Ethereum’s $660 Million Whale Push Meets a Wall of Doubt — What’s Next For The Price

October 23, 2025

Ethereum’s price has been quiet, hovering near $3,875, down 3.7% this week and showing little follow-through after last week’s selloff. Yet behind the calm, some of the biggest wallets have started buying again.

Roughly $660 million in whale accumulation has rekindled optimism that ETH might be setting up for a rebound — but not everyone is convinced.

SponsoredSponsored

On-chain data shows that between October 21 and October 23, Ethereum whales added roughly 170,000 ETH, lifting their collective stash from 100.30 million to 100.47 million ETH. At the current Ethereum price, that’s about $660 million worth of new accumulation — one of the biggest 48-hour whale upticks this month.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

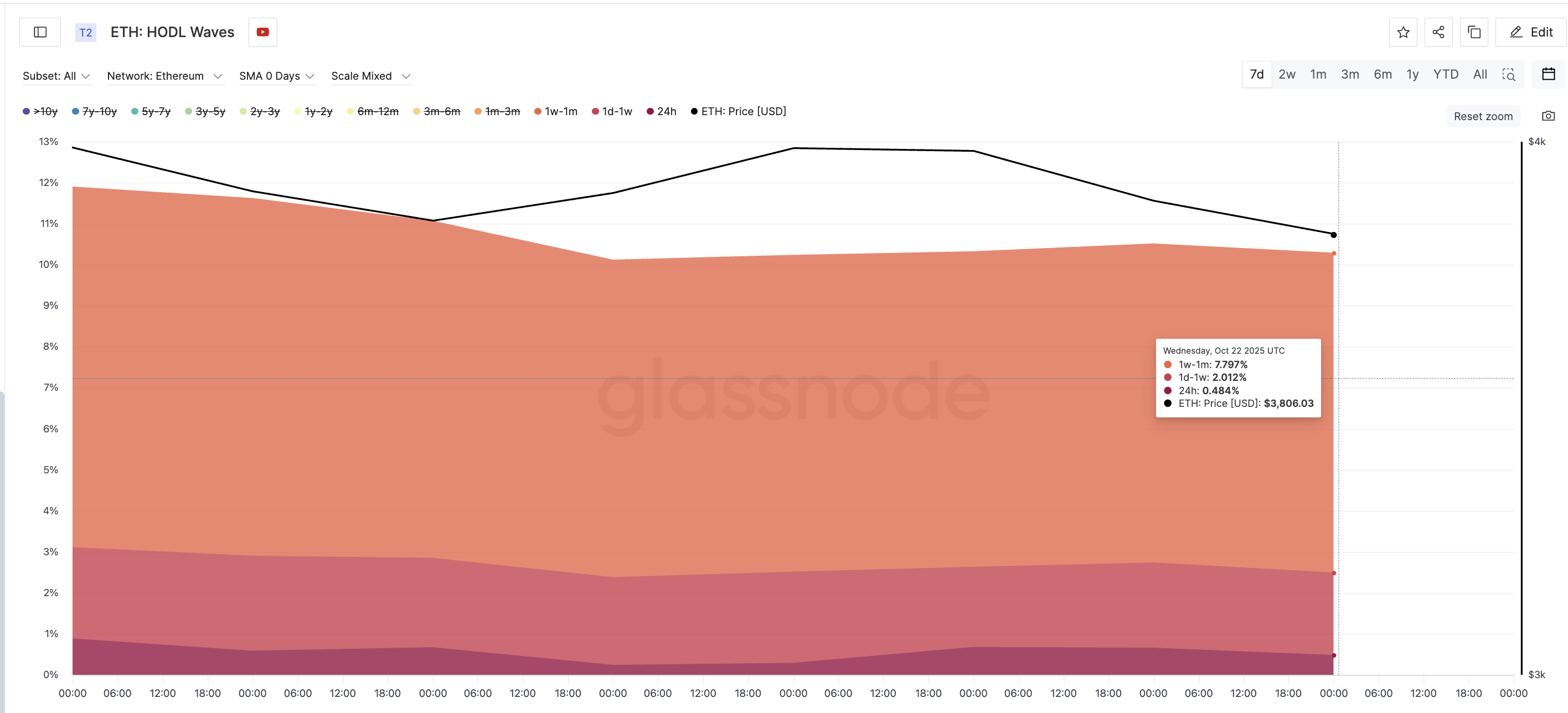

But while large wallets have stepped in, short-term holders have been heading the other way. According to HODL Waves, which shows how long different groups of wallets hold their coins, three fast-moving cohorts have all reduced their share of supply since mid-October:

- 24-hour holders: down from 0.887% to 0.48%

- 1-day–1-week holders: down from 2.22% to 2.01%

- 1 week–1 month holders: down from 8.79% to 7.79%

SponsoredSponsored

The pattern is clear: whales are buying, but short-term traders are selling into every rally (the wall of doubt). This push-pull dynamic is keeping Ethereum stuck in a narrow range, preventing the inflows from translating into higher prices. Until these smaller holders regain confidence, whale demand alone might not be enough to spark a full Ethereum price rebound.

Despite the pressure, Ethereum’s technical structure remains supportive. On the daily chart, ETH has formed lower lows between September 25 and October 22, while the Relative Strength Index (RSI) — which measures price momentum — has formed higher lows over the same period. This bullish divergence often hints that selling is losing steam, even before a reversal begins.

ETH is also trading inside an ascending triangle, a pattern that typically resolves upward once resistance levels (triangle bases) are cleared. The key ETH price zones to watch now are $3,989 and $4,137, both aligned with important Fibonacci retracement levels. Each resistance level breach would therefore mean a triangle breakout.

For Ethereum’s rebound to take shape, a daily close (breakout) above $4,137 might be the key. That’s roughly a 7% move from current levels, which ETH would need to confirm breakout strength. If successful, ETH could then target $4,495 or even $4,950 in the following weeks.

However, failure to hold $3,806 could send ETH down to $3,511 or $3,355. That would even invalidate the bullish setup and revive broader bearish pressure.

Search

RECENT PRESS RELEASES

Related Post