3 Quantum Computing Stocks That Could Be Once-in-a-Lifetime Investment Opportunities

October 26, 2025

Quantum computing stocks have been on a tear over the past few weeks.

The quantum computing arms race isn’t something that’s years out. It’s heating up right now, and there are several companies announcing promising breakthroughs.

While we’re still a few years away from widespread commercial deployment, that could be accelerated as quantum computing companies start to announce more accurate computers that can be applied to real-world problems. This could allow investors to learn lessons from the AI arms race and apply them to the quantum computing one.

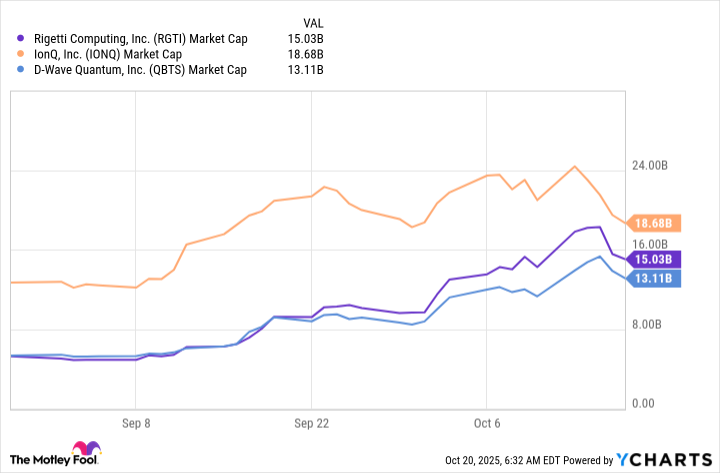

Three stocks that have the potential to turn into monster winners are IonQ (IONQ +1.55%), Rigetti Computing (RGTI 1.92%), and D-Wave Quantum (QBTS +5.05%). All three of these stocks have gone on epic runs since the start of September, but is there still room to run even following their run-ups?

Image source: Getty Images.

All three quantum computing companies are taking a different approach

Quantum computing can be performed using multiple techniques. The idea is to harness the quantum mechanics of a particle to perform calculations, but how each company does it is completely different. However, the problem each company is trying to solve is the same: computing accuracy.

Right now, each company competing in this space is working on this goal as it’s holding quantum computing back from being a viable alternative to traditional computing methods. IonQ is the current leader in this space, with a two-qubit gate fidelity of 99.97% — a current world record. This means that when a calculation must pass through two processing gates, there’s a three in 10,000 chance of the calculation producing an error.

Today’s Change

(1.55%) $0.92

Current Price

$60.29

While that may sound impressive, it’s not good enough to compete with traditional computers. IonQ has achieved this through its trapped ion technology, which can be done at room temperature. This technique is inherently more accurate, but it comes at the cost of processing speed.

Rigetti Computing uses the most common technique, known as superconducting. This requires cooling a particle down to near absolute zero, which is an expensive process. However, superconducting qubits yield the fastest processing speeds, which could separate Rigetti from the competition once the accuracy issue is solved. However, Rigetti is already seeing some use cases, as it sold two of its Novera quantum computing systems for $5.7 million total during September.

Lastly, there is D-Wave Quantum, which takes a different approach altogether. They’re exploring quantum annealing, which can be used for optimization problems like AI models, logistics networks, and statistical calculations. This locks D-Wave’s technology into specific use cases, rather than a general-purpose quantum computer that IonQ and Rigetti are pursuing.

D-Wave Quantum

Today’s Change

(5.05%) $1.57

Current Price

$32.63

However, if D-Wave can make a viable quantum computer that’s purpose-built for a handful of industries that are expected to be the lion’s share of quantum computing demand, then its approach makes perfect sense.

All three of these quantum computing companies have compelling investment theses, but the industry could be a winner-take-all scenario, where one (or none) of these stocks pans out. With the massive run-up that these three experienced, is there still room to run?

The quantum computing market is set to explode by 2030

Nearly every company competing in quantum computing agrees that 2030 is set to be a pivotal year for the technology. Rigetti predicts that the annual value for quantum computing before 2030 is $1 billion to $2 billion. After that, the annual market value could be $15 billion to $30 billion between 2030 and 2040. That’s a large potential market, but is it enough for all three to be successful picks?

Rigetti Computing

Today’s Change

(-1.92%) $-0.76

Current Price

$38.84

Let’s say that all three of these companies produce viable solutions and capture a 20% market share by 2035, when the annual value reaches $30 billion. If that occurs, each company would generate around $6 billion in sales. If each company could generate a 30% profit margin and trade for 30 times earnings, that would price each stock with a market cap of about $54 billion. That would result in each stock tripling to quadrupling over the next decade.

RGTI Market Cap data by YCharts

However, there’s no guarantee of success here, so there’s a ton of risk involved in the stocks. I think investors can be a bit patient and wait for these three to cool off a bit. Then, you can scoop up shares for a cheaper price and get even better long-term returns. The quantum computing revolution is coming, and investors need to have some exposure, but after the massive run these stocks have been on, it may be good to wait for a month or two.

Search

RECENT PRESS RELEASES

Related Post