Better Crypto Buy: Ethereum vs. Solana

November 16, 2025

Ethereum might get all the attention from crypto investors, but don’t sleep on Solana.

Over the past decade, Ethereum (ETH 0.77%) has been one of the top-performing cryptocurrencies in the world. Over that time period, it is up a head-spinning 120,000%.

But there are now a growing number of highly regarded Ethereum challengers, and one of the best is Solana (SOL 1.35%). So which is the better investment right now: the entrenched market incumbent (Ethereum) or the upstart rival (Solana)?

Historical performance

Based on past performance, Ethereum would appear to have the advantage over Solana. Its track record over the past five years is particularly impressive. In 2020, Ethereum skyrocketed by 472%, and then followed that up with an equally stellar 2021, when it soared by 395%. In 2023, Ethereum increased in value by 93%, and followed that up with a robust 46% return in 2024.

Ethereum

Today’s Change

(-0.77%) $-24.51

Current Price

$3146.59

The only down year for Ethereum was 2022, when it lost 68% of its value. If you gave up on Ethereum during the crypto winter of 2022, you probably lost everything. But if you held on to your position, you are likely sitting on a hefty profit right now.

Solana has been much more volatile than Ethereum. After launching in 2020, Solana nearly doubled in value. It followed that up with an even more impressive 2021, when it was one of the top crypto performers on the planet, up more than 11,000%. However, in 2022, Solana lost more than 94% of its value. Many gave up on it entirely.

Solana

Today’s Change

(-1.35%) $-1.91

Current Price

$139.61

While Solana rebounded with a sizzling 919% return in 2023, and an 86% return in 2024, it no longer looks like the slam-dunk investment it once did. In 2025, Solana is still down nearly 20% for the year.

Institutional support

Here too, Ethereum appears to have the clear advantage. It has become the preferred blockchain of Wall Street, due to its market dominance in decentralized finance (DeFi). And new crypto legislation in the U.S. could make Ethereum even more dominant. That’s because Ethereum is far and away the top blockchain when it comes to stablecoins, which have emerged as one of the hottest growth categories in the crypto market.

While Solana shows signs of upending Ethereum’s market-leading role in DeFi, it is nowhere close to challenging Ethereum. For example, Ethereum accounts for 63% of all total value locked (TVL), a key metric for measuring DeFi strength. Solana ranks a distant second, with a market share of only 8%.

Key factors to consider

But there are a few factors that could tip the scales in Solana’s favor. One of them is its blazing-fast transaction speeds. While the core Ethereum blockchain can only handle 15-30 transactions per second, Solana just demonstrated the ability to handle 100,000 transactions per second. In November 2023, Cathie Wood of Ark Invest suggested that Solana’s superior speed, combined with its lower costs, might be enough to migrate developers, users, and institutions over to Solana.

Image source: Getty Images.

There’s already been evidence of this within the world of DeFi. Ethereum once dominated in terms of 24-hour trading activity on its decentralized exchanges, but Solana surpassed Ethereum in late 2024, and hasn’t looked back since. Much of this has to do with a surge of interest in meme coin trading, where Solana is the clear market leader.

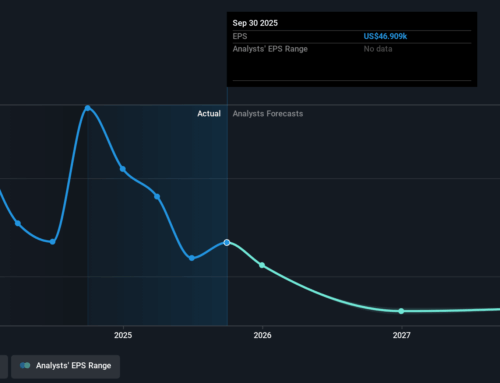

Also, in terms of revenue it is creating, Solana is growing at a faster pace than Ethereum. According to a report from 21Shares, the Solana blockchain ecosystem generated nearly $3 billion in revenue over the most recent 12-month period.

And the winner is…

It’s hard to pick against Ethereum. It has been so good, for so long, and has an obvious first-mover advantage over other Layer-1 blockchain networks such as Solana. For good reason, it is the world’s second-most popular cryptocurrency, with a hefty market cap of $410 billion.

But, if cryptocurrencies are valued the way tech stocks are, then investors also need to focus on future growth prospects and future cash flows. And this is where Solana appears to have the edge. Over time, Solana’s superior transaction processing speeds should give it an edge in any area where speed matters, including DeFi and artificial intelligence.

If you’re investing only for the short term, Ethereum is the no-brainer pick. But if you’re investing for the long haul, it’s worth giving Solana a closer look. Over time, I’m expecting it to grow at a faster pace than Ethereum, with a good chance to outperform it over the next decade.

Search

RECENT PRESS RELEASES

Related Post