Spin-Off Plan and Weaker Guidance Might Change the Case for Investing in Kraft Heinz (KHC)

November 8, 2025

-

In the past week, Kraft Heinz reported mixed third-quarter results, lowered its full-year guidance, and announced plans to spin off into two independent companies by the second half of 2026, while also unveiling collaborations and product launches such as a partnership with Herschel Supply and a limited-time Apple Pie flavored Kraft Mac & Cheese.

-

This combination of operational challenges, updated financial outlook, and a significant company restructuring signals both uncertainty and a shift in the long-term direction for Kraft Heinz.

-

We’ll explore how the planned spin-off and weaker guidance may change Kraft Heinz’s investment narrative and outlook.

Find companies with promising cash flow potential yet trading below their fair value.

To be a Kraft Heinz shareholder today, you have to believe in the company’s ability to successfully execute a major restructuring, revitalize product innovation, and deliver stabilizing volumes amid persistent headwinds. The recent mix of softer guidance and plans to spin off into two companies puts even greater focus on execution risk, a key short-term concern for Kraft Heinz, while potentially redefining what will matter most to near-term performance. This news could intensify scrutiny on management’s ability to manage costs and drive volume recovery, but the overall risk profile remains largely unchanged for now.

Among recent announcements, the company’s decision to lower its full-year guidance directly impacts investor sentiment and expectations for the next several quarters. With organic net sales now expected to fall by as much as 3.5% year over year, the spotlight shifts to whether Kraft Heinz can halt core-market volume declines and overcome ongoing consumer and margin pressures. Meanwhile, performance in North America retail continues to act as a gating factor for growth and could influence the outcome of the planned separation.

However, any optimism must be balanced by awareness of the costly risks if the separation fails to generate value or introduces…

Read the full narrative on Kraft Heinz (it’s free!)

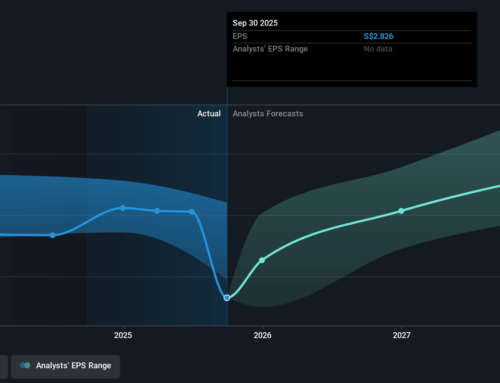

Kraft Heinz is expected to reach $26.1 billion in revenue and $3.3 billion in earnings by 2028. This outlook assumes a 1.0% annual revenue growth rate and a turnaround in earnings, increasing by $8.6 billion from the current $-5.3 billion.

Uncover how Kraft Heinz’s forecasts yield a $28.82 fair value, a 19% upside to its current price.

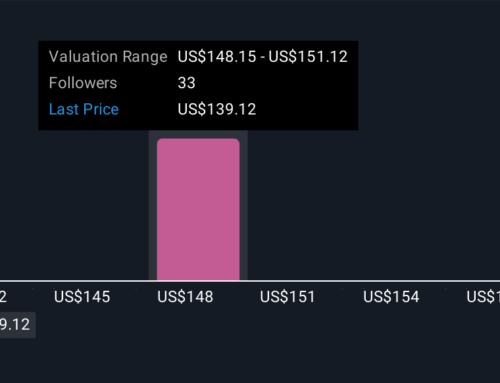

Twenty one fair value forecasts from the Simply Wall St Community range from US$23.95 to US$68.79 per share. Persistent volume declines and weak core market performance remain core issues that could weigh on future returns, highlighting the reasons why market voices can differ so widely.

Explore 21 other fair value estimates on Kraft Heinz – why the stock might be worth just $23.95!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Kraft Heinz research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

-

Our free Kraft Heinz research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Kraft Heinz’s overall financial health at a glance.

Our top stock finds are flying under the radar-for now. Get in early:

-

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

-

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

-

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KHC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Terms and Privacy Policy

Search

RECENT PRESS RELEASES

Related Post