Strategy Inc (MSTR) Q3 2025 Earnings Call Highlights: Record Bitcoin Holdings and Strong .

October 30, 2025

This article first appeared on GuruFocus.

-

Bitcoin Holdings: 640,808 Bitcoin, representing over 3% of all Bitcoin ever to exist.

-

Market Cap: $83 billion.

-

Capital Raised Year-to-Date: $19.8 billion.

-

Q3 2025 Operating Income: $3.9 billion.

-

Q3 2025 Net Income: $2.8 billion.

-

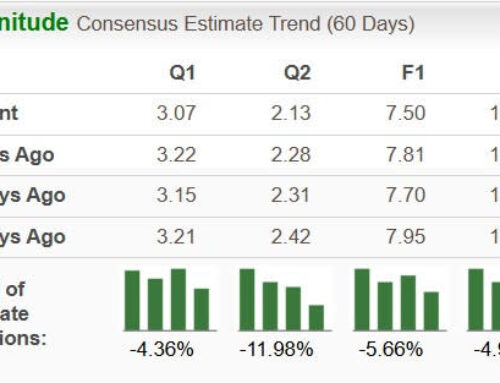

Q3 2025 Earnings Per Share (EPS): $8.43.

-

First Nine Months 2025 Operating Income: $12 billion.

-

First Nine Months 2025 Net Income: $8.6 billion.

-

First Nine Months 2025 EPS: $27.80.

-

Bitcoin Per Share (October 26, 2025): 41,370 Satoshi’s.

-

Year-to-Date BTC Yield: 26%.

-

Year-to-Date BTC Gain: 116,555 BTC.

-

Bitcoin Holdings Value (Q3 2025): $73.2 billion.

-

Enterprise Value (October 24, 2025): $98 billion.

-

Total Notional Debt: $8.2 billion.

-

Total Annual Interest and Dividend Obligations: $689 million.

-

Convertible Debt: $8.2 billion with a weighted average maturity of 4.4 years.

-

Preferred Equity Value (October 24, 2025): $6.7 billion.

-

Annual Dividend Rate for Stretch (Effective November 1, 2025): 10.5%.

-

2025 Earnings Guidance: Operating income target of $34 billion, net income target of $24 billion, EPS target of $80.

Release Date: October 30, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

-

Strategy Inc (NASDAQ:MSTR) holds 640,808 Bitcoin, representing over 3% of all Bitcoin ever to exist, reinforcing its position as a dominant corporate Bitcoin treasury.

-

The company reported $3.9 billion in operating income and $2.8 billion in net income for Q3 2025, with earnings of $8.43 per share, marking a significant year-over-year improvement.

-

Strategy Inc has raised $19.8 billion in capital year-to-date to acquire more Bitcoin, demonstrating strong capital market engagement and investor interest.

-

The company achieved a 26% BTC yield year-to-date, reflecting disciplined capital deployment and strengthening of its Bitcoin balance sheet.

-

Strategy Inc’s adoption of fair value accounting has added approximately $18 billion to its digital assets, enhancing transparency and shareholder equity.

-

The company’s strategy heavily relies on Bitcoin price fluctuations, which can introduce significant volatility and risk to its financial performance.

-

Despite strong earnings, Strategy Inc’s focus on Bitcoin may limit its appeal to investors seeking diversified asset exposure.

-

The company faces challenges in achieving its 30% BTC yield target for 2025, requiring additional capital raises in a short timeframe.

-

Strategy Inc’s high leverage and amplification strategy could pose risks if market conditions deteriorate or if Bitcoin prices decline significantly.

-

The company’s ambitious international expansion plans face regulatory hurdles and complexities, which could delay or complicate execution.

Q: Can you shed some light on plans to fund dividends, especially if MNAV compresses or falls below 1? A: Phong Le, CEO, explained that the company currently funds dividends and interest through ATM issuances, having raised $27 billion in equity over the past 12 months. If MNAV falls below 1, they could sell equity derivatives, Bitcoin derivatives, or high basis Bitcoin to cover dividends while preserving tax-deferred treatment for preferreds.

Q: What are the anticipated expenses and ROI for marketing and advertising around preferreds? A: Phong Le mentioned that initial expenses would be minimal compared to potential inflows from preferreds. They plan to experiment with digital marketing and engage in direct outreach to investors. Michael Saylor added that they are leveraging media appearances to promote their offerings.

Q: Would Strategy Inc consider acquiring a Bitcoin treasury company trading at a lower MNAV? A: Michael Saylor stated that while they focus on transparent digital transactions and selling digital credit, they have no current plans for M&A activity. The management prefers to focus on selling credit instruments and improving the balance sheet.

Q: Are you considering tapping international markets for capital raising, and would you design new instruments for those markets? A: Michael Saylor confirmed they would design native instruments for each market, such as CAD-denominated products for Canada or EUR-denominated for Europe, to avoid currency risk for investors.

Q: Beyond Bitcoin price action, what challenges are headwinds for Strategy Inc and the Bitcoin treasury industry? A: Michael Saylor highlighted the need for Bitcoin to be recognized as capital by credit rating agencies and the importance of banking acceptance for custody and credit. Educating banks, insurance companies, and investors about Bitcoin’s potential is crucial for industry growth.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post