United States clean energy spending reaches a new high on EV surge, solar boom, and rising

November 27, 2025

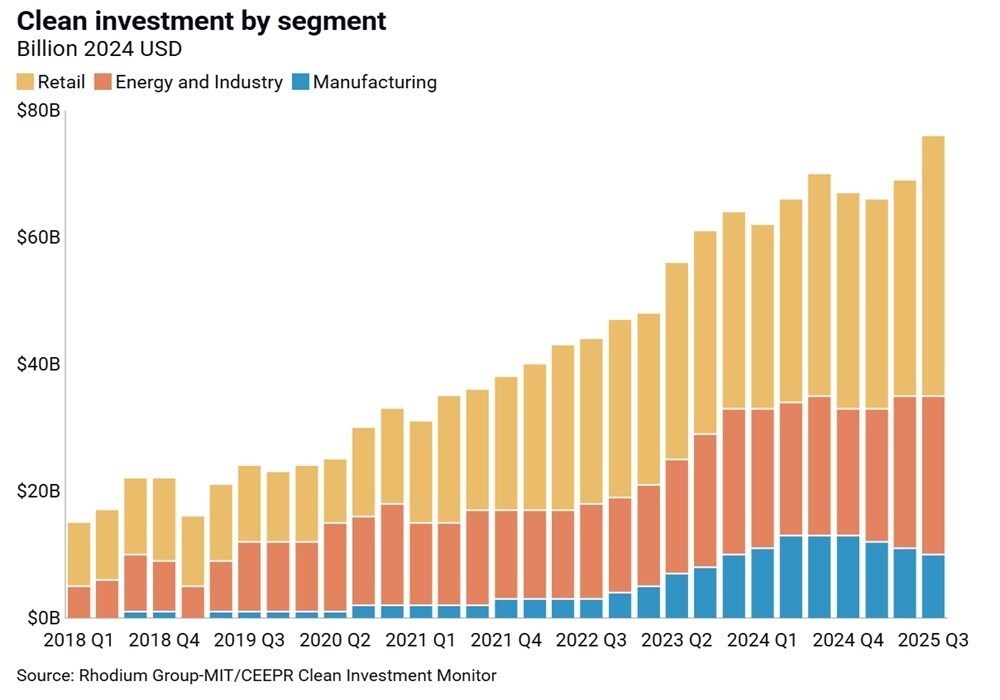

The United States closed the third quarter of 2025 with a record investment of USD 75 billion in renewable energy, suggesting a rapid momentum in the country’s energy transition efforts. Figures compiled by the Clean Investment Monitor (CIM) show a similar trend, with spending on clean energy rising 9 per cent from the previous quarter and 8 per cent compared with Q3 last year. The momentum extends across the year with USD 279 billion invested in clean vehicles (zero emission vehicles), carbon management, building electrification and clean power deployment, contributing to 6 per cent annual increase, reveals CIM.

alcircleadd

A snapshot of a rapidly expanding market

Based on the nationwide records covering 22,000 manufacturing and energy facilities, five million zero-emission vehicle registrations, 28 million heat pump purchases and 4.5 million distributed energy installations, CIM has stated that renewable energy investment in the US is mostly attributed to the following sectors:

• Manufacturing – factories producing solar modules, EV components, batteries, and other clean-tech hardware.

• Energy & Industry – utility-scale projects including solar farms, storage sites, wind installations, and industrial emissions-reduction projects.

• Retail – consumer-level purchases from EVs to rooftop solar, home batteries, and heat pumps.

Only technologies supported under the Inflation Reduction Act (IRA) are included, making CIM’s dataset one of the clearest indicators of how policy is shaping the clean economy.

Explore- Most accurate data to drive business decisions with 50+ reports across the value chain

EV purchases steal the spotlight

The most striking driver of growth in Q3 2025 was largely pushed by EV purchases: retail clean-tech spending reached USD 41 billion, of which USD 31 billion (about 40–42 per cent of total clean investment) came from EV sales as buyers rushed to capture expiring federal credits by September 2025.

With this accelerated consumer demand, OEMs scaled production accordingly, and the need for large volumes of automotive-grade, low-carbon aluminium, a major material for EV manufacturing, rose in parallel.

Recycled aluminium requires far less energy to produce than metal made from raw ore, which also means significantly fewer greenhouse gas emissions. Using this lower-carbon material helps shrink the overall environmental footprint of major EV parts, from body panels and safety structures to battery and motor enclosures. As a result, manufacturers can more easily meet stricter emissions standards while appealing to buyers who prioritise sustainable choices.

Usage of aluminium for EVs is not a trivial volume. On average, battery electric vehicles in North America contained about 643 lb (292 kg) of aluminium in 2020 and roughly 885 lb (401 kg) by 2022, a marked increase that reflects lightweighting and new structural designs. That rise in metal content raises the potential climate benefit from using recycled metal rather than virgin aluminium.

Models such as the Ford F-150 Lightning, Lucid Air and certain Tesla and Jaguar models use substantial aluminium content. To support this, OEMs are working together to raise recycled content wherever possible.

Other large manufacturers like Novelis and OEMs like Norsk Hydro are explicitly embracing low-carbon aluminium, contributing to the EV boom in the nation.

Manufacturing investment softens despite EV momentum

Factory investment, by contrast, slowed. The manufacturing segment brought in USD 10 billion, down 10 per cent from the previous quarter and 26 per cent from last year.

Yet the EV supply chain still dominated activity:

- USD 8 billion went to EV-related manufacturing

- Battery plants accounted for USD 6 billion, though this was 23per cent lower than Q2

CIM emphasises that many manufacturing announcements never materialise. By tracing each facility from planning to operation, the tracker highlights the gap between proposals and actual capital spend, most visible in industrial decarbonisation.

Utility-Scale renewables continue steady progress

Investment in Energy and Industry assets, which include utility-scale solar, storage, and industrial decarbonisation, climbed to USD 25 billion, representing a 3 per cent quarterly increase and 15 per cent growth year over year. Clean electricity dominated the space with USD 24 billion in spending, driven mainly by solar and storage development. Solar infrastructure is another space where aluminium is widely used for its lightweight and recyclability factor. On average, aluminium content of a PV system is around 20–22 kg per kW.

Also Read: Websol Energy steers for long-term growth with a capacity boost

Policy influence remains strong

Federal and state incentives played a defining role in shaping Q3 clean energy outcomes. The rush to capture EV tax credits inflated retail spending, while state-level support programmes buoyed rooftop solar, home batteries, and heat pumps helped lift household adoption. Large-scale developers, meanwhile, remain highly sensitive to policy certainty. CIM’s findings suggest that sectors like battery manufacturing and clean electricity expand most reliably when long-term federal incentives are locked in.

Broader US energy trends signal a structural shift

Long-term trends show the United States gradually moving away from fossil energy dominance. Between 2015 and 2024, the share of total annual energy investment going to fossil supply and fossil-based power fell from 60 per cent to below 40 per cent.

In that same period, renewable energy investment surged, supported by falling technology costs and policy tailwinds. These conditions triggered a wave of new manufacturing commitments, pushing clean-tech manufacturing investment to USD 60 billion in 2024. The United States now accounts for 8 per cent of global lithium-ion battery output, and in 2024 its solar PV module manufacturing capacity nearly tripled to 42 GW. These structural changes explain why domestic production capacity for batteries and solar modules is rising at a pace once thought unlikely.

The global context: spending continues to climb

The US is not alone in accelerating investment. Worldwide spending on clean energy reached USD 2.1 trillion in 2024, an 11 per cent rise from 2023, with electrified transport, EVs, charging networks, and related systems contributing USD 757 billion. The International Energy Agency projects USD 3.3 trillion in global energy investment in 2025, with USD 2.2 trillion dedicated to clean technologies. Improving technology, cheaper batteries, stronger climate commitments, and increasing public awareness continue to fuel global momentum.

Must read: Key industry individuals share their thoughts on the trending topics

What the latest wave of investment suggests

The third quarter’s record-breaking numbers reveal a clean energy economy increasingly powered by consumer decisions. EV buyers alone accounted for nearly half of all investment, a sign that US households are becoming central to the country’s energy transition.

At the same time, manufacturing and industrial decarbonisation remain areas where progress shows a volatile curve. Solar and storage continue to expand steadily, but large-scale industrial emissions-reduction projects lag significantly.

Even so, with clean technologies now making up nearly 5 per cent of all private investment in major US goods and structures, the sector is becoming a critical pillar of the national economy. Sustaining this momentum will depend on investment that strengthens domestic manufacturing, expands clean electricity, and supports industry-level decarbonisation, all supported by stable and predictable policy.

Search

RECENT PRESS RELEASES

Related Post