Is Bitcoin a Millionaire-Maker?

December 8, 2025

Bitcoin is the world’s largest cryptocurrency by market cap.

It’s been an interesting year for Bitcoin (BTC +3.15%), the world’s largest cryptocurrency. After Donald Trump’s election as president last year, Bitcoin and the rest of the crypto sector soared, as Trump vowed to remove regulatory overhangs on the sector, which he has largely done. Congress has now passed legislation to further clarify the regulatory landscape, and crypto-friendly cabinet members and advisors have also bolstered the sector. Trump even announced the creation of a U.S. Strategic Bitcoin Reserve.

However, in recent months, Bitcoin has stumbled, possibly due to several concerns, including the extent to which the Federal Reserve will lower interest rates, the state of the economy, and broader economic liquidity. So is Bitcoin a millionaire maker?

Image source: Getty Images.

The digital gold theory

Due to Trump’s pro-crypto approach, more investors are willing to buy Bitcoin, and more mainstream financial institutions are offering crypto solutions, including custody and the ability to buy many cryptocurrencies on mainstream brokerages.

But beyond this new environment, investors seem to increasingly believe that Bitcoin is a form of digital gold. That’s because there is a finite supply of 21 million tokens, with roughly 95% of tokens already in circulation. Still, it could be a while before all Bitcoin tokens are issued, due to halving events that make it harder to mine new Bitcoin, therefore slowing issuance of new coins.

Still, this creates a favorable supply-and-demand dynamic. There is also a wide debate over whether Bitcoin is truly a form of digital gold, as it often trades like a highly volatile tech stock. However, Bitcoin has enjoyed strong appreciation over the years, similar to gold. Gold can hedge against inflation due to its finite supply, and investors often view it as a haven amid rising geopolitical tensions, which have been plentiful in recent years.

Advertisement

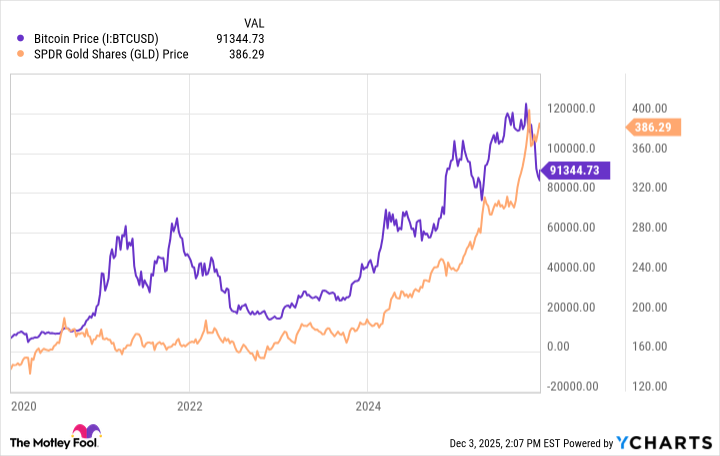

Bitcoin Price data by YCharts

As you can see in the chart above, although it’s not perfect, there appears to be a clear correlation between Bitcoin and gold’s price movement during the past roughly six years. Part of the reason gold — and possibly Bitcoin too — has performed so well is that the market is clearly increasingly concerned about the U.S.’s worsening debt situation.

Total debt has now surged past $38 trillion, the fiscal deficit is approaching $1.8 trillion, and the U.S. government’s interest payments on the debt now account for 13% of total U.S. government spending. Investors are concerned that the dollar will lose significant value, which has made gold and perhaps Bitcoin a hedge against dollar debasement.

Is Bitcoin a millionaire maker?

Making long-term price predictions on a volatile asset like Bitcoin is extraordinarily difficult because crypto is still a new sector, and we can’t value cryptocurrencies like traditional stocks. But several notable names on Wall Street, like Strategy’s Michael Saylor and Ark Invest’s Cathie Wood, believe Bitcoin will trade at many multiples of its current price in five, 10, and 20 years.

And if the digital gold theory turns out to be correct, then they may be right. Currently, Bitcoin’s market cap of about $1.8 trillion is a fraction of gold’s total market cap of more than $29.4 trillion. Again, there is still no definitive answer to whether Bitcoin is a form of digital gold, and it has often failed to trade or behave like gold.

All that said, I believe investors can hold at least some Bitcoin in their portfolios because it appears to offer a unique form of diversification. Bitcoin is also resilient and has survived many significant declines over its short life, so I don’t think it’s going anywhere. Whether Bitcoin will be a millionaire maker depends on how much one invests and how long they wait. But it’s certainly possible long-term.

Search

RECENT PRESS RELEASES

Related Post