Does Amazon Stock Reflect Its AI and Logistics Deals or Is There More Upside Ahead?

November 16, 2025

- Curious if Amazon.com’s stock is a true bargain or has already priced in its best days? You are not alone, and we’re about to dig into what really drives its value.

- Recently, the stock has had a rollercoaster ride, rising 10.2% in the last 30 days but dipping 4.0% over the past week. It is up 6.6% year-to-date and sitting 15.8% above where it was a year ago.

- Amazon’s price swings have been fueled by high-profile partnerships and moves in the AI and logistics spaces, adding fresh momentum and new questions about what its future cash flows will look like. Stories about Amazon expanding one-day delivery and investing in artificial intelligence have caught investor attention and contributed to the latest shifts in sentiment.

- When it comes to valuation, Amazon.com currently scores 5 out of 6 on our undervaluation checks, making it a standout among its peers. Before jumping in, let’s break down the popular ways to value Amazon. Be sure to stick around because we will explore a more insightful approach to valuation by the end of the article.

Find out why Amazon.com’s 15.8% return over the last year is lagging behind its peers.

Advertisement

Approach 1: Amazon.com Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a stock’s value by projecting its future cash flows and discounting them back to today’s value. This approach allows investors to gauge whether the company’s current stock price reflects its actual long-term earning power.

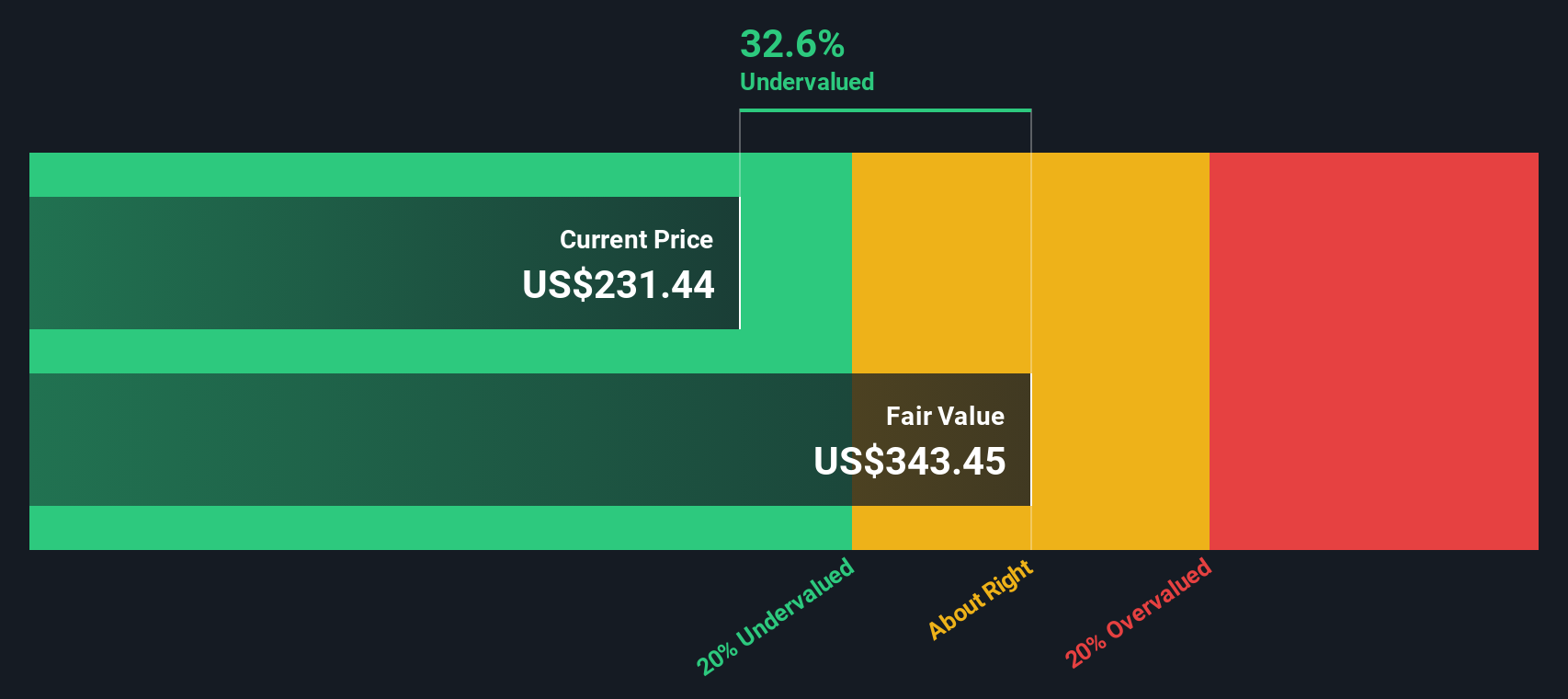

For Amazon.com, the latest reported Free Cash Flow (FCF) stands at $40.04 Billion. Analysts provide forecasts for the next five years, with projections continuing up to ten years via Simply Wall St’s own estimates. By 2029, Amazon’s annual FCF is projected to reach $141.87 Billion. This upward trend highlights high expectations for the company’s ability to continue generating sizable cash flows well into the future.

The DCF model values Amazon stock at $301.81, which is about 22.2% higher than its current market price. This suggests Amazon shares are currently trading below what they might be truly worth, based on the present value of expected future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amazon.com is undervalued by 22.2%. Track this in your watchlist or portfolio, or discover 886 more undervalued stocks based on cash flows.

Approach 2: Amazon.com Price vs Earnings (P/E Ratio)

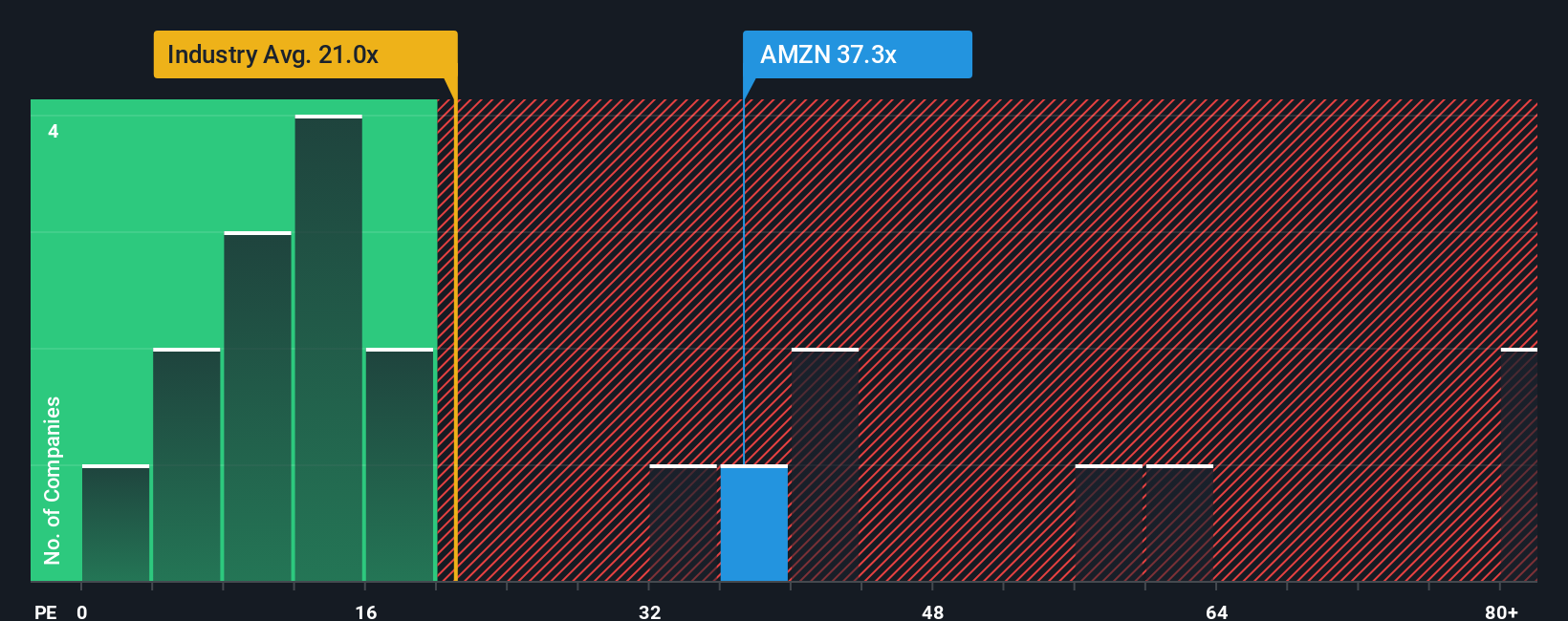

The Price-to-Earnings (P/E) ratio is widely used to value profitable companies like Amazon.com because it relates a company’s stock price directly to its earnings. This makes it a practical gauge of how much investors are willing to pay for each dollar of profits generated by the business.

Growth expectations and risk both play a major role in determining what a “normal” or fair P/E ratio should be. High-growth firms often command higher P/E multiples, while increased risk or low growth prospects can lead to lower ratios compared to market or industry averages.

Amazon.com currently trades at a P/E of 32.8x. Relative to its industry average of 20.3x and the average of its peers at 34.7x, Amazon is priced at a modest premium to the broader market but in line with similar large retailers. However, Simply Wall St’s proprietary Fair Ratio, which analyzes factors like earnings growth, profit margins, market cap, industry risks, and more, suggests a fair value multiple of 36.7x for Amazon. Unlike raw peer or sector comparisons, the Fair Ratio offers a more nuanced view by factoring in what actually drives value for a business of Amazon’s scale and track record.

Because Amazon’s current P/E ratio is just below its Fair Ratio, the stock appears to be trading at around a fair valuation based on this approach.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amazon.com Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful approach that allows you to connect your overall story or perspective about a company, such as your assumptions for future growth, profit margins, and fair value, to a clear financial forecast and fair value estimate.

On Simply Wall St, Narratives make it easy for anyone to personalize their investment viewpoint by creating a dynamic, story-driven fair value directly on the Community page, where millions of investors share these perspectives. By comparing your Narrative’s Fair Value to the current market price, you can confidently decide whether to buy, sell, or hold a stock. Narratives automatically update as company news or earnings emerge to keep your thesis relevant in real time.

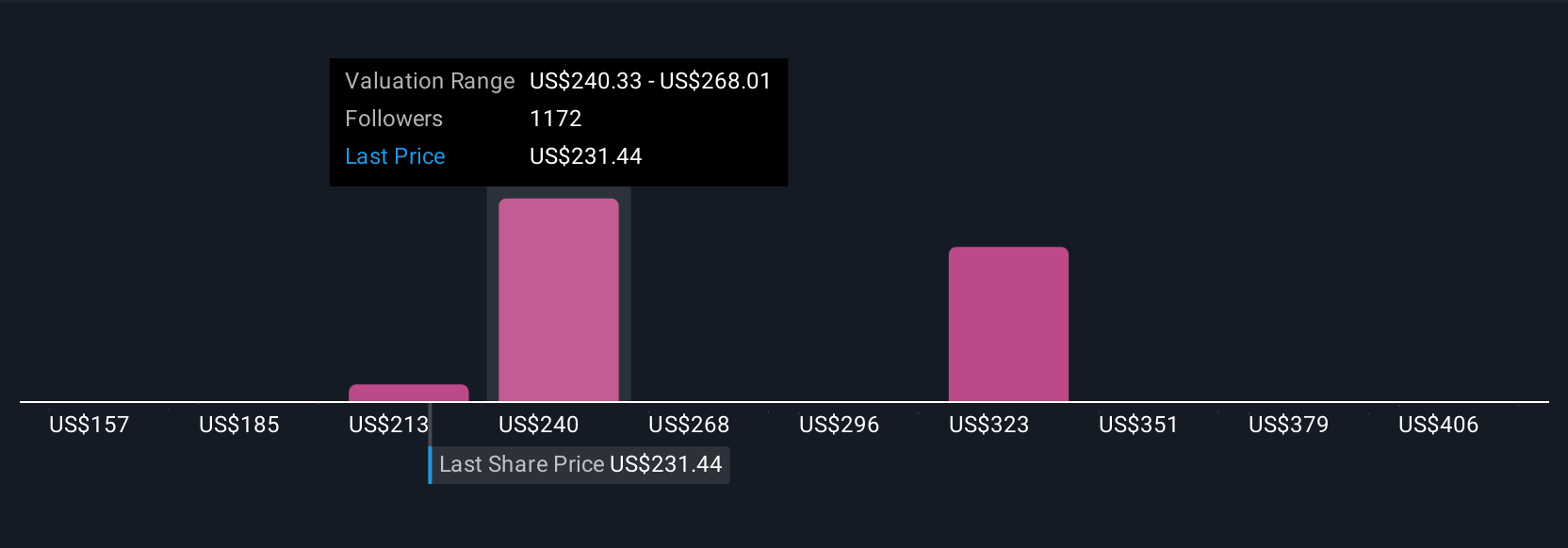

For Amazon.com, Narratives can differ widely. One investor might estimate a fair value as low as $217.95, anticipating steady but moderate margin gains, while another projects as high as $287.57, based on strong confidence in AWS leadership and expanding profit margins. Narratives transform investment analysis from number crunching into a living, tailored decision-making tool that is accessible to everyone.

For Amazon.com, however, we’ll make it really easy for you with previews of two leading Amazon.com Narratives:

Fair Value: $234.75

Undervalued by: 0.0%

Revenue Growth Rate: 13.6%

- Bullish on Amazon’s e-commerce leadership, AWS strength, commitment to growth investments in AI and logistics, and steadily rising revenues and earnings.

- Highlights consistent major brand partnerships, rapid innovation, and strong recent earnings, with price projections that see robust returns over the next decade.

- Cautions include AWS growth coming in just below recent expectations and some vagueness around AI strategy. Overall, the outlook remains very optimistic based on Amazon’s pipeline and scale.

Fair Value: $222.55

Overvalued by: 5.5%

Revenue Growth Rate: 15.19%

- Amazon is positioned for excellent long-term growth from AWS, third-party sellers, and advertising, but heavy reinvestment will keep free cash flows suppressed for the near future.

- Recent performance shows segments like online stores, AWS, and advertising mostly on track or slightly below high expectations, with a fair value close to current prices. This suggests limited upside right now.

- Identifies potential risks from regulatory headwinds and macroeconomic slowdowns. The current market price may already be factoring in much of the upside from ongoing growth drivers.

Do you think there’s more to the story for Amazon.com? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Search

RECENT PRESS RELEASES

Related Post