Why 2026 May Be Apple’s Year

December 19, 2025

One of the most important stocks in the market, and still one of the most valuable companies in the world, Apple (NASDAQ:AAPL) is a company I’d argue investors can’t ignore. Indeed, given the company’s market capitalization of more than $4 trillion, the directional moves Apple makes over any time frame will likely impact most investors, whether they hold this stock directly or not. That’s because most investors now have some sort of exposure to index funds or exchange traded funds (ETFs), many of which are market cap weighted. Thus, Apple’s performance is a key indicator of the performance of the broader market.

Of late, Apple has been a winner, and is now one of the best-performing stocks in the market. Let’s dive into why Apple has had another incredible year, and why 2026 could be just as good for investors who have held steady in this name over time.

The Bear Case

Teddy bear in the street

Before diving into all the positives around Apple, I thought it would be helpful to touch on some of the downside risks many investors are pricing into this stock, or at least were during stretches over the past few years.

First, Apple’s growth rate has slowed notably in recent years, and was actually negative in several quarters over this time frame. That’s certainly disconcerting for investors who banked on this previously high-flying growth stock to continue. In the company’s most recent quarter, both iPad and wearables sales growth were flat on a year-over-year basis. These trends reinforce the idea that saturated markets for iPhone upgrades and new product launches could lead to slower growth ahead.

With some of the company’s recent AI investments risking margin dilution (and also don’t have clear monetization upside), potential Capex strains could drive this stock lower over time. And at a valuation of 33-times forward earnings, Apple is now among the most expensive of the Magnificent 7 growth stocks relative to its growth rate.

The Bull Case

A bull with arrows heading up and to the right

Okay, that’s enough doom and gloom.

While all those facts are true, and Apple’s AI spending could certainly negatively impact its margins in the near-term, plenty of investors are bullish on the company’s more targeted approach to network-specific AI integrations. I think that’s a fair way of looking at Apple’s AI rollout – it’s very targeted.

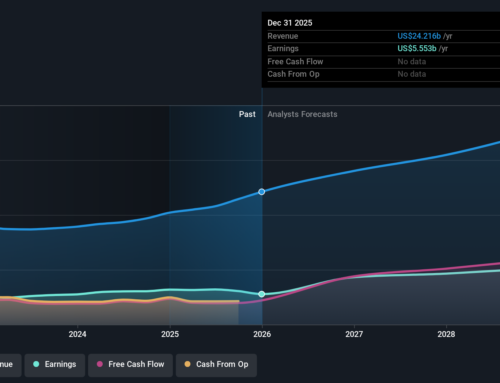

And because the company is spending so much less than its peers on AI Capex, I’d argue the company’s valuation multiple probably deserves the premium bump it’s gotten in recent quarters. While Buffett and other major investors clearly don’t view Apple in the same way they did a few quarters ago, it’s also true that the company’s product lineup (headlined by its iPhone) remains world-class and will continue growing in terms of global market share over time, at least in developed markets.

And with higher-margin growth from services delivering $100 billion in annual profits, there’s a lot to like about a potential bolstering of the company’s balance sheet moving forward. In particular, this past quarter was actually pretty strong, with App Store, cloud and payments sectors supporting a 47.2% gross margin overall and enabling the company to retain a $34 billion net cash position which allows Apple to continue to pay out increasing dividends and share buybacks.

The bottom line is that in an environment where other investors are focusing on growth, I think investors focused on quality may outperform in 2026. In that regard, I do think Apple could have another year where it outperforms its mega-cap tech peers, surging to new all-time highs.

Search

RECENT PRESS RELEASES

Related Post