How Investors Are Reacting To Goldman Sachs Group (GS) Q3 Earnings Surge and AI-Driven Exp

November 15, 2025

-

Goldman Sachs reported robust third-quarter earnings in November 2025, with strong revenue growth across Banking & Markets and Asset & Wealth Management, and continued expansion in fixed income offerings and proprietary investments.

-

The company’s ongoing integration of AI-driven automation and technology initiatives, combined with its recent acquisition activities, signals a broader shift toward more efficient, diversified, and resilient sources of income.

-

We’ll examine how Goldman Sachs’ outperformance in its core segments and adoption of AI-driven efficiencies may influence its investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

For investors considering Goldman Sachs, the key thesis centers on the firm’s ability to drive earnings through ongoing innovation, operational efficiency, and a diversified revenue model. The recent third-quarter earnings beat and acceleration in AI-driven automation support this narrative, with short-term catalysts remaining anchored in sustained Banking & Markets strength and asset inflow momentum. At present, these news events have not materially impacted the primary risk: ongoing regulatory uncertainty and potential changes to capital requirements.

Among the recent announcements, the wave of fixed-income offerings stands out as particularly relevant. These issuances align with Goldman’s strategic expansion in global financing and capital-light businesses, which support the current catalyst of revenue growth without significant capital consumption, enhancing stability and earnings potential in the face of changing markets.

Yet, amid these positive signals, investors should remain alert to the possibility of regulatory shifts suddenly driving…

Read the full narrative on Goldman Sachs Group (it’s free!)

Goldman Sachs Group’s outlook anticipates $61.4 billion in revenue and $17.0 billion in earnings by 2028. This scenario is based on a 3.9% annual revenue growth rate and a $2.3 billion earnings increase from current earnings of $14.7 billion.

Uncover how Goldman Sachs Group’s forecasts yield a $802.53 fair value, in line with its current price.

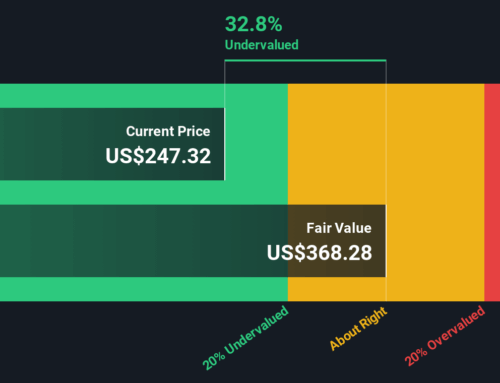

Community estimates for Goldman Sachs’ fair value run from US$498.93 to US$815 across 9 individual perspectives. While many see robust earnings growth as a catalyst, ongoing regulatory risks could alter the company’s earnings trajectory, so explore several different viewpoints before making your own assessment.

Explore 9 other fair value estimates on Goldman Sachs Group – why the stock might be worth as much as $815.00!

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

-

A great starting point for your Goldman Sachs Group research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

-

Our free Goldman Sachs Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Goldman Sachs Group’s overall financial health at a glance.

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

-

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

-

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

-

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include GS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post