BitMine Has Some Competitor As Ark-Backed Firm Accumulates More Ethereum (ETH)

October 23, 2025

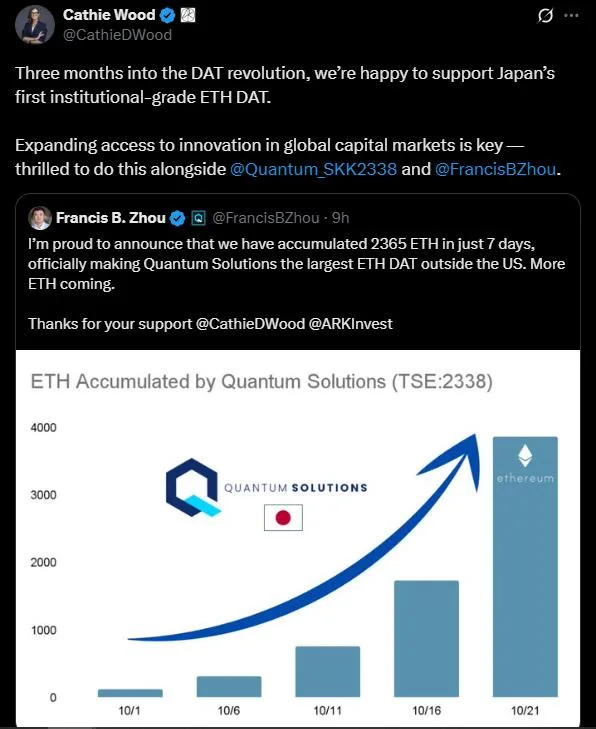

Ethereum continues to attract institutional buyers, and Japan’s Quantum Solutions is now leading the charge. The company, backed by ARK Invest, has become the largest Ethereum treasury holder among publicly listed firms in Japan after buying 2,365 ETH in just one week.

The purchase, worth roughly $9 million, brings Quantum Solutions’ total holdings to about 3,866 ETH, valued at $14.8 million.

Ethereum is at the centre of Quantum Solutions’ digital asset strategy. According to its latest statement, the company intends to keep accumulating Ethereum to diversify its holdings and reinforce its balance sheet.

“Ethereum is the primary focus of our digital asset strategy,” Quantum Solutions said in its official announcement. “We will continue to build our reserves as we expand in the blockchain and digital asset sectors.”

The company’s rising confidence in ETH shows a trend among Asian corporations that have been integrating crypto into their financial structures.

Publicly listed firms in Japan are showing greater interest in blockchain-based assets, even as markets in Hong Kong, India, and Australia tighten regulations on digital asset treasuries.

ARK Invest, led by Cathie Wood was one of the firms that supported Quantum Solutions’ recent $180 million fundraising round in September.

The funding aims to help the company build a 100,000 ETH treasury and advance its presence in the digital asset market.

Quantum Solutions is backed by Cathie Wood and Ark Invest | source: X

Wood described Quantum Solutions as Japan’s first institutional-grade Ethereum digital asset treasury. She further mentioned that ARK Invest is excited to back such innovation in the region.

ARK also recently invested in BitMine, the world’s largest Ether DAT and this collaboration strengthens the link between traditional investment firms and digital asset companies.

Quantum Solutions’ Hong Kong subsidiary, GPT Pals Studio, led the latest round of ETH purchases.

The company financed the purchase using a mix of external borrowings and proceeds from financial instruments like convertible bonds and stock acquisition rights.

Quantum Solutions currently holds 11.6 BTC worth around $1.3 million. This is a smaller portion of its overall treasury, and the company says the focus will remain on Ethereum because of its importance to defi and tokenisation.

The digital asset treasury (DAT) market around the world has cooled slightly after months of excitement. Share prices of some large crypto-holding firms have slipped, and are leading to questions about whether the DAT boom is slowing down.

Tom Lee, who chairs BitMine, recently questioned if the “DAT bubble” had popped. However, he has also been buying aggressively after recent market dips. This means that he has continued faith in the long-term value of this market.

Quantum Solutions seems to share that confidence. Its leadership has said that Ethereum is an important part of its business plan, despite short-term price.

Search

RECENT PRESS RELEASES

Related Post