XRP, Bitcoin, Ethereum Extend Losses Despite ETF Boost But Dogecoin Defies The Drop

November 7, 2025

Bitcoin ETFs saw $240 million in inflows on Thursday, ending a $2 billion outflow streak since late October.

- Ethereum ETFs also reversed course with $12.5 million in inflows after six straight days of losses.

- Bitcoin traded near $100,700, down 2.4% in the last 24 hours, while Ethereum slipped 3.4%.

- XRP led losses among major tokens, dropping by more than 5%, while Dogecoin was the only top-10 token to gain.

Ripple’s XRP (XRP) led losses, while Dogecoin (DOGE) was the only gainer among major tokens in early morning trade on Friday, even as Bitcoin (BTC) spot ETFs ended a six-day outflow streak.

According to SoSoValue data, spot BTC ETFs saw $240 million in inflows on Thursday, breaking a streak of outflows that began on October 29 and totaled more than $2 billion. Ethereum (ETH) spot ETFs also rebounded, drawing $12.5 million in inflows after six consecutive days of outflows amounting to nearly $1 billion.

Bitcoin and Ethereum, however, struggled to maintain their gains on Thursday as the cryptocurrency market continued to slow down. Bitcoin’s price dipped 2.4% in the last 24 hours, trading at around $100,700. On Stocktwits, retail sentiment around the apex cryptocurrency trended in ‘neutral’ territory even as chatter remained at ‘high’ levels over the past day.

Meanwhile, Ethereum’s price fell 3.4% in the last 24 hours, trading at around $3,280. Retail sentiment around the leading altcoin on Stockwits also trended in ‘neutral’ territory, accompanied by ‘high’ levels of chatter over the past day.

The overall cryptocurrency market declined by nearly 2% over the last 24 hours, with its market capitalization dropping to $3.4 trillion. According to CoinGlass data, the market saw nearly $660 million in liquidations, with $450 million from long bets and $208 million from short positions.

According to JPMorgan analyst Nikolaos Panigirtzoglou, Bitcoin could climb to $170,000 over the next six to 12 months, as it remains undervalued compared to gold following October’s record $1.9 billion liquidation event.

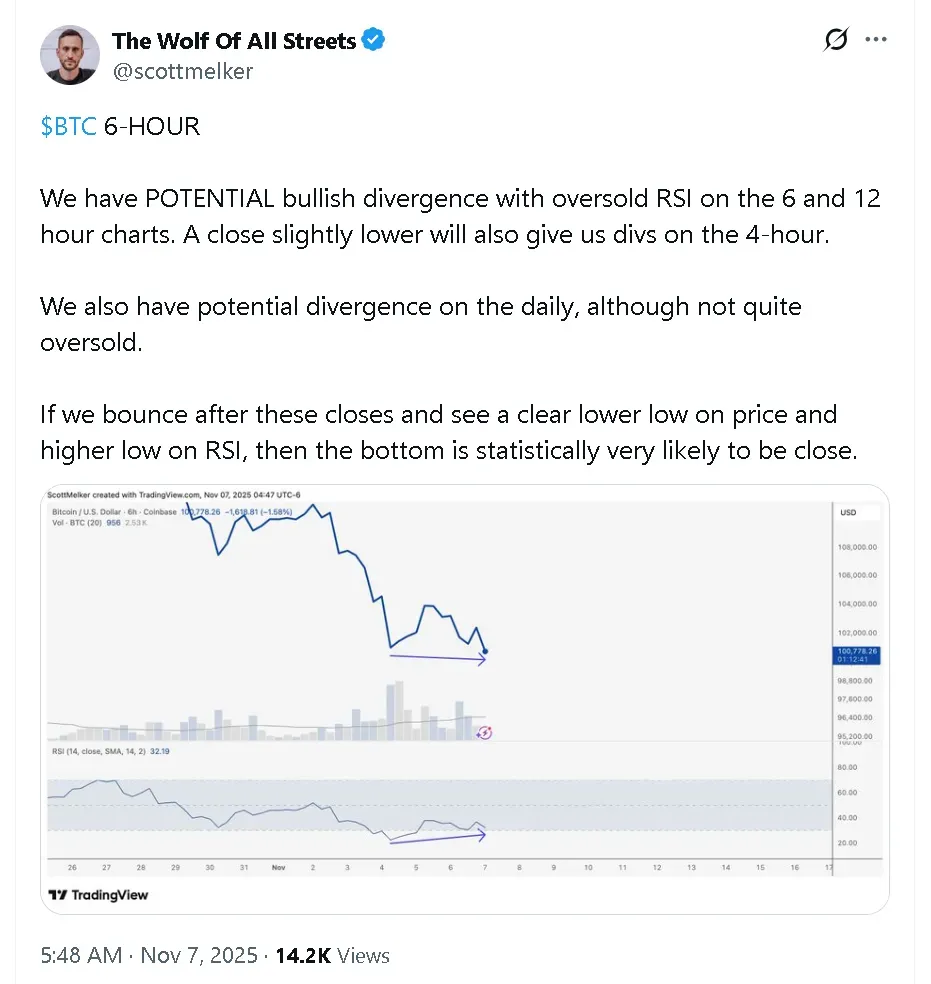

Crypto analyst Scott Melker, known online as the ‘Wolf of All Streets,’ suggested Bitcoin may be nearing a short-term bottom. In a post on X, he said the Relative Strength Index (RSI) indicates that selling pressure is easing, and a bounce could confirm a potential reversal.

Standard Chartered’s head of digital asset research, Geoffrey Kendrick, offered a more cautious view, saying a drop below $100,000 appears “inevitable” but could mark “the last-ever chance” to buy Bitcoin under six figures.

In contrast, gold advocate Peter Schiff reiterated that Bitcoin remains “ridiculously overpriced.” “The opportunity to sell Bitcoin above $100,000 won’t be available much longer,” he said in a post on X.

Among the top 10 cryptocurrencies by market capitalisation, XRP led losses. XRP’s price dipped more than 5% in the last 24 hours, trading at around $2.20. However, retail sentiment around Ripple’s native token improved to ‘bullish’ from ‘neutral’ over the past day on Stocktwits.

Solana (SOL) dropped 2.9%, while Binance Coin (BNB) and Cardano (ADA) posted marginal losses of 0.3% and 0.1%, respectively.

Dogecoin’s price, meanwhile, gained 1% in the last 24 hours. Retail sentiment around the meme token edged higher on Stocktwits, but remained in the ‘bearish’ zone as chatter increased to ‘normal’ from ‘low’ levels over the past day.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, fell 1.2% in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) edged 0.1% higher. Crypto-exchange Coinbase (COIN) dipped 0.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Search

RECENT PRESS RELEASES

Related Post