Ethereum Price Forecast: ETH recovers $2,850 support as BitMine’s holdings cross 3.6 milli

November 24, 2025

- BitMine purchased 69,822 ETH last week, growing its total holdings to 3.63 million ETH.

- The company plans to begin staking its assets in early 2026.

- ETH faces pressure near $3,000 after recovering the $2,850 support.

Ethereum treasury company BitMine Immersion Technologies increased its ETH holdings last week.

The Nasdaq-listed firm acquired 69,822 ETH, growing its total holdings to 3.63 million ETH, according to a Monday statement. The figure represents 3% of the entire ETH circulation, bringing BitMine closer to its original goal of holding 5% of Ethereum’s supply.

The Nevada-based firm also maintained a balance of 192 Bitcoin (BTC), a $38 million stake in Worldcoin (WLD) treasury, Eightco Holdings and unencumbered cash of $800 million.

With crypto prices declining over the past few weeks, the value of its total assets has fallen to $11.2 billion. The company is holding an unrealized loss of over $3.4 billion via its ETH treasury, per CryptoQuant data.

“The continued decline in crypto prices in the past week reflects the impaired liquidity since October 10th, as well as price technicals, which remain weak,” said BitMine Chairman Thomas Lee. “A few weeks ago, we noted the likely downside for ETH prices would be around $2,500 and current ETH prices are basically there. This implies asymmetric risk/reward as the downside is 5% to 7%, while the upside is the supercycle ahead for Ethereum.”

BitMine highlighted that it will begin staking its ETH holdings in 2026 using the Made in America Validator Network (MAVAN), which it claims will be the “best in class solution offering staking infrastructure.”

Such a move could help it shore up the average cost basis of its ETH holdings.

BitMine claims it ranks #50 among most traded US stocks, with an average trading volume of $1.6 billion behind Mastercard and ahead of Palo Alto Networks.

The company remains the number #1 Ethereum treasury globally, followed by SharpLink Gaming and The Ether Machine with holdings of 859,395 ETH and 496,712 ETH, respectively, according to the SER data.

BitMine shares gained 19.6% on Monday, reducing its monthly decline to 42.1%.

Ethereum recorded $74 million in liquidations over the past 24 hours, led by $53.17 million in short liquidations, according to Coinglass data.

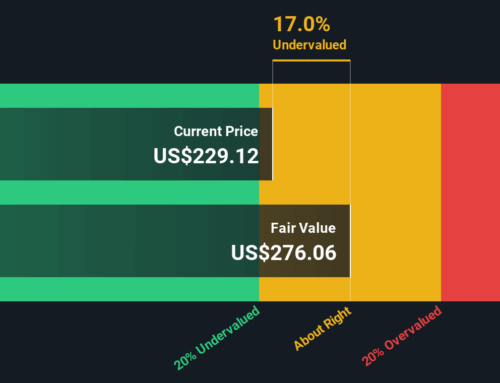

ETH has recovered the $2,850 level after a decline below it last weekend. The recovery suggests whales and accumulation addresses defended their average cost basis, which lies within the $2,800-$2,900 range.

However, ETH continues to face pressure, as it shows signs of rejection after reaching the $3,000 psychological level. Further upward, the $3,100 level, strengthened by the 20-day Exponential Moving Average (EMA), is another key resistance.

On the downside, the top altcoin could decline toward $2,300 if the $2,850 support fails to hold again.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) have recovered from oversold conditions but remain below their neutral levels, indicating a modest decline in the dominant bearish momentum.

Search

RECENT PRESS RELEASES

Related Post