “the rotation from gold to Bitcoin has begun,”

while Swissblock research pointed to similar patterns in April when gold

fell 5% over three days before Bitcoin rallied from its macro bottom.

However, this rotation proved short-lived as broader risk-off sentiment

eventually pulled Bitcoin lower.

Gold Technical Analysis

and Price Outlook

After

reaching new all-time highs in the daily chart, gold stalled at resistance

around $4,350 per ounce, which after several sessions of

accumulation triggered dynamic depreciation on Monday with a drop

exceeding 5% to $4,124 per ounce. According to my technical analysis, tuesday

brought continued declines of 1.5% and a test of the psychological $4,000

level. At the time of writing, the metal was changing hands at $4,062, bouncing

slightly from local support defined by the all-time highs from October

8-9.

Gold has

significantly more room for correction, and I would not rule out a descent

toward $3,400, the 200-day exponential moving average, before a

stronger rebound materializes. The $2.1 trillion in market

capitalization erased on Tuesday alone, equivalent to 55% of the entire

cryptocurrency market’s value according to trader Peter Brandt, demonstrates

the magnitude of this correction.

Critical Support and

Resistance Levels

Gold Technical Levels:

- Immediate resistance: $4,200-$4,235 marking

previous consolidation highs - Current price: $4,062 with slight bounce

from October 8-9 ATH support - Psychological support: $4,000 round number

testing investor confidence - Key support zone: $4,035 representing near-term

floor - Bearish invalidation: $3,965 breakdown would

confirm deeper correction - Major correction target: $3,400 aligning with 200-day

EMA

Bitcoin Technical Levels:

- Consolidation resistance: $110,000-$113,000 upper

boundary tested Monday - Current price: $108,342 retesting critical

support zone - Key support: $108,000 coinciding with late

August lows and consolidation floor - Bull trend support: 200-day EMA maintaining

bullish structure - Psychological level: $100,000 major

support if current range breaks

Historical Crash

Comparison: Bitcoin, Gold and Silver

|

Event |

Date |

Decline |

Recovery Time |

Cause |

|

Gold Crash |

August 2020 |

-6.3% |

3 months |

Cyprus |

|

Gold Crash |

Oct 21, 2025 |

-5.6% |

TBD |

Profit-taking, dollar strength |

|

Silver Crash |

Feb 2021 |

-8.7% |

6 weeks |

Reddit squeeze unwind |

|

Bitcoin Crash |

Oct 10, 2025 |

-14% |

2 weeks |

Leverage liquidation |

|

Gold Correction |

Aug 2020 |

-5.0% |

4 months |

Post-COVID rally exhaustion |

Bitcoin and Gold Price

Analysis, Frequently Asked Questions

Why did gold crash 5%

on October 21, 2025?

Gold

crashed 5-6% due to profit-taking after a 60% rally in 2025, combined with

a stronger US dollar, easing US-China trade tensions, and

technical correction from overbought conditions following $34.2 billion in

precious metals inflows over ten weeks.

When was the last time

gold fell this much in one day?

The last

time gold experienced a comparable or larger single-day decline was August 2020,

when it dropped 5.7% during the Cyprus banking crisis and Federal Reserve

tapering concerns.

Why is Bitcoin

falling with gold?

Bitcoin

fell alongside gold because the correlation between the two assets reached

0.85, near the all-time high of 0.9, causing synchronized selling

pressure as investors treated both as linked safe-haven assets.

Is the gold rally

over?

Analysts view

this as a technical correction rather than the end of the bull market,

with gold potentially correcting toward $3,400 (the 200-day EMA) before

resuming its uptrend, though the rally’s pace needed to slow from unsustainable

levels.

Why Bitcoin is crashing?

Bitcoin

remains in a technical bull trend as long as the 200-day EMA

holds as support around $108,000, though a breakdown below this level

would open the path to testing $100,000 psychological support before

a potential recovery.

What caused silver to

drop 8.7%?

Silver

crashed 8.7% in its worst day since February 2021 due to the same

factors affecting gold—profit-taking, dollar strength, and easing

geopolitical tensions—amplified by silver’s higher volatility and smaller

market size.

Gold price experienced

its most severe single-day collapse in over five years this week, plunging more

than 5% from record highs and dragging Bitcoin (BTC) lower in a synchronized

selloff that erased billions in market capitalization.

The

precious metal fell from Monday’s all-time peak of $4,381 per ounce to an

intraday low of $4,082, marking the steepest decline since August 2020’s 5.7%

crash. Bitcoin simultaneously dropped over 2%, falling from $110,000

levels to test critical support at $108,000 as the correlation between

digital and physical safe-haven assets reached 0.85.

The gold

crash followed an unsustainable rally that saw

prices surge 60% throughout 2025 and 25% in just the previous two

months, creating what analysts described as “stratosphere” conditions

ripe for correction.

Standard

Chartered analyst Suki Cooper characterized the movement as a “technical

correction” after record-breaking precious metals inflows totaling

$34.2 billion over ten weeks pushed the market into severely overbought

territory. Bart Melek, global head of commodity strategy at TD Securities,

confirmed dealers were “realizing gains after a strong

rally” that proved unsustainable long-term.

Profit-taking

accelerated as

the US dollar index strengthened 0.4%, making gold more expensive for

international buyers and reducing its appeal against competing assets. The

timing coincided with renewed optimism over US-China trade negotiations, with

President Trump expressing confidence about reaching a deal with Chinese

President Xi Jinping at their scheduled meeting. This easing of geopolitical

tensions diminished safe-haven demand that had propelled gold to consecutive

record highs.

Physical

demand also weakened following the conclusion of the Diwali festival in India,

the world’s second-largest gold consumer, removing a significant source of

buying pressure. Silver crashed even harder at 8.7% in its

worst single-day drop since February 2021, while platinum fell 5-7%,

confirming the broad-based precious metals correction.

Why Bitcoin Price Is Going

Down Today?

Bitcoin’s

decline mirrored gold’s weakness as the strengthening correlation

between the two assets, currently at 0.85, near the all-time high of 0.9

reached in April 2024, caused synchronized selling pressure. The cryptocurrency

ended Tuesday’s session at $108,342, dropping over 2% and retesting local

support around the $108,000 level that coincides with late August lows and

marks the lower boundary of the months-long consolidation range.

From my

technical analysis of Bitcoin’s chart, the price attempted to strengthen

on Monday before ultimately pulling back sharply in direct reaction to

gold’s crash. Bitcoin tested the critical support zone around $108,000,

which aligns with late August lows and represents the lower boundary of the

consolidation drawn since mid-October.

Importantly,

the 200-day exponential moving average continues to provide support,

meaning we remain technically in a bull trend. However, a breakdown below

this range would open the door to further declines and a test of the

$100,000 level, a major psychological support zone.

Paul Howard

from Wincent noted that “many analysts follow technical trends

including M2 money supply, gold, stock2flow models plus other metrics as

ways to predict Bitcoin’s next move. Arguably many now indicate a big

upswing and with so many leveraged longs and shorts liquidated, and a positive

global macro environment may see Bitcoin as a gold laggard”. The

comment highlights how Bitcoin’s underperformance relative to gold’s

earlier rally may reverse following the liquidation cleanup.

Please also check my previous articles including Bitcoin and gold price predictions:

Key Market Indicators for

Gold and Bitcoin

|

Metric |

Value |

Change |

Significance |

|

Gold Price (Oct 22) |

$4,082 |

-5.6% |

Worst drop since August 2020 |

|

Bitcoin Price (Oct 22) |

$108,342 |

-2.1% |

Testing August support levels |

|

Silver Price |

$51.89 |

-8.7% |

Worst drop since February 2021 |

|

Gold-Bitcoin Correlation |

0.85 |

Near ATH |

Explaining synchronized selloff |

|

US Bitcoin ETF Flows |

-$40.47M |

Outflows |

Institutional caution |

|

Crypto Market Cap |

$3.76T |

-2.3% |

Broad-based decline |

Gold-Bitcoin Correlation

Drives Synchronized Selloff

The

increasingly tight correlation between gold and Bitcoin, rising from

negative 0.8 in October 2021 to current levels of 0.85, explains why

both assets experienced simultaneous pressure.

Mostafa

Al-Mashita, Co-founder & Director of Sales and Trading at Secure

Digital Markets, provided exclusive analysis: “Gold’s loss of neutrality

and Bitcoin’s rise as a borderless asset mark a fundamental shift in

global value dynamics. The recent gold sell-off, though expected after an

extended rally, underscores how traditional havens are becoming tools

of policy rather than stores of neutrality”.

He

continued: “Nations like China, India, and Turkey are stockpiling gold

to reduce reliance on the US dollar, turning it into a geopolitical

instrument tied to state agendas. Bitcoin, though increasingly adopted by

institutions and states, remains structurally decentralized and resistant to

control. It signals economic independence while functioning as both a

volatile trading vehicle and a modern store of value. This isn’t simply

gold versus Bitcoin; it’s a broader reallocation of trust, with

governments asserting sovereignty through gold and individuals and institutions

seeking autonomy through Bitcoin”.

Initially

on Tuesday, Bitcoin actually surged as gold crashed, briefly jumping above

$113,000 as traders rotated capital from precious metals into crypto. Analyst

Ash Crypto declared “the rotation from gold to Bitcoin has begun,”

while Swissblock research pointed to similar patterns in April when gold

fell 5% over three days before Bitcoin rallied from its macro bottom.

However, this rotation proved short-lived as broader risk-off sentiment

eventually pulled Bitcoin lower.

Gold Technical Analysis

and Price Outlook

After

reaching new all-time highs in the daily chart, gold stalled at resistance

around $4,350 per ounce, which after several sessions of

accumulation triggered dynamic depreciation on Monday with a drop

exceeding 5% to $4,124 per ounce. According to my technical analysis, tuesday

brought continued declines of 1.5% and a test of the psychological $4,000

level. At the time of writing, the metal was changing hands at $4,062, bouncing

slightly from local support defined by the all-time highs from October

8-9.

Gold has

significantly more room for correction, and I would not rule out a descent

toward $3,400, the 200-day exponential moving average, before a

stronger rebound materializes. The $2.1 trillion in market

capitalization erased on Tuesday alone, equivalent to 55% of the entire

cryptocurrency market’s value according to trader Peter Brandt, demonstrates

the magnitude of this correction.

Critical Support and

Resistance Levels

Gold Technical Levels:

- Immediate resistance: $4,200-$4,235 marking

previous consolidation highs - Current price: $4,062 with slight bounce

from October 8-9 ATH support - Psychological support: $4,000 round number

testing investor confidence - Key support zone: $4,035 representing near-term

floor - Bearish invalidation: $3,965 breakdown would

confirm deeper correction - Major correction target: $3,400 aligning with 200-day

EMA

Bitcoin Technical Levels:

- Consolidation resistance: $110,000-$113,000 upper

boundary tested Monday - Current price: $108,342 retesting critical

support zone - Key support: $108,000 coinciding with late

August lows and consolidation floor - Bull trend support: 200-day EMA maintaining

bullish structure - Psychological level: $100,000 major

support if current range breaks

Historical Crash

Comparison: Bitcoin, Gold and Silver

|

Event |

Date |

Decline |

Recovery Time |

Cause |

|

Gold Crash |

August 2020 |

-6.3% |

3 months |

Cyprus |

|

Gold Crash |

Oct 21, 2025 |

-5.6% |

TBD |

Profit-taking, dollar strength |

|

Silver Crash |

Feb 2021 |

-8.7% |

6 weeks |

Reddit squeeze unwind |

|

Bitcoin Crash |

Oct 10, 2025 |

-14% |

2 weeks |

Leverage liquidation |

|

Gold Correction |

Aug 2020 |

-5.0% |

4 months |

Post-COVID rally exhaustion |

Bitcoin and Gold Price

Analysis, Frequently Asked Questions

Why did gold crash 5%

on October 21, 2025?

Gold

crashed 5-6% due to profit-taking after a 60% rally in 2025, combined with

a stronger US dollar, easing US-China trade tensions, and

technical correction from overbought conditions following $34.2 billion in

precious metals inflows over ten weeks.

When was the last time

gold fell this much in one day?

The last

time gold experienced a comparable or larger single-day decline was August 2020,

when it dropped 5.7% during the Cyprus banking crisis and Federal Reserve

tapering concerns.

Why is Bitcoin

falling with gold?

Bitcoin

fell alongside gold because the correlation between the two assets reached

0.85, near the all-time high of 0.9, causing synchronized selling

pressure as investors treated both as linked safe-haven assets.

Is the gold rally

over?

Analysts view

this as a technical correction rather than the end of the bull market,

with gold potentially correcting toward $3,400 (the 200-day EMA) before

resuming its uptrend, though the rally’s pace needed to slow from unsustainable

levels.

Why Bitcoin is crashing?

Bitcoin

remains in a technical bull trend as long as the 200-day EMA

holds as support around $108,000, though a breakdown below this level

would open the path to testing $100,000 psychological support before

a potential recovery.

What caused silver to

drop 8.7%?

Silver

crashed 8.7% in its worst day since February 2021 due to the same

factors affecting gold—profit-taking, dollar strength, and easing

geopolitical tensions—amplified by silver’s higher volatility and smaller

market size.

Search

RECENT PRESS RELEASES

Live: Crypto Market Continues Decline as Bitcoin Holds Near $108,000 on Oct. 22

SWI Editorial Staff2025-10-22T04:46:23-07:00October 22, 2025|

Crypto Goes Mainstream: Fed Governor Admits Bitcoin is Now Part of the Financial Fabric

SWI Editorial Staff2025-10-22T04:46:02-07:00October 22, 2025|

Crypto Goes Mainstream: Fed Governor Admits Bitcoin is Now Part of the Financial Fabric

SWI Editorial Staff2025-10-22T04:45:48-07:00October 22, 2025|

Why Gold Price Is Falling the Most Since 2020? The Crash Is Dragging Bitcoin Down Too

SWI Editorial Staff2025-10-22T04:45:37-07:00October 22, 2025|

Why Gold Price Is Falling the Most Since 2020? The Crash Is Dragging Bitcoin Down Too

SWI Editorial Staff2025-10-22T04:45:21-07:00October 22, 2025|

People Moves: Pyfrom Named Starwind Cannabis EVP of Sales and Distribution; Golden Bear Ad

SWI Editorial Staff2025-10-22T04:45:04-07:00October 22, 2025|

Related Post