AMZN, NFLX, AAPL, RDDT, COIN: 5 Trending Stocks Today

October 30, 2025

On Thursday, major U.S. indexes closed lower, with the Dow Jones Industrial Average slipping 0.2% to 47,522.12, the S&P 500 falling nearly 1% to 6,822.34, and the Nasdaq dropping about 1.6% to 23,581.14.

These were the stocks that drew the most attention from retail traders and investors throughout the day.

Amazon’s stock fell by 3.23%, closing at $222.86. The stock reached an intraday high of $228.44 and a low of $222.75, with a 52-week range of $242.52 to $161.43. The stock shot up 13.16% to $252.18 in the after-hours session.

The ecommerce giant reported third-quarter net sales of $180.2 billion, surpassing the consensus estimate of $177.8 billion. Amazon continues to show strong growth, with AWS experiencing its fastest pace since 2022.

Netflix shares dipped 1.04% to close at $1,089. The stock’s intraday high was $1,106.16, while the low was $1,088.11, and its 52-week range is $1,341.15 to $748. The shares rose 3.2% to $1,123.97 in extended trading.

The company announced a 10-for-1 stock split, causing shares to rise in extended trading. This move is aimed at making the stock more accessible to a broader range of investors.

Apple’s stock climbed 0.63%, closing at $271.40, with an intraday high of $274.14 and a low of $268.48. The stock hit a 52-week high of $274.14, with a low of $169.21. The stock rose 2.3% to $277.75 in the after-hours session.

The tech giant reported fourth-quarter revenue of $102.47 billion, exceeding analyst estimates of $102.17 billion. Apple has consistently outperformed expectations for 11 consecutive quarters. Product revenue was recorded at $73.72 billion, while services revenue was at $28.75 billion. “Apple is very proud to report a September quarter revenue record of $102.5 billion, including a September quarter revenue record for iPhone and an all-time revenue record for Services,” said CEO Tim Cook.

Reddit’s stock dropped 7.76%, closing at $194.42. The stock’s intraday high was $209.47, with a low of $193.81, and its 52-week range is $282.95 to $79.75. Reddit shares rose sharply in the after-hours session, gaining 10.2% to $214.26.

The company reported third-quarter earnings of 80 cents per share, significantly beating the analyst estimate of 52 cents. Reddit also surpassed revenue expectations, reporting $585 million, which was higher than the consensus estimate of $545.71 million.

Coinbase’s stock fell 5.77%, closing at $328.51. The stock reached an intraday high of $344.22 and a low of $328.21, with a 52-week range of $444.65 to $142.58. The stock rose 3.6% to $340.36 in extended trading.

The company reported third-quarter earnings of $1.44 per share, beating the analyst estimate of $1.11. Coinbase continues to show strong financial performance.

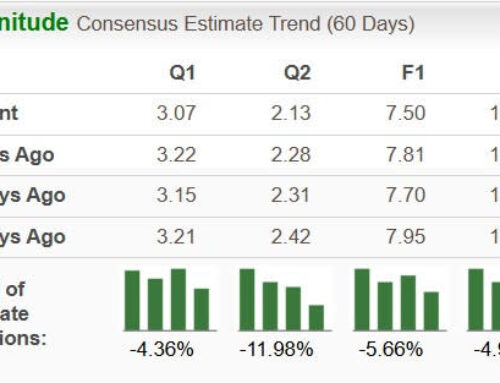

Benzinga’s Edge Stock Rankings indicate Amazon has a Momentum in the 70th percentile. Here is how the stock is placed against ecommerce rivals.

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Photo Courtesy: vectorfusionart on Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Search

RECENT PRESS RELEASES

Related Post